Traditional mergers involve the combination of two companies where one entity legally absorbs the other, leading to unified operations and integrated management. This approach often aims to enhance competitive advantage, expand market share, and achieve operational synergies. Discover more about how traditional mergers can impact your business growth and strategic positioning in the rest of the article.

Table of Comparison

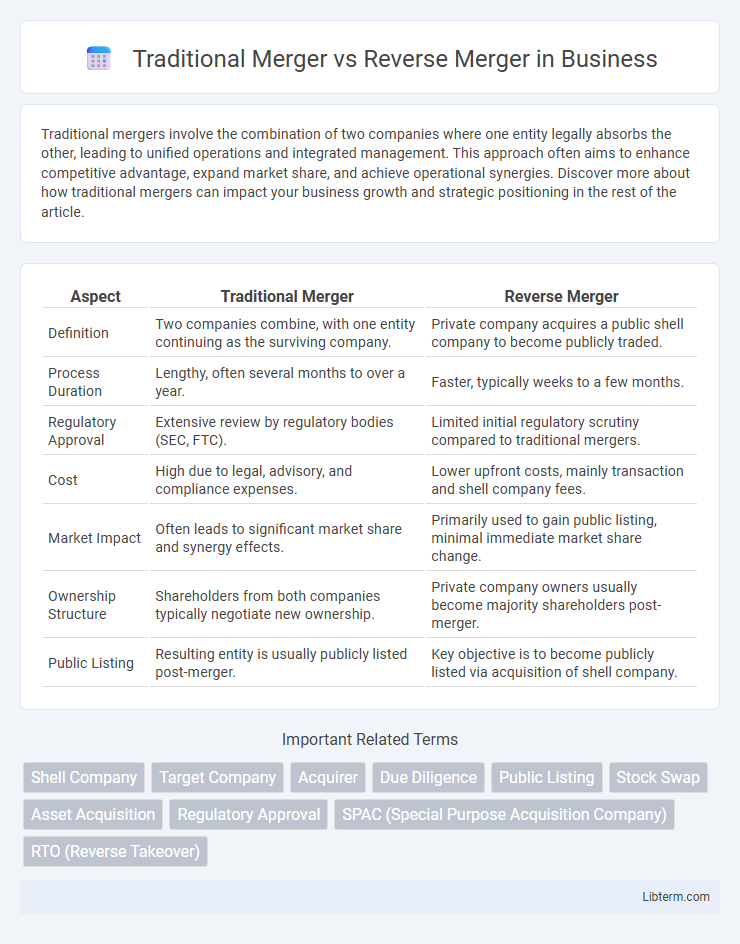

| Aspect | Traditional Merger | Reverse Merger |

|---|---|---|

| Definition | Two companies combine, with one entity continuing as the surviving company. | Private company acquires a public shell company to become publicly traded. |

| Process Duration | Lengthy, often several months to over a year. | Faster, typically weeks to a few months. |

| Regulatory Approval | Extensive review by regulatory bodies (SEC, FTC). | Limited initial regulatory scrutiny compared to traditional mergers. |

| Cost | High due to legal, advisory, and compliance expenses. | Lower upfront costs, mainly transaction and shell company fees. |

| Market Impact | Often leads to significant market share and synergy effects. | Primarily used to gain public listing, minimal immediate market share change. |

| Ownership Structure | Shareholders from both companies typically negotiate new ownership. | Private company owners usually become majority shareholders post-merger. |

| Public Listing | Resulting entity is usually publicly listed post-merger. | Key objective is to become publicly listed via acquisition of shell company. |

Introduction to Mergers: Traditional vs Reverse

Traditional mergers involve the direct acquisition of one company by another, resulting in the acquiring company absorbing the target's assets and operations. Reverse mergers occur when a private company merges with a publicly traded shell company, enabling the private entity to become publicly listed without an initial public offering (IPO). This strategic approach provides faster market access and potentially lower costs compared to traditional merger processes.

Definition and Key Features of Traditional Mergers

Traditional mergers involve the consolidation of two companies where one entity survives and the other ceases to exist, commonly structured as a merger of equals or a takeover. Key features include a thorough due diligence process, combined financial statements, and integration of operations and management to create synergies. Target company shareholders typically receive cash, stock, or a combination thereof in exchange for their shares, leading to unified corporate governance.

Understanding Reverse Mergers: An Overview

Reverse mergers involve a private company acquiring a publicly traded shell company to bypass the lengthy and expensive IPO process. This method enables faster access to public capital markets and immediate liquidity advantages, compared to traditional mergers where two companies combine to form a single entity through a negotiated agreement. Reverse mergers offer a strategic alternative for rapid public listing, often favored by smaller firms seeking to streamline regulatory requirements and reduce costs.

Structural Differences Between Traditional and Reverse Mergers

Traditional mergers involve a private company being absorbed by a public company, resulting in the private entity losing its original legal identity as it becomes a subsidiary or part of the public firm. Reverse mergers occur when a private company acquires a publicly traded shell company, enabling the private firm to become public without an initial public offering (IPO). Structurally, traditional mergers follow a consolidation approach requiring regulatory approvals and shareholder votes, whereas reverse mergers rely on stock exchange processes and are typically faster, bypassing extensive regulatory scrutiny.

Advantages of Traditional Mergers

Traditional mergers offer advantages such as greater regulatory clarity and investor confidence due to established legal frameworks and transparent processes. They often result in smoother integration of management teams and operational synergies, enhancing long-term strategic growth. Access to broader financial markets and stronger valuation premiums typically benefits companies pursuing traditional mergers.

Benefits of Reverse Mergers

Reverse mergers offer a faster and more cost-effective way for private companies to become publicly traded compared to traditional mergers, often bypassing the lengthy and expensive IPO process. They provide greater control and flexibility for company management while allowing access to public capital markets with less regulatory scrutiny. This strategic approach also enhances liquidity and can improve the company's market visibility without diluting ownership.

Drawbacks and Risks: Traditional vs Reverse Mergers

Traditional mergers often involve lengthy regulatory approvals and higher transaction costs, creating delays and increasing financial risks for companies. Reverse mergers carry risks of insufficient due diligence, potential fraud, and limited market scrutiny, which can lead to volatility and investor skepticism. Both methods pose challenges in integration and shareholder alignment, but reverse mergers may lack the transparency typically associated with traditional mergers.

Regulatory and Legal Considerations

Traditional mergers typically require extensive regulatory approval, including filings with the Securities and Exchange Commission (SEC) and shareholder votes, ensuring compliance with antitrust laws and financial disclosures. Reverse mergers offer a faster route to public trading by acquiring an existing public shell company, but they often face heightened scrutiny due to potential risks of inadequate due diligence and fraud, necessitating thorough legal review. Both processes demand adherence to corporate governance standards, securities regulations, and ongoing disclosure obligations to protect investors and maintain market integrity.

Real-World Examples of Traditional and Reverse Mergers

Traditional mergers often involve large corporations such as Disney acquiring 21st Century Fox, which expanded market share and content libraries. Reverse mergers have been exemplified by TPG Pace, where a private firm became publicly traded by merging with a dormant shell company, bypassing the lengthy IPO process. These real-world cases highlight traditional mergers' focus on synergy and scale, contrasted with reverse mergers' efficiency in gaining public market access.

Choosing the Right Merger Strategy for Your Business

Choosing the right merger strategy, such as a traditional merger or reverse merger, depends on business goals, financial health, and market conditions. Traditional mergers involve two companies combining assets and liabilities, often requiring extensive due diligence and regulatory approval. Reverse mergers offer faster public listing by acquiring a publicly traded shell company, ideal for startups seeking capital without lengthy IPO processes.

Traditional Merger Infographic

libterm.com

libterm.com