Hostile takeovers occur when one company attempts to acquire another without the consent of its management, often by directly approaching shareholders or initiating a tender offer. These aggressive acquisition strategies can significantly impact the target company's value, operations, and shareholder rights. Explore the rest of this article to understand how hostile takeovers work and how they might affect your investments.

Table of Comparison

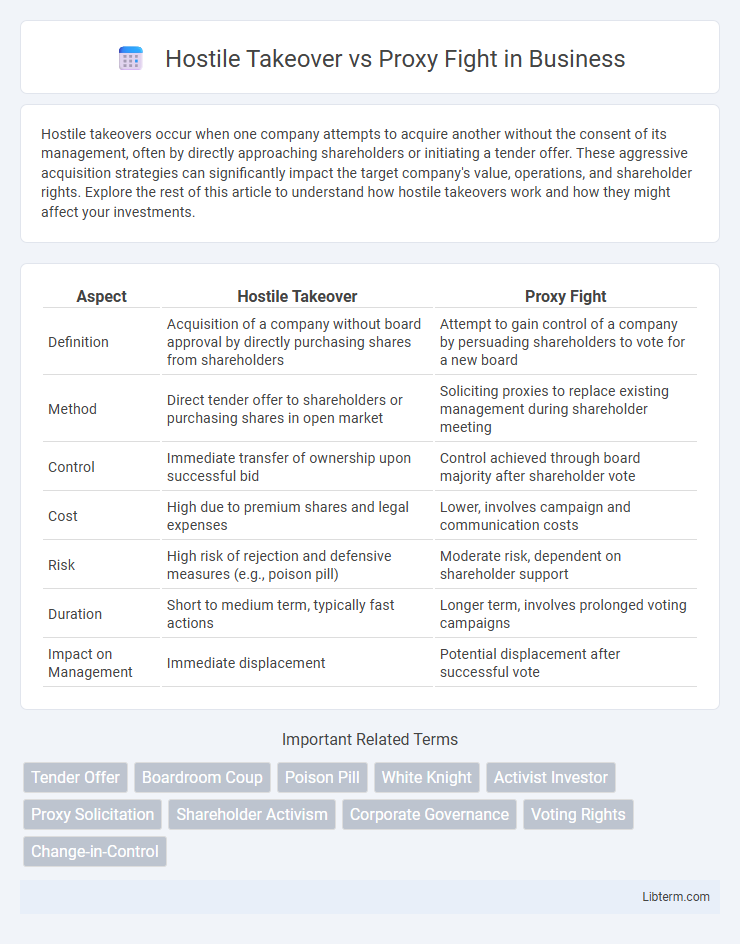

| Aspect | Hostile Takeover | Proxy Fight |

|---|---|---|

| Definition | Acquisition of a company without board approval by directly purchasing shares from shareholders | Attempt to gain control of a company by persuading shareholders to vote for a new board |

| Method | Direct tender offer to shareholders or purchasing shares in open market | Soliciting proxies to replace existing management during shareholder meeting |

| Control | Immediate transfer of ownership upon successful bid | Control achieved through board majority after shareholder vote |

| Cost | High due to premium shares and legal expenses | Lower, involves campaign and communication costs |

| Risk | High risk of rejection and defensive measures (e.g., poison pill) | Moderate risk, dependent on shareholder support |

| Duration | Short to medium term, typically fast actions | Longer term, involves prolonged voting campaigns |

| Impact on Management | Immediate displacement | Potential displacement after successful vote |

Understanding Hostile Takeovers

Hostile takeovers occur when an acquiring company attempts to gain control of a target company without the approval of its board, often by directly purchasing shares from shareholders or launching a tender offer. Such actions can lead to strategic shifts, management changes, or restructuring within the target company. Understanding hostile takeovers involves analyzing acquisition tactics, shareholder dynamics, and defensive measures like poison pills or staggered board appointments.

Defining Proxy Fights

Proxy fights are corporate battles where shareholders use their voting power to influence or replace management, typically during contested mergers or board elections. Unlike hostile takeovers, which involve direct acquisition attempts, proxy fights rely on persuading shareholders to vote for a proposed slate of directors or policies. Successful proxy fights can shift control without transferring ownership, emphasizing strategic shareholder engagement.

Key Differences Between Hostile Takeovers and Proxy Fights

Hostile takeovers involve acquiring control of a company against the wishes of its management by directly purchasing a majority of shares, whereas proxy fights focus on persuading shareholders to vote for new management or board members to change corporate direction. Hostile takeovers typically result in immediate ownership change, while proxy fights rely on shareholder voting at annual meetings to effect change. The legal, strategic, and financial implications vary significantly, with hostile takeovers often requiring tender offers and proxy fights centered on soliciting shareholder proxies.

Mechanics of a Hostile Takeover

A hostile takeover occurs when an acquiring company attempts to gain control of a target company without the approval of its board by directly purchasing shares from existing shareholders or initiating a tender offer. The mechanics involve bypassing management through aggressive stock accumulation, public appeal to shareholders, and potentially launching a proxy fight to replace the board with candidates supportive of the acquisition. This process contrasts with negotiated mergers, emphasizing control acquisition through shareholder manipulation rather than mutual agreement.

How Proxy Fights Work

Proxy fights occur when shareholders are solicited to vote for or against management proposals, often during contested board elections. Shareholders receive proxy materials outlining competing candidates or resolutions, allowing them to grant voting power to a chosen representative. This mechanism enables activists or dissenting shareholders to influence corporate governance without acquiring a controlling stake through a hostile takeover.

Legal and Regulatory Considerations

Hostile takeovers involve direct acquisition attempts bypassing the target company's management, often triggering strict regulatory scrutiny under securities laws like the Williams Act, which mandates disclosure and fair bidding practices. Proxy fights primarily revolve around soliciting shareholder votes to replace management or influence corporate policy, requiring compliance with proxy solicitation rules enforced by the SEC to ensure transparency and prevent misleading information. Both strategies must navigate complex legal frameworks, including antitrust regulations and corporate governance standards, to avoid litigation and regulatory penalties.

Common Motivations Behind Each Tactic

Hostile takeovers are primarily driven by acquirers seeking rapid control of a target company to implement strategic changes or unlock undervalued assets. Proxy fights typically arise when dissident shareholders aim to influence corporate governance or redirect company management without full acquisition. Both tactics reflect underlying conflicts over control, value creation, and corporate direction in competitive business environments.

Impact on Shareholders and Management

Hostile takeovers often lead to significant changes in management as acquiring firms bypass the target's board, directly appealing to shareholders to gain control, which can create uncertainty and disrupt company strategy. Proxy fights involve shareholders attempting to influence or replace existing management through voting, empowering shareholders but potentially causing internal conflict and hesitation in decision-making. Both strategies impact shareholder value and corporate governance, with hostile takeovers risking aggressive restructuring and proxy fights reflecting shareholder activism and power struggles.

Defense Strategies Against Hostile Takeovers and Proxy Fights

Defense strategies against hostile takeovers include poison pills, which dilute shares to make acquisition costly, and golden parachutes, offering lucrative benefits to executives if ousted. In proxy fights, companies focus on securing loyal shareholder votes through targeted communication campaigns and reinforcing board support to outmaneuver activist investors. Both methods require robust legal counsel and shareholder engagement to effectively counteract aggressive acquisition attempts.

Famous Real-World Examples and Case Studies

The hostile takeover of RJR Nabisco by Kohlberg Kravis Roberts in 1988 remains a landmark event, illustrating aggressive acquisition tactics bypassing management consent. In contrast, the proxy fight at Yahoo! in 2008, led by activist investor Carl Icahn, demonstrated how shareholders can leverage voting power to influence corporate governance without outright acquisition. These cases highlight distinct strategies in corporate control battles, with hostile takeovers emphasizing direct purchase of shares and proxy fights harnessing shareholder activism to effect change.

Hostile Takeover Infographic

libterm.com

libterm.com