Working capital measures the difference between a company's current assets and current liabilities, indicating its short-term financial health and operational efficiency. Managing working capital effectively ensures Your business can meet its short-term obligations while optimizing liquidity and profitability. Discover more strategies to improve Your working capital in the rest of this article.

Table of Comparison

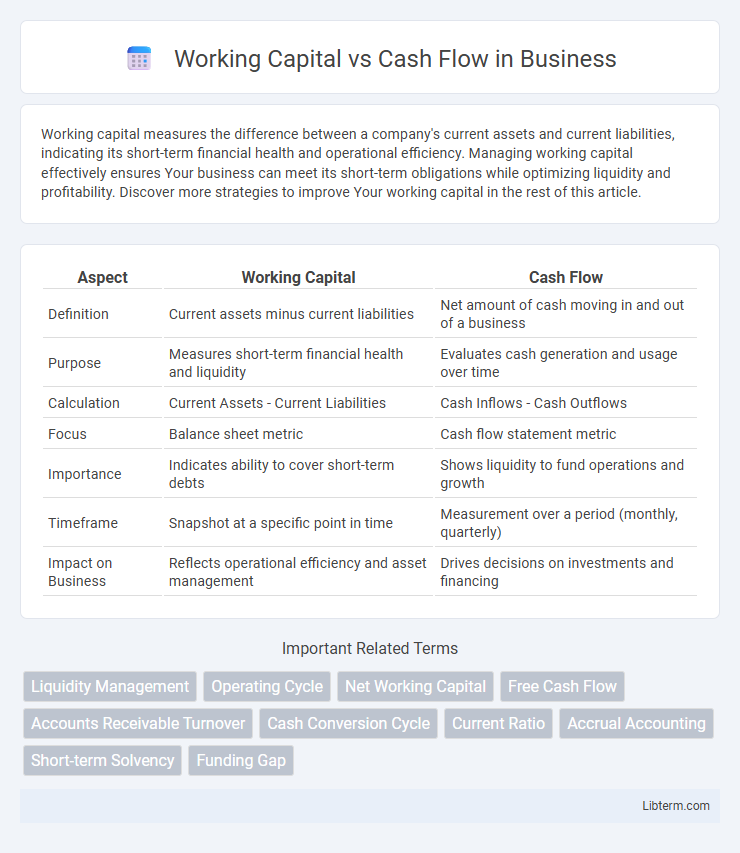

| Aspect | Working Capital | Cash Flow |

|---|---|---|

| Definition | Current assets minus current liabilities | Net amount of cash moving in and out of a business |

| Purpose | Measures short-term financial health and liquidity | Evaluates cash generation and usage over time |

| Calculation | Current Assets - Current Liabilities | Cash Inflows - Cash Outflows |

| Focus | Balance sheet metric | Cash flow statement metric |

| Importance | Indicates ability to cover short-term debts | Shows liquidity to fund operations and growth |

| Timeframe | Snapshot at a specific point in time | Measurement over a period (monthly, quarterly) |

| Impact on Business | Reflects operational efficiency and asset management | Drives decisions on investments and financing |

Understanding Working Capital: Definition and Importance

Working capital represents the difference between a company's current assets and current liabilities, serving as a crucial indicator of operational efficiency and short-term financial health. Positive working capital ensures a business can meet its short-term obligations and invest in growth opportunities without relying on external financing. Effective working capital management boosts liquidity, supports smooth daily operations, and reduces insolvency risk, distinguishing it from cash flow, which tracks the actual cash movement within the business.

What Is Cash Flow? Key Concepts Explained

Cash flow represents the net amount of cash and cash-equivalents moving into and out of a business within a specific period, reflecting the company's liquidity and operational efficiency. Key concepts include operating cash flow, which is cash generated from core business activities, investing cash flow related to asset purchases or sales, and financing cash flow involving debt or equity transactions. Understanding cash flow is critical for assessing a company's ability to sustain operations, meet financial obligations, and invest in growth opportunities.

Working Capital vs Cash Flow: Core Differences

Working capital represents the difference between a company's current assets and current liabilities, reflecting its short-term financial health and operational efficiency. Cash flow measures the net amount of cash moving in and out of the business during a specific period, indicating liquidity and the ability to meet immediate expenses. Unlike cash flow, which tracks actual cash transactions, working capital encompasses assets and liabilities that may not affect cash immediately but impact overall financial stability.

Components of Working Capital

Working capital consists of current assets such as inventory, accounts receivable, and cash, minus current liabilities including accounts payable and short-term debt, which together measure a company's operational liquidity. Effective management of these components ensures that a business maintains sufficient cash flow to meet short-term obligations and fund day-to-day operations. Optimizing inventory turnover and accelerating receivables collection directly enhance working capital while improving cash flow stability.

Types of Cash Flow in Business Operations

Working capital represents the difference between current assets and current liabilities, indicating a company's short-term financial health and operational efficiency. Cash flow in business operations is categorized primarily into operating cash flow, investing cash flow, and financing cash flow, each reflecting distinct sources and uses of cash. Operating cash flow specifically measures the cash generated or used by core business activities, providing critical insight into a company's ability to sustain and grow operations.

How Working Capital Affects Business Liquidity

Working capital directly impacts business liquidity by representing the difference between current assets and current liabilities, indicating the company's ability to cover short-term obligations. Positive working capital ensures sufficient resources to manage day-to-day operations, pay suppliers, and meet payroll, which maintains smooth business functioning. Insufficient working capital, even with positive cash flow, can lead to liquidity problems, risking delays in payments and operational disruptions.

The Impact of Cash Flow on Financial Stability

Cash flow directly influences a company's financial stability by ensuring liquidity for daily operations and preventing insolvency. Positive cash flow enables timely payment of liabilities, employee salaries, and reinvestment into growth opportunities, which strengthens working capital management. Maintaining strong cash flow is crucial for sustaining operational efficiency and avoiding disruptions that could compromise overall financial health.

Managing Working Capital for Business Growth

Effective management of working capital, encompassing accounts receivable, accounts payable, and inventory, directly influences cash flow, ensuring sufficient liquidity for daily operations and strategic investments. Optimizing working capital cycles reduces cash conversion time, enabling businesses to allocate resources toward growth initiatives and operational expansion. Maintaining a balance between current assets and liabilities allows companies to avoid cash shortages, enhance creditworthiness, and sustain long-term financial stability.

Cash Flow Management Strategies for Success

Effective cash flow management strategies involve closely monitoring inflows and outflows to maintain liquidity, ensuring timely payments to suppliers and employees, and optimizing receivables collection cycles to accelerate cash availability. Implementing cash flow forecasting tools allows businesses to anticipate shortfalls and plan financing solutions proactively. Prioritizing cash reserve buffers and negotiating favorable payment terms enhances financial stability and operational continuity, distinguishing cash flow focus from working capital, which broadly encompasses current assets and liabilities.

Which Matters More: Working Capital or Cash Flow?

Working capital and cash flow are both critical financial metrics, but cash flow often matters more because it directly measures the liquidity available for daily operations and obligations. Positive cash flow ensures a business can pay expenses and invest in growth, while working capital provides a snapshot of short-term financial health by comparing current assets to liabilities. Companies with strong working capital but poor cash flow may still face solvency issues, making cash flow management essential for sustainable business success.

Working Capital Infographic

libterm.com

libterm.com