Outstanding shares represent the total number of a company's shares currently held by all its shareholders, including institutional investors, insiders, and the public. This figure is crucial for calculating metrics like earnings per share and market capitalization, directly impacting investment decisions. Discover how understanding outstanding shares can enhance your financial insights by reading the rest of the article.

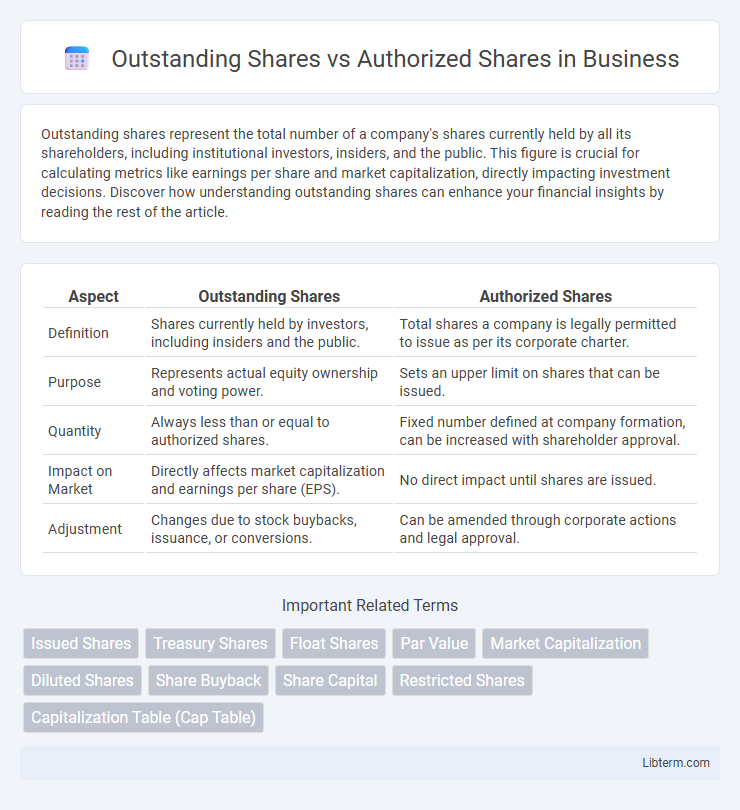

Table of Comparison

| Aspect | Outstanding Shares | Authorized Shares |

|---|---|---|

| Definition | Shares currently held by investors, including insiders and the public. | Total shares a company is legally permitted to issue as per its corporate charter. |

| Purpose | Represents actual equity ownership and voting power. | Sets an upper limit on shares that can be issued. |

| Quantity | Always less than or equal to authorized shares. | Fixed number defined at company formation, can be increased with shareholder approval. |

| Impact on Market | Directly affects market capitalization and earnings per share (EPS). | No direct impact until shares are issued. |

| Adjustment | Changes due to stock buybacks, issuance, or conversions. | Can be amended through corporate actions and legal approval. |

Introduction to Outstanding Shares vs Authorized Shares

Outstanding shares represent the total number of shares currently held by shareholders, including institutional investors and company insiders, while authorized shares denote the maximum shares a corporation can legally issue as specified in its corporate charter. The difference between authorized and outstanding shares outlines the potential shares a company can issue in the future for capital raising or employee compensation. Understanding the distinction is crucial for investors assessing ownership dilution and company valuation metrics such as earnings per share (EPS).

Definition of Authorized Shares

Authorized shares represent the maximum number of shares a corporation is legally permitted to issue as specified in its corporate charter. This ceiling serves as a framework for the company's equity structure, determining the potential scale of ownership distribution to shareholders. Authorized shares do not fluctuate with market activity and remain constant unless formally amended through a corporate resolution.

Definition of Outstanding Shares

Outstanding shares represent the total number of a company's shares currently held by all shareholders, including institutional investors and company insiders, reflecting the actual equity stake in the company. Authorized shares indicate the maximum number of shares a corporation is legally permitted to issue as specified in its corporate charter. Understanding outstanding shares is crucial for calculating market capitalization, earnings per share (EPS), and voting rights during shareholder meetings.

Key Differences Between Outstanding and Authorized Shares

Authorized shares represent the maximum number of shares a company is legally allowed to issue, as specified in its corporate charter, while outstanding shares are the actual number of shares currently held by shareholders, excluding treasury shares. Outstanding shares impact shareholder voting power and earnings per share calculations, whereas authorized shares set the upper limit for potential equity issuance and capital raising. Understanding the distinction is crucial for evaluating a company's capital structure and potential dilution risks.

The Role of Authorized Shares in Corporate Structure

Authorized shares represent the maximum number of shares a corporation is legally allowed to issue as defined in its articles of incorporation, serving as a foundational cap for equity distribution and capital raising. These shares provide flexibility for future financing, stock options, or strategic acquisitions without requiring immediate shareholder approval. Understanding the distinction between authorized and outstanding shares is essential for assessing a company's voting power, ownership dilution potential, and long-term growth strategy.

How Outstanding Shares Affect Shareholder Rights

Outstanding shares represent the actual number of shares held by shareholders, directly influencing voting power, dividend distribution, and ownership percentage within a company. Shareholders with a higher proportion of outstanding shares gain greater control over corporate decisions, including electing board members and approving mergers or policies. The dynamics of outstanding shares impact shareholder rights more significantly than authorized shares, which merely indicate the maximum number of shares a company may issue.

Reasons for the Gap Between Authorized and Outstanding Shares

The gap between authorized shares and outstanding shares arises because companies often reserve a portion of authorized shares for future needs such as raising capital, employee stock options, or acquisitions without immediate issuance. This reserved number provides flexibility to meet strategic financial goals while controlling shareholder dilution. Regulatory compliance and corporate governance considerations also influence the difference, allowing companies to maintain a buffer of shares that can be issued without requiring frequent shareholder approval.

Impact on Stock Price and Market Capitalization

Outstanding shares directly influence stock price and market capitalization by representing the actual number of shares available for trading, thereby determining the supply in the market. Authorized shares set the maximum limit a company can issue but do not impact stock price or market capitalization until shares are issued and become outstanding. Changes in outstanding shares through stock buybacks or new issuances affect market capitalization by altering the total shares multiplied by the current share price.

Legal and Regulatory Considerations

Authorized shares represent the maximum number of shares a corporation is legally permitted to issue as specified in its articles of incorporation, while outstanding shares refer to the total shares currently held by shareholders, excluding treasury shares. Legal and regulatory frameworks, such as securities laws and stock exchange regulations, require corporations to disclose both figures accurately in financial statements and filings to ensure transparency and protect investor interests. Failure to comply with authorized share limits or inaccurate reporting of outstanding shares can result in legal penalties, regulatory scrutiny, and potential shareholder lawsuits.

Conclusion: Choosing the Right Share Structure

Selecting the appropriate share structure hinges on understanding the distinct roles of outstanding shares and authorized shares in corporate finance. Outstanding shares represent the actual equity held by investors, influencing voting power and dividends, while authorized shares define the legal limit a company can issue. Balancing these factors ensures optimal capital management, shareholder control, and regulatory compliance for long-term growth.

Outstanding Shares Infographic

libterm.com

libterm.com