Operating leverage measures how a company's fixed costs impact its earnings before interest and taxes (EBIT) as sales volume changes. High operating leverage means your profits are more sensitive to changes in revenue, amplifying both gains and losses. Discover how understanding operating leverage can enhance your financial strategy by reading the full article.

Table of Comparison

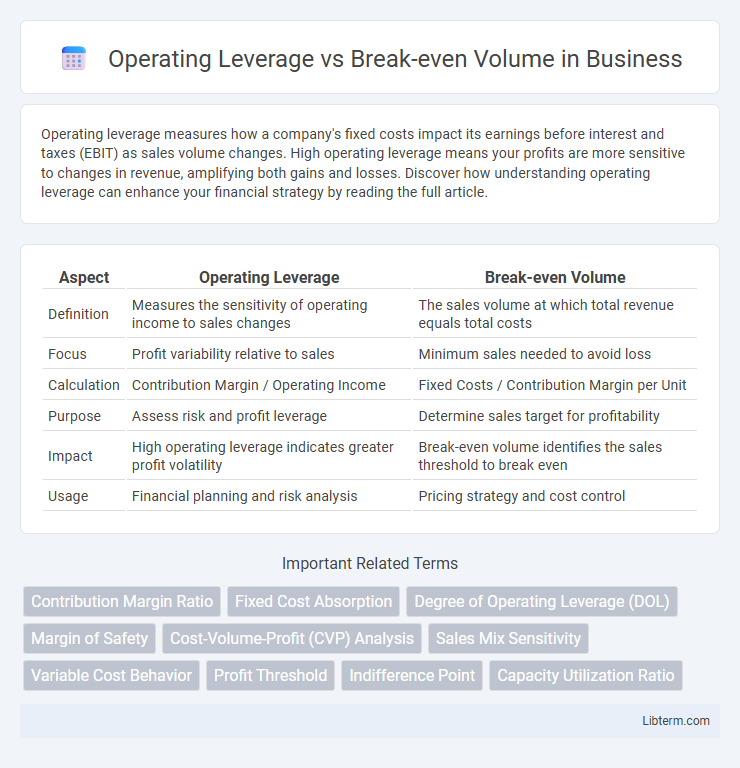

| Aspect | Operating Leverage | Break-even Volume |

|---|---|---|

| Definition | Measures the sensitivity of operating income to sales changes | The sales volume at which total revenue equals total costs |

| Focus | Profit variability relative to sales | Minimum sales needed to avoid loss |

| Calculation | Contribution Margin / Operating Income | Fixed Costs / Contribution Margin per Unit |

| Purpose | Assess risk and profit leverage | Determine sales target for profitability |

| Impact | High operating leverage indicates greater profit volatility | Break-even volume identifies the sales threshold to break even |

| Usage | Financial planning and risk analysis | Pricing strategy and cost control |

Understanding Operating Leverage

Operating leverage measures the sensitivity of a company's operating income to changes in sales volume, highlighting the impact of fixed costs on profitability. Higher operating leverage indicates that a small increase in sales can lead to a significant rise in operating income due to fixed cost structure. Understanding operating leverage helps businesses assess risk profiles and optimize break-even volume to maximize profit margins.

Defining Break-even Volume

Break-even volume represents the sales quantity at which total revenues exactly cover total costs, resulting in zero profit or loss. Operating leverage measures the sensitivity of operating income to changes in sales volume, emphasizing cost structure impact on profitability around the break-even point. Understanding break-even volume is crucial for assessing risk and decision-making with respect to operating leverage.

The Role of Fixed and Variable Costs

Operating leverage measures how fixed costs influence a company's profit sensitivity to sales volume changes, with higher fixed costs amplifying profit fluctuations. Break-even volume is the sales quantity where total revenues equal total costs, determined by the balance between fixed costs and variable costs per unit. Understanding fixed and variable costs is crucial, as fixed costs remain constant regardless of output, while variable costs vary directly with production, impacting both operating leverage and break-even analysis.

How Operating Leverage Impacts Profitability

Operating leverage amplifies the effect of sales volume changes on profitability by increasing fixed costs relative to variable costs, meaning higher operating leverage leads to greater profit sensitivity once the break-even volume is surpassed. Firms with high operating leverage experience larger profit increases from additional sales beyond the break-even volume but face higher risk if sales decline. Understanding the relationship between operating leverage and break-even volume is crucial for managing financial risk and optimizing profit margins in variable sales environments.

Calculating the Break-even Volume

Calculating the break-even volume involves dividing the total fixed costs by the contribution margin per unit, which is the selling price minus variable cost per unit. Operating leverage measures the sensitivity of operating income to changes in sales volume, highlighting the impact of fixed costs on profitability. Understanding the break-even volume helps businesses determine the minimum sales needed to cover costs before generating profit, aiding strategic decision-making related to cost structure and sales targets.

Key Differences Between Operating Leverage and Break-even Volume

Operating leverage measures the sensitivity of operating income to changes in sales volume, highlighting the proportion of fixed costs in a company's cost structure. Break-even volume represents the exact sales quantity required to cover all fixed and variable costs, resulting in zero profit or loss. The key difference is that operating leverage indicates profit potential variability, while break-even volume defines the minimum sales threshold for financial viability.

Advantages and Risks of High Operating Leverage

High operating leverage amplifies profit potential by increasing sensitivity to sales volume changes, allowing companies to rapidly boost earnings beyond break-even volume due to a higher fixed cost structure. However, this increased leverage also escalates financial risk, as firms must cover substantial fixed costs regardless of revenue fluctuations, leading to significant losses if sales fall below break-even volume. Businesses with high operating leverage benefit from strong profit growth during demand surges but must carefully manage risks in volatile markets to avoid financial distress.

Break-even Volume in Decision Making

Break-even volume represents the sales level where total revenues equal total costs, serving as a crucial metric in decision-making to determine the minimum output needed to avoid losses. Understanding break-even volume helps managers assess the risk associated with fixed and variable costs and evaluate how changes in sales volume impact profitability. Calculating break-even volume guides pricing strategies, cost control, and investment decisions, enabling firms to optimize operational leverage and ensure financial stability.

Practical Examples: Operating Leverage vs Break-even Volume

Operating leverage measures the extent to which fixed costs contribute to a firm's cost structure, affecting profitability as sales volume changes, while break-even volume identifies the sales quantity needed to cover all fixed and variable costs. For example, a company with high operating leverage, such as a software firm with significant fixed development costs, achieves profitability quicker after surpassing break-even because additional sales mostly contribute to profit. Conversely, a manufacturing business with lower operating leverage and higher variable costs requires a larger break-even volume, meaning it must sell more units to avoid losses.

Choosing the Right Metric for Business Strategy

Operating leverage measures the sensitivity of a company's operating income to changes in sales volume, highlighting fixed versus variable cost structures, while break-even volume identifies the sales amount needed to cover total costs without profit or loss. Selecting the right metric depends on strategic goals: operating leverage suits businesses aiming to maximize profit growth with sales fluctuations, whereas break-even volume is crucial for managing risk and setting minimum performance targets. Understanding both metrics enables firms to craft robust financial strategies that balance growth potential with operational stability.

Operating Leverage Infographic

libterm.com

libterm.com