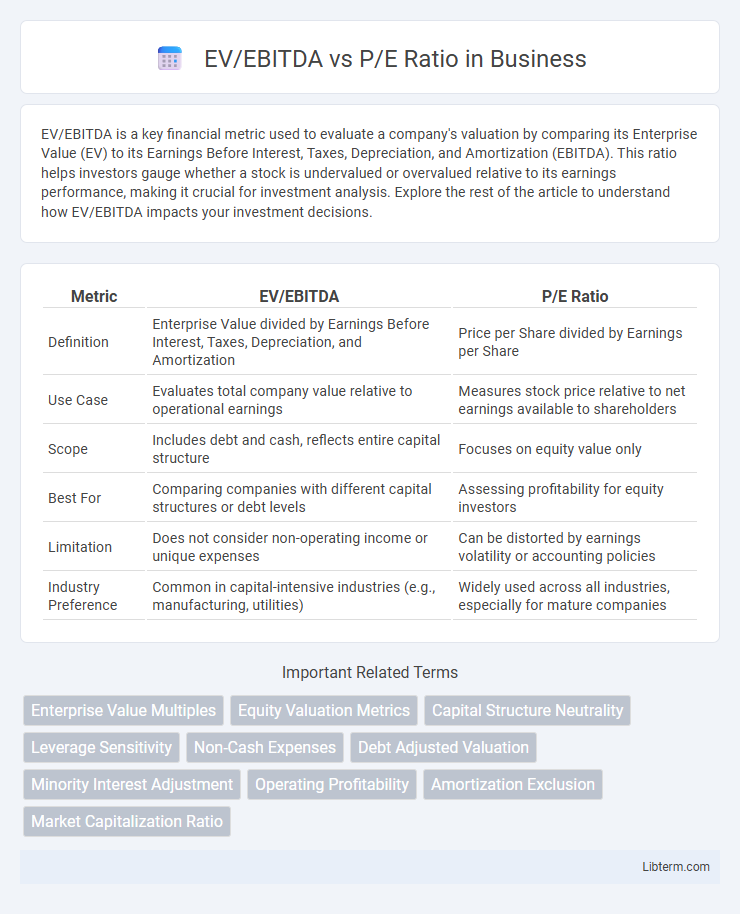

EV/EBITDA is a key financial metric used to evaluate a company's valuation by comparing its Enterprise Value (EV) to its Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA). This ratio helps investors gauge whether a stock is undervalued or overvalued relative to its earnings performance, making it crucial for investment analysis. Explore the rest of the article to understand how EV/EBITDA impacts your investment decisions.

Table of Comparison

| Metric | EV/EBITDA | P/E Ratio |

|---|---|---|

| Definition | Enterprise Value divided by Earnings Before Interest, Taxes, Depreciation, and Amortization | Price per Share divided by Earnings per Share |

| Use Case | Evaluates total company value relative to operational earnings | Measures stock price relative to net earnings available to shareholders |

| Scope | Includes debt and cash, reflects entire capital structure | Focuses on equity value only |

| Best For | Comparing companies with different capital structures or debt levels | Assessing profitability for equity investors |

| Limitation | Does not consider non-operating income or unique expenses | Can be distorted by earnings volatility or accounting policies |

| Industry Preference | Common in capital-intensive industries (e.g., manufacturing, utilities) | Widely used across all industries, especially for mature companies |

Introduction to EV/EBITDA and P/E Ratio

EV/EBITDA measures a company's enterprise value relative to its earnings before interest, taxes, depreciation, and amortization, providing a clear picture of operational profitability and cash flow potential. The P/E ratio compares a company's share price to its earnings per share, reflecting market expectations of future growth and profitability. Investors use EV/EBITDA for capital-intensive businesses to assess valuation independent of capital structure, while P/E is common for evaluating earnings-driven growth prospects.

Defining EV/EBITDA: What It Measures

EV/EBITDA measures a company's total value relative to its earnings before interest, taxes, depreciation, and amortization, offering insight into operating performance and cash flow potential without the impact of capital structure and non-cash expenses. Unlike the P/E ratio, which compares stock price to net earnings, EV/EBITDA includes debt and cash, providing a more comprehensive valuation metric for comparing companies with different capital structures. This ratio is particularly useful in capital-intensive industries where depreciation and amortization significantly affect net income.

Understanding the P/E Ratio: A Quick Overview

The P/E ratio measures a company's current share price relative to its earnings per share, indicating investor expectations about future profitability. It serves as a key valuation metric to compare companies within the same industry and assess whether a stock is overvalued or undervalued. Unlike EV/EBITDA, the P/E ratio does not account for debt or cash, making it less comprehensive for firms with varying capital structures.

Key Differences Between EV/EBITDA and P/E Ratios

EV/EBITDA evaluates a company's overall value by comparing enterprise value to earnings before interest, taxes, depreciation, and amortization, providing insight into operational efficiency without the influence of capital structure. P/E ratio measures a company's share price relative to its net earnings per share, reflecting market expectations and profitability from shareholders' perspective. Key differences include EV/EBITDA's focus on enterprise-level value and cash flow, whereas P/E ratio centers on equity value and net income, making EV/EBITDA less affected by debt and non-cash expenses.

Situations Where EV/EBITDA Is Preferable

EV/EBITDA is preferable when comparing companies with different capital structures because it accounts for debt and cash, providing a more comprehensive valuation metric than the P/E ratio, which only considers equity. It is especially useful in industries with heavy depreciation or significant non-cash expenses, as EBITDA excludes these factors, offering clearer insights into operational profitability. Investors favor EV/EBITDA when analyzing firms undergoing restructuring or with volatile earnings, where net income-based P/E ratios might be misleading.

When to Use the P/E Ratio for Valuation

The P/E ratio is most effective for valuing companies with consistent earnings and stable capital structures, such as mature firms in stable industries. It provides insight into how much investors are willing to pay per dollar of reported earnings, making it useful for comparing profitability across similar companies. When earnings vary widely or companies have significant debt, other multiples like EV/EBITDA may offer a clearer valuation perspective.

Advantages and Limitations of EV/EBITDA

EV/EBITDA offers a comprehensive valuation metric by factoring in a company's debt and cash, making it advantageous for comparing firms with varying capital structures. It minimizes distortions from non-cash expenses like depreciation, providing a clearer picture of operational profitability. However, EV/EBITDA ignores changes in working capital and capital expenditures, sometimes leading to an incomplete assessment of cash flow sustainability compared to the P/E ratio.

Strengths and Weaknesses of P/E Ratio

The P/E ratio offers a straightforward metric for evaluating a company's market valuation relative to its earnings, widely used for its simplicity and easy comparability across firms. However, it can be misleading for companies with volatile earnings or those in capital-intensive industries where depreciation heavily affects net profits, thus distorting true operational performance. Unlike EV/EBITDA, the P/E ratio ignores debt and cash levels, limiting its ability to fully capture enterprise value and financial risk.

Industry Examples: Comparing EV/EBITDA and P/E

EV/EBITDA is often preferred in capital-intensive industries like manufacturing and telecommunications due to its ability to account for debt and capital structure, providing a clearer picture of operational performance. In contrast, the P/E ratio is commonly used in technology and consumer sectors where earnings reflect growth potential and less leverage, making it suitable for comparing profitability relative to stock price. For example, automotive companies exhibit significant variation between EV/EBITDA and P/E metrics due to heavy capital investments, whereas software firms typically show closer alignment between these ratios because of lower depreciation and interest impacts.

Conclusion: Choosing the Right Metric for Valuation

EV/EBITDA provides a more comprehensive valuation by accounting for debt and capital structure, making it ideal for comparing companies with varying financial leverage. The P/E ratio emphasizes net earnings but can be distorted by differences in tax rates, depreciation, or debt levels, limiting its effectiveness across diverse industries. Selecting the appropriate metric depends on the specific financial context and capital structure of the business under analysis.

EV/EBITDA Infographic

libterm.com

libterm.com