Fixed costs remain constant regardless of production volume, covering expenses such as rent, salaries, and insurance. These costs are crucial for budgeting and financial planning since they impact profitability even when sales fluctuate. Explore the rest of the article to understand how managing fixed costs can optimize your business performance.

Table of Comparison

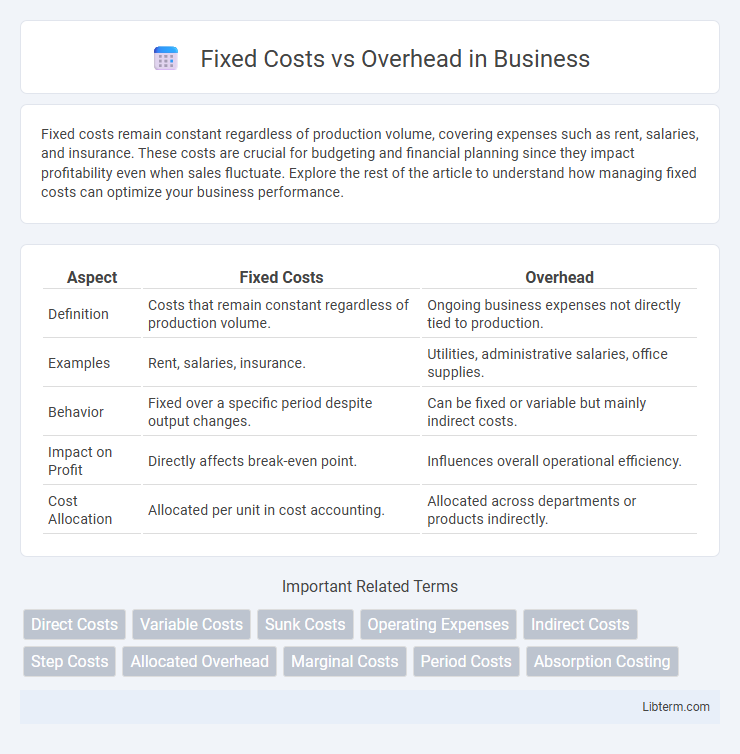

| Aspect | Fixed Costs | Overhead |

|---|---|---|

| Definition | Costs that remain constant regardless of production volume. | Ongoing business expenses not directly tied to production. |

| Examples | Rent, salaries, insurance. | Utilities, administrative salaries, office supplies. |

| Behavior | Fixed over a specific period despite output changes. | Can be fixed or variable but mainly indirect costs. |

| Impact on Profit | Directly affects break-even point. | Influences overall operational efficiency. |

| Cost Allocation | Allocated per unit in cost accounting. | Allocated across departments or products indirectly. |

Introduction to Fixed Costs and Overhead

Fixed costs represent business expenses that remain constant regardless of production levels, such as rent, salaries, and insurance. Overhead includes fixed costs but also encompasses indirect expenses necessary for daily operations, like utilities and administrative salaries. Understanding the distinction between fixed costs and overhead is essential for accurate budgeting and cost control.

Defining Fixed Costs

Fixed costs are expenses that remain constant regardless of production levels, such as rent, salaries, and insurance. These costs do not fluctuate with business activity and are essential for maintaining operational stability. Overhead includes fixed costs but also covers variable expenses necessary to keep the business running.

What Constitutes Overhead?

Overhead costs include all ongoing business expenses not directly tied to specific products or services, such as rent, utilities, salaries of administrative staff, and depreciation. These expenses support the overall operations but do not fluctuate directly with production levels, distinguishing them from variable costs. Understanding overhead is crucial for accurate budgeting, pricing strategies, and profitability analysis.

Key Differences Between Fixed Costs and Overhead

Fixed costs represent expenses that remain constant regardless of production levels, such as rent or salaried wages, while overhead includes all ongoing business expenses not directly tied to specific products, including fixed costs, utilities, and administrative salaries. Unlike fixed costs, overhead encompasses both fixed and variable components essential for general business operations. Understanding this distinction is crucial for accurate budgeting, cost control, and profitability analysis in financial management.

Examples of Fixed Costs in Business

Fixed costs in business include expenses such as rent, salaries of permanent staff, insurance premiums, and lease payments that remain constant regardless of production levels. Overhead costs encompass fixed costs but also include variable expenses related to day-to-day operations, like utilities or office supplies. Understanding specific examples of fixed costs helps businesses budget accurately and maintain financial stability during fluctuations in sales.

Common Types of Overhead Expenses

Common types of overhead expenses include rent, utilities, insurance, and administrative salaries, which remain constant regardless of production levels and are essential for daily business operations. Fixed costs overlap with several overhead expenses, as both involve expenditures that do not fluctuate with output, such as depreciation and lease payments. Understanding these categories helps businesses allocate resources efficiently and maintain profitability during periods of variable production.

Importance of Separating Fixed Costs and Overhead

Separating fixed costs from overhead is crucial for accurate financial analysis and effective budgeting in business operations. Fixed costs, such as rent and salaries, remain constant regardless of production levels, while overhead includes all ongoing expenses necessary to run the business, including indirect costs like utilities and administrative expenses. Distinguishing between these cost types enables precise cost control, better pricing strategies, and improved profitability forecasting.

Impact on Financial Planning and Budgeting

Fixed costs, such as rent and salaried wages, remain constant regardless of production levels, providing financial planners with predictable expense benchmarks essential for accurate budgeting. Overhead costs encompass both fixed and variable expenses necessary for daily operations, demanding meticulous allocation to avoid distortions in profitability analysis. Effective differentiation between fixed costs and overhead enables businesses to optimize resource allocation, enhance cost control, and improve forecasting accuracy.

Managing Fixed Costs and Overhead for Profitability

Managing fixed costs and overhead efficiently is crucial for enhancing profitability, as fixed costs remain constant regardless of sales volume, making cost control essential. Overhead expenses, which include rent, utilities, and administrative salaries, should be regularly analyzed and optimized to prevent eroding profit margins. Implementing budget monitoring and cost allocation strategies helps businesses maintain operational efficiency and improve financial performance.

Conclusion: Optimizing Costs for Business Success

Fixed costs remain constant regardless of production levels, while overhead includes ongoing expenses necessary to keep operations running. Efficiently managing both fixed costs and overhead can significantly improve profit margins and business sustainability. Prioritizing cost control strategies in these areas enables businesses to achieve optimal financial performance and competitive advantage.

Fixed Costs Infographic

libterm.com

libterm.com