Commission-based pay rewards employees based on their sales performance, directly linking income to productivity and motivation. This compensation structure encourages individuals to improve their sales skills and actively contribute to company growth. Explore the rest of the article to understand how commission-based pay can impact your earnings and career development.

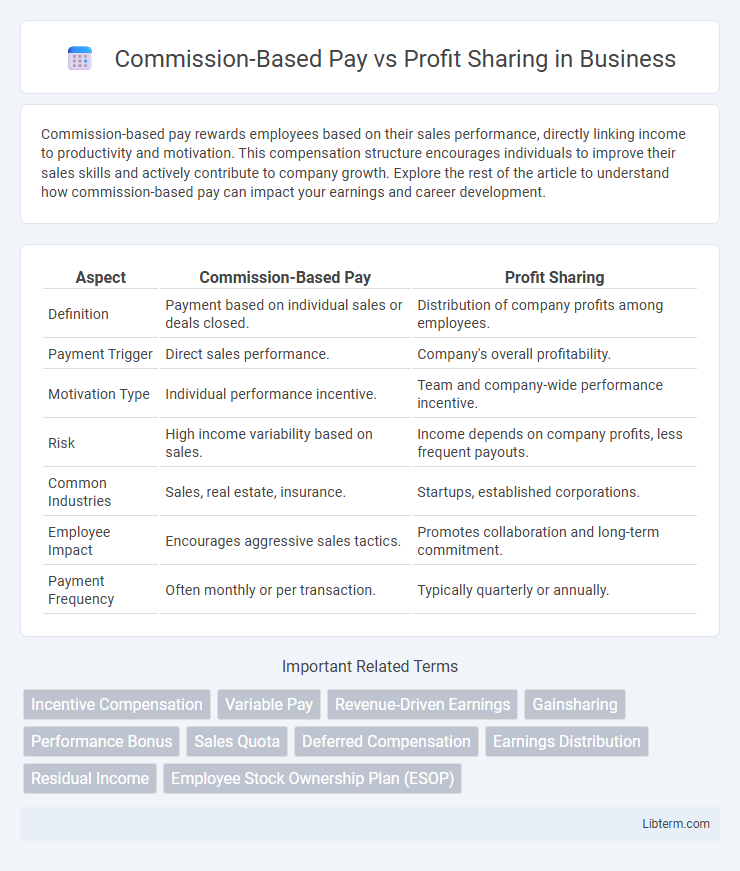

Table of Comparison

| Aspect | Commission-Based Pay | Profit Sharing |

|---|---|---|

| Definition | Payment based on individual sales or deals closed. | Distribution of company profits among employees. |

| Payment Trigger | Direct sales performance. | Company's overall profitability. |

| Motivation Type | Individual performance incentive. | Team and company-wide performance incentive. |

| Risk | High income variability based on sales. | Income depends on company profits, less frequent payouts. |

| Common Industries | Sales, real estate, insurance. | Startups, established corporations. |

| Employee Impact | Encourages aggressive sales tactics. | Promotes collaboration and long-term commitment. |

| Payment Frequency | Often monthly or per transaction. | Typically quarterly or annually. |

Introduction to Commission-Based Pay and Profit Sharing

Commission-based pay rewards employees with a percentage of sales or revenue they generate, directly linking compensation to individual performance and sales outcomes. Profit sharing distributes a portion of company earnings among employees, aligning their interests with overall business profitability and encouraging teamwork. Both compensation models motivate employees but differ in focus: commission-based pay emphasizes personal contributions, while profit sharing promotes collective success.

Defining Commission-Based Pay: Key Features

Commission-based pay directly ties employee earnings to sales performance, usually expressed as a percentage of the revenue generated. Key features include incentive alignment, motivating sales representatives to maximize individual sales, and providing immediate financial rewards based on measurable results. This pay structure is prevalent in industries like real estate, insurance, and retail, where individual contributions significantly impact overall revenue.

Understanding Profit Sharing: Core Concepts

Profit sharing is a compensation strategy where employees receive a portion of a company's profits, aligning their interests with business performance and fostering a sense of ownership. Unlike commission-based pay, which rewards individual sales efforts, profit sharing distributes financial gains collectively based on overall profitability. This model encourages teamwork, long-term commitment, and enhances motivation by linking employee rewards directly to the company's success.

Similarities and Differences Between the Two Structures

Commission-based pay and profit sharing both serve as performance-linked compensation methods designed to motivate employees by aligning their earnings with company success. Commission-based pay directly rewards employees based on individual sales or outputs, offering immediate financial incentives tied to personal performance. Profit sharing distributes a portion of the company's profits among employees, fostering collective ownership and incentivizing teamwork, with payouts typically dependent on overall organizational profitability rather than individual metrics.

Advantages of Commission-Based Pay for Employees

Commission-based pay offers employees the advantage of directly linking earnings to individual performance, providing strong motivation to increase sales and productivity. This compensation structure enables high performers to potentially earn more than fixed-salary counterparts, fostering financial empowerment and incentivizing skill development. The transparent nature of commission-based pay also allows employees to easily track income growth in correlation with their efforts, enhancing job satisfaction and retention.

Benefits of Profit Sharing for Teams and Organizations

Profit sharing fosters a collaborative team environment by aligning employee interests with organizational success, leading to increased motivation and productivity. It enhances employee retention and engagement by providing a sense of ownership and shared responsibility in the company's financial performance. Organizations benefit from improved teamwork and collective problem-solving, which drive innovation and sustainable growth.

Potential Drawbacks and Challenges of Each Approach

Commission-based pay can lead to income instability and encourage aggressive sales tactics that may harm customer relationships and company reputation. Profit sharing may dilute individual motivation as rewards depend on overall company performance, which can be influenced by factors beyond employees' control. Both approaches require careful design to balance incentives, maintain fairness, and align with long-term business goals.

Which Pay Structure Motivates Employees More?

Commission-based pay directly ties employee earnings to individual sales performance, creating a strong incentive for personal productivity and goal attainment. Profit sharing aligns employee rewards with overall company success, fostering teamwork and a collective sense of ownership that can enhance long-term motivation. Studies indicate that commission-based pay tends to motivate sales-driven roles more effectively, while profit sharing appeals to employees invested in organizational growth and collaboration.

Industry Trends: Where is Each Model Most Common?

Commission-based pay is predominantly utilized in sales-driven industries such as real estate, automotive, and retail, where individual performance directly correlates with revenue generation. Profit sharing is more common in sectors like manufacturing, technology, and professional services, fostering collective ownership and long-term company growth among employees. Current industry trends indicate a growing preference for hybrid compensation models combining both commission and profit sharing to balance immediate incentives with shared success.

Choosing the Right Compensation Plan for Your Business

Choosing the right compensation plan for your business hinges on aligning employee incentives with company goals. Commission-based pay drives individual sales performance by rewarding direct contributions, while profit sharing fosters a collective sense of ownership and motivates long-term company growth. Evaluating factors such as sales structure, profit margins, and team dynamics ensures the optimal balance between immediate results and sustainable profitability.

Commission-Based Pay Infographic

libterm.com

libterm.com