Hedging is a risk management strategy used to protect investments against potential losses by taking an offsetting position in related assets. This technique is vital for businesses and investors aiming to minimize exposure to price fluctuations in markets such as commodities, currencies, or stocks. Explore the rest of the article to understand how hedging can safeguard your financial interests effectively.

Table of Comparison

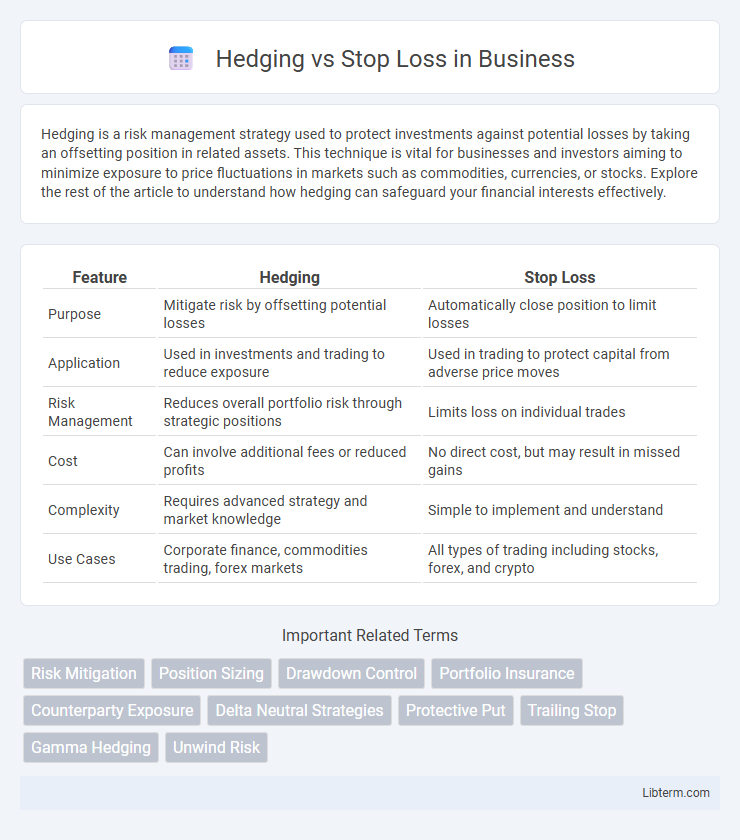

| Feature | Hedging | Stop Loss |

|---|---|---|

| Purpose | Mitigate risk by offsetting potential losses | Automatically close position to limit losses |

| Application | Used in investments and trading to reduce exposure | Used in trading to protect capital from adverse price moves |

| Risk Management | Reduces overall portfolio risk through strategic positions | Limits loss on individual trades |

| Cost | Can involve additional fees or reduced profits | No direct cost, but may result in missed gains |

| Complexity | Requires advanced strategy and market knowledge | Simple to implement and understand |

| Use Cases | Corporate finance, commodities trading, forex markets | All types of trading including stocks, forex, and crypto |

Introduction to Risk Management in Trading

Hedging and stop loss are fundamental strategies in risk management for trading, designed to minimize potential losses and protect capital. Hedging involves opening offsetting positions to reduce exposure to adverse market movements, while stop loss orders automatically close trades at predetermined price levels to limit losses. Both techniques are essential tools for traders to control risk and improve portfolio stability in volatile markets.

What is Hedging?

Hedging is a risk management strategy used in trading and investing to protect against potential losses by opening positions that offset existing exposure. It involves taking an opposite position in a correlated asset or using financial instruments like options or futures contracts to minimize adverse price movements. Unlike stop loss orders that close a position at a predetermined price, hedging aims to reduce overall portfolio risk without exiting the market.

What is a Stop Loss?

A stop loss is a risk management tool used by traders to automatically close a position at a predetermined price level, limiting potential losses. It acts as a protective order triggered when the market moves unfavorably, ensuring controlled exposure in volatile markets. Unlike hedging, which involves opening an offsetting position, stop loss directly exits the trade to prevent further adverse price movement.

Key Differences Between Hedging and Stop Loss

Hedging involves taking an opposite position in a related asset to reduce potential losses, while a stop loss is an order placed to automatically sell an asset when its price reaches a predetermined level to limit losses. Hedging provides ongoing risk management by offsetting exposure, whereas stop loss triggers a complete exit from the position once the price threshold is hit. Hedging is typically used for risk mitigation across portfolios, while stop loss is a tactical tool for individual trade protection.

Pros and Cons of Using Hedging

Hedging in trading offers the advantage of risk minimization by opening offsetting positions to protect against adverse market movements, allowing traders to lock in profits and limit losses without exiting their initial trades. However, hedging can result in increased transaction costs and potential reduced profits due to the complexity of managing multiple positions simultaneously. Unlike stop loss orders, which automatically close trades at a set price to prevent further losses, hedging requires active management and may tie up capital that could be used for other opportunities.

Pros and Cons of Using Stop Loss

Stop loss orders automatically limit losses by closing a position at a predetermined price, providing traders with a clear risk management strategy and protecting capital in volatile markets. However, stop loss orders can trigger prematurely during temporary market fluctuations, leading to unwanted positions being closed and potential missed opportunities for recovery. Unlike hedging, stop loss strategies do not offer protection against broader market risks or account for complex scenarios where offsetting positions might be more effective.

When to Use Hedging Strategies

Hedging strategies are most effective when managing risk during periods of high market volatility or uncertain economic conditions, allowing traders to protect existing positions from adverse price movements. Using hedging in forex or commodities trading provides a safeguard against unexpected losses while maintaining potential upside gains. This approach suits investors seeking to preserve capital without exiting the market, especially when fundamental analysis signals potential market reversals.

When to Implement Stop Loss Orders

Stop loss orders should be implemented when traders want to limit potential losses and protect their capital in volatile markets or uncertain trade conditions. It is essential to place stop loss orders at strategic price levels based on technical support or resistance to avoid premature exits caused by normal market fluctuations. Using stop loss orders helps manage risk effectively by ensuring positions are automatically closed when prices reach unfavorable levels.

Impact on Trading Performance

Hedging provides traders with a strategic method to mitigate potential losses by opening offsetting positions that protect against adverse market movements, thus preserving capital and enhancing risk management. Stop loss orders automatically close losing trades at predetermined levels, limiting downside risk but potentially causing premature exits due to market volatility. Combining hedging and stop loss techniques can optimize trading performance by balancing risk control with the opportunity to capture favorable market trends.

Choosing the Right Risk Management Tool

Choosing between hedging and stop loss depends on the trader's risk tolerance and market strategy. Hedging provides a way to offset potential losses by opening opposite positions, which can be effective during volatile markets but may increase costs. Stop loss orders limit downside risk by automatically closing positions at predetermined price levels, offering simplicity and control without additional capital requirements.

Hedging Infographic

libterm.com

libterm.com