Low Days Payable Outstanding (DPO) indicates a company pays its suppliers quickly, which can strengthen vendor relationships but may reduce cash flow flexibility. Efficient management of DPO helps balance maintaining strong supplier trust with optimizing working capital. Discover how managing your DPO impacts overall business performance in the rest of this article.

Table of Comparison

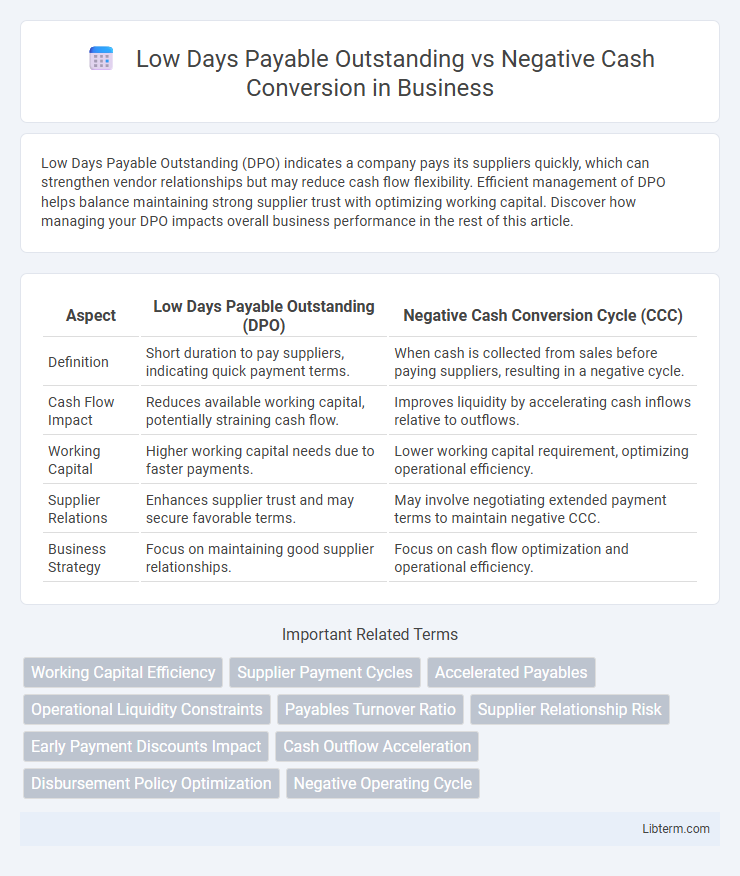

| Aspect | Low Days Payable Outstanding (DPO) | Negative Cash Conversion Cycle (CCC) |

|---|---|---|

| Definition | Short duration to pay suppliers, indicating quick payment terms. | When cash is collected from sales before paying suppliers, resulting in a negative cycle. |

| Cash Flow Impact | Reduces available working capital, potentially straining cash flow. | Improves liquidity by accelerating cash inflows relative to outflows. |

| Working Capital | Higher working capital needs due to faster payments. | Lower working capital requirement, optimizing operational efficiency. |

| Supplier Relations | Enhances supplier trust and may secure favorable terms. | May involve negotiating extended payment terms to maintain negative CCC. |

| Business Strategy | Focus on maintaining good supplier relationships. | Focus on cash flow optimization and operational efficiency. |

Understanding Days Payable Outstanding (DPO)

Days Payable Outstanding (DPO) measures the average number of days a company takes to pay its suppliers, reflecting its accounts payable management efficiency. Low DPO indicates quicker payments, which can reduce negative cash conversion by shortening the cash conversion cycle. Companies with lower DPO may face cash flow challenges since paying suppliers faster can strain liquidity and increase the risk of negative cash conversion.

What Is Negative Cash Conversion Cycle?

Negative Cash Conversion Cycle (CCC) occurs when a company collects payments from customers faster than it pays its suppliers, resulting in a cash inflow before cash outflow. Low Days Payable Outstanding (DPO) shortens the payment period to suppliers, which can increase the risk of a positive, rather than negative, CCC by reducing the time the company holds onto its cash. A negative CCC is financially advantageous as it improves liquidity and minimizes the need for external financing by optimizing working capital management.

Key Differences Between Low DPO and Negative Cash Conversion

Low Days Payable Outstanding (DPO) indicates how quickly a company pays its suppliers, reflecting efficient or strained cash flow management, while Negative Cash Conversion implies the company collects cash from operations faster than it pays its suppliers, creating a cash flow advantage. A low DPO often signals prompt supplier payments but can reduce available cash reserves, whereas negative cash conversion highlights strong operational liquidity and working capital efficiency. Understanding the interplay between DPO and cash conversion cycle is crucial for assessing a company's short-term financial health and operational efficiency.

Impact of Low DPO on Cash Flow Management

Low Days Payable Outstanding (DPO) indicates faster payment to suppliers, reducing the company's available cash for daily operations and leading to negative cash conversion cycles. This strain on cash flow hampers liquidity management, forcing businesses to rely more on external financing to meet short-term obligations. Effective cash flow strategies necessitate optimizing DPO to balance timely payments with sufficient working capital retention.

How Negative Cash Conversion Boosts Liquidity

Negative Cash Conversion Cycle (CCC) accelerates cash inflows by collecting receivables faster than paying suppliers, effectively improving liquidity despite low Days Payable Outstanding (DPO). A low DPO often indicates quicker payments to vendors, which can strain cash reserves, but a negative CCC offsets this by reducing working capital needs and freeing cash for operational use. Companies with negative CCC optimize their cash flow management, boosting liquidity without relying on external financing.

Risks Associated With Low Days Payable Outstanding

Low Days Payable Outstanding (DPO) can indicate that a company is paying suppliers too quickly, which risks straining cash flow and reducing liquidity. Maintaining a low DPO limits the firm's ability to use supplier credit as a working capital source, increasing vulnerability to negative cash conversion cycles where cash outflows precede inflows. This liquidity pressure can lead to challenges in meeting other short-term obligations and increase reliance on external financing.

Strategies to Achieve a Negative Cash Conversion Cycle

Achieving a negative cash conversion cycle involves optimizing days payable outstanding (DPO) by extending payment terms to suppliers while accelerating receivables and inventory turnover. Strategies include negotiating longer payment terms without damaging supplier relationships, implementing just-in-time inventory systems, and improving accounts receivable processes to speed up cash inflows. This balanced approach minimizes working capital requirements and enhances liquidity by effectively managing payables against cash collections.

Case Studies: Companies With Low DPO vs Negative Cash Conversion

Companies with low Days Payable Outstanding (DPO) often face negative cash conversion cycles, as seen in case studies of fast-moving consumer goods firms that pay suppliers quickly but struggle to collect receivables on time. Retail giants with low DPO leverage strong supplier relationships for favorable pricing but experience cash flow strain due to extended inventory turnover periods. Analysis of these companies highlights the critical balance between operational efficiency and working capital management to avoid liquidity issues despite rapid supplier payments.

Best Practices for Optimizing Payables and Cash Cycles

Low Days Payable Outstanding (DPO) can lead to negative cash conversion cycles, indicating that a company pays its suppliers faster than it collects receivables, straining liquidity. Best practices for optimizing payables and cash cycles include negotiating extended payment terms with suppliers, implementing automated invoice processing to improve accuracy and timing, and strategically managing payment schedules to maximize available cash without damaging supplier relationships. Leveraging supplier financing options and regularly analyzing cash flow metrics helps maintain balanced working capital and enhances overall financial stability.

Choosing the Right Strategy for Sustainable Growth

Low Days Payable Outstanding (DPO) enhances supplier relationships by extending payment terms, but excessively high DPO can lead to negative cash conversion cycles, straining liquidity and operational efficiency. Balancing DPO with Days Sales Outstanding (DSO) and Inventory Turnover ensures positive cash flow, enabling reinvestment for sustainable growth. Implementing strategic payables management aligned with cash conversion metrics supports long-term financial health and scalable business expansion.

Low Days Payable Outstanding Infographic

libterm.com

libterm.com