Alpha in finance measures an investment's performance relative to a benchmark, indicating the excess returns generated beyond market expectations. It serves as a key metric for evaluating a portfolio manager's skill in outperforming the market. Discover how understanding Alpha can enhance your investment strategy by reading the rest of this article.

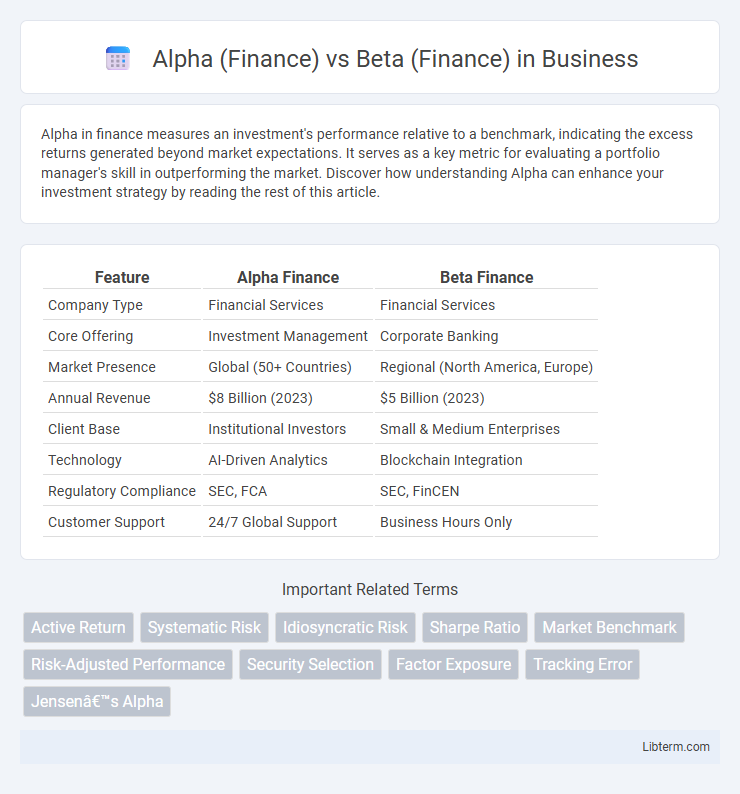

Table of Comparison

| Feature | Alpha Finance | Beta Finance |

|---|---|---|

| Company Type | Financial Services | Financial Services |

| Core Offering | Investment Management | Corporate Banking |

| Market Presence | Global (50+ Countries) | Regional (North America, Europe) |

| Annual Revenue | $8 Billion (2023) | $5 Billion (2023) |

| Client Base | Institutional Investors | Small & Medium Enterprises |

| Technology | AI-Driven Analytics | Blockchain Integration |

| Regulatory Compliance | SEC, FCA | SEC, FinCEN |

| Customer Support | 24/7 Global Support | Business Hours Only |

Introduction to Alpha and Beta in Finance

Alpha in finance measures an investment's performance relative to a market benchmark, representing the value an active manager adds beyond passive index returns. Beta quantifies the volatility or systematic risk of a security compared to the overall market, indicating its sensitivity to market movements. Understanding alpha and beta helps investors assess risk-adjusted returns and portfolio volatility for informed decision-making.

Defining Alpha: Measuring Active Returns

Alpha in finance represents the excess return generated by an investment relative to a benchmark index, indicating the value added by active management strategies. It measures an investor's ability to achieve returns beyond the market risk-adjusted performance, isolating the skill component from overall market movements. Quantifying alpha involves calculating the difference between actual portfolio returns and expected returns based on beta, risk factors, and market conditions.

Understanding Beta: Gauging Market Risk

Beta measures an investment's sensitivity to market movements, indicating its relative volatility compared to the overall market index, typically the S&P 500. A beta greater than 1 signifies higher risk and potential return, while a beta less than 1 denotes lower risk and volatility. Investors use beta to gauge systematic market risk and align portfolio risk with their investment goals.

Key Differences Between Alpha and Beta

Alpha measures the excess return of an investment compared to a benchmark index, reflecting the value added by active management, while Beta quantifies the investment's sensitivity to market movements, indicating its systematic risk. Alpha is a performance metric expressing how much an investment beats or underperforms the market, whereas Beta assesses volatility relative to the market, with a Beta of 1 indicating equal volatility. Investors use Alpha to evaluate skill and strategy effectiveness, and Beta to understand risk exposure and potential market-driven fluctuations.

Importance of Alpha for Investors

Alpha in finance represents the excess return of an investment relative to a benchmark index, indicating the value a portfolio manager adds beyond market movements. Investors prioritize alpha as it measures the effectiveness of active management strategies in generating higher profits and mitigating risks compared to passive investments. A consistent positive alpha signifies superior asset selection and timing skills, making it a crucial metric for evaluating investment performance and attracting capital.

Role of Beta in Portfolio Management

Beta measures a portfolio's sensitivity to market movements, playing a crucial role in assessing systematic risk and guiding diversification strategies. By quantifying the expected return volatility relative to the broader market, Beta helps investors construct portfolios that align with their risk tolerance and investment goals. This metric allows portfolio managers to balance risk and return efficiently by adjusting asset allocations based on market correlation.

Alpha Strategies: How to Generate Excess Returns

Alpha in finance represents the excess returns generated by an investment strategy beyond the market benchmark, reflecting the investor's skill in identifying opportunities. Alpha strategies often involve active management techniques such as stock selection, market timing, and factor investing to exploit inefficiencies and achieve superior performance. These strategies rely on deep fundamental analysis, quantitative models, and risk management to consistently generate returns that outperform beta, which solely measures market-related risk and returns.

Beta Strategies: Building Market-Tracking Portfolios

Beta in finance measures a portfolio's sensitivity to market movements, serving as a fundamental metric for market risk exposure. Beta strategies focus on constructing market-tracking portfolios that replicate the performance of benchmark indices, enabling investors to achieve returns closely aligned with overall market trends. These strategies prioritize diversification and cost efficiency, offering systematic exposure to market risk factors while minimizing idiosyncratic risk.

Alpha and Beta in Modern Portfolio Theory

Alpha in Modern Portfolio Theory represents the excess return of an investment relative to the expected market returns based on its beta, measuring portfolio manager skill or strategy effectiveness. Beta quantifies the sensitivity of an investment's returns to market movements, serving as a key risk metric in portfolio construction and asset pricing. Emphasizing alpha helps investors identify securities that outperform while beta guides diversification and risk management within a portfolio.

Choosing the Right Metric: When to Focus on Alpha vs. Beta

Alpha measures an investment's excess return relative to a benchmark, indicating skill or value added by active management, while Beta quantifies an asset's sensitivity to market movements, reflecting systematic risk. Investors focused on outperforming the market or evaluating fund manager skill should prioritize Alpha, especially in active portfolio management and stock selection contexts. Conversely, Beta is crucial when assessing market exposure, managing risk in passive strategies, or constructing diversified portfolios aligned with market trends.

Alpha (Finance) Infographic

libterm.com

libterm.com