The issue price refers to the initial price set for securities when they are offered to the public during an IPO or other capital-raising event. This price is crucial because it determines the amount of capital a company can raise and influences investor interest and market perception. Discover more about how the issue price impacts your investment strategies in the rest of this article.

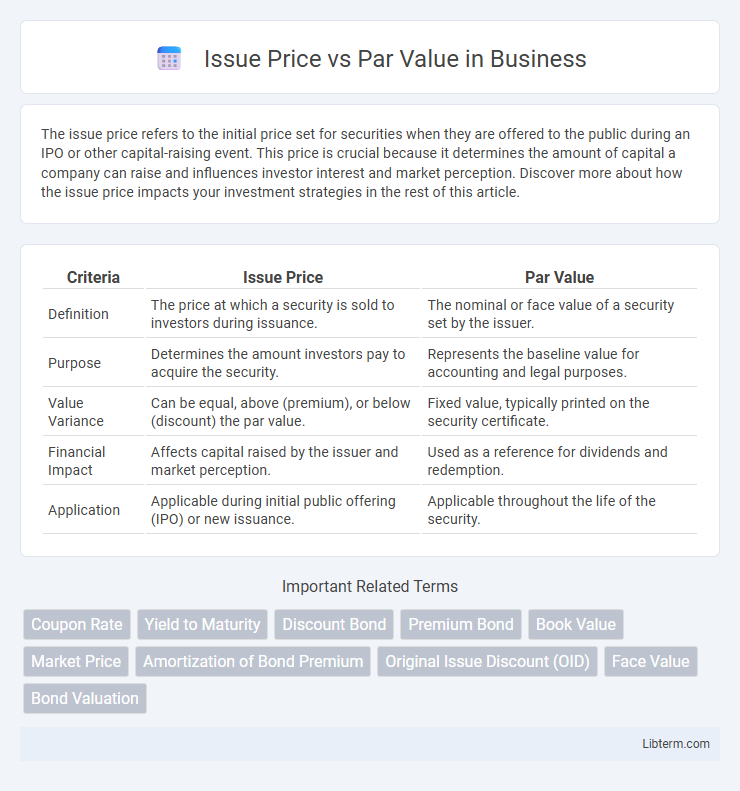

Table of Comparison

| Criteria | Issue Price | Par Value |

|---|---|---|

| Definition | The price at which a security is sold to investors during issuance. | The nominal or face value of a security set by the issuer. |

| Purpose | Determines the amount investors pay to acquire the security. | Represents the baseline value for accounting and legal purposes. |

| Value Variance | Can be equal, above (premium), or below (discount) the par value. | Fixed value, typically printed on the security certificate. |

| Financial Impact | Affects capital raised by the issuer and market perception. | Used as a reference for dividends and redemption. |

| Application | Applicable during initial public offering (IPO) or new issuance. | Applicable throughout the life of the security. |

Introduction to Issue Price and Par Value

Issue price represents the initial price at which a security, such as a bond or stock, is offered to investors during its issuance, often influenced by market conditions and investor demand. Par value, also known as face value, is the nominal or stated value of a security set by the issuer, serving as a benchmark for accounting and legal purposes. Understanding the distinction between issue price and par value is crucial for accurate valuation and financial reporting in capital markets.

Defining Par Value of Shares

Par value of shares represents the nominal or face value assigned to each share at the time of issuance, serving as the minimum price at which shares can be sold initially. It is a legal capital amount recorded in the company's charter and does not fluctuate with market conditions. Understanding par value is essential for determining the relationship between issue price and the legal capital base of the company.

What is Issue Price?

Issue price is the amount at which a bond or stock is initially sold to investors during an offering, often set based on market conditions, demand, and company valuation. It can be equal to, above, or below the par value, reflecting the security's perceived worth at issuance. Understanding the issue price is critical for investors to assess potential returns and for companies to determine the capital raised.

Key Differences Between Issue Price and Par Value

Issue price refers to the price at which a security, such as a stock or bond, is initially sold to investors, which can be above, below, or equal to its par value. Par value is the nominal or face value assigned to a security by the issuing company, typically representing the minimum price at issuance and a baseline value on the balance sheet. The key difference lies in that issue price fluctuates based on market demand and underwriting factors, while par value remains fixed and serves primarily accounting and legal purposes.

Significance of Par Value in Corporate Finance

Par value represents the nominal or face value of a stock set by the issuing company, serving as a legal capital foundation and protecting creditors by establishing a minimum equity base. It provides a baseline for transaction accounting and affects the calculation of dividends and stock issuance pricing. Although often different from the issue price, par value remains a critical metric for regulatory compliance and maintaining company capitalization integrity.

Factors Influencing Issue Price

Issue price is determined by market demand, prevailing interest rates, and the creditworthiness of the issuing company, which often leads to a difference from the par value. Economic conditions and investor perceptions also impact the premium or discount at which securities are issued. Regulatory frameworks and underwriting costs further influence the final issue price compared to the stated par value.

Legal and Regulatory Considerations

Issue price and par value are crucial in corporate finance, governed by securities regulations and corporate laws to ensure transparency and protect investors. Legal frameworks often mandate that shares cannot be issued below par value, preserving company capital and shareholder equity. Regulatory compliance includes accurate disclosure of issue price relative to par value in financial statements and prospectuses to prevent market manipulation and maintain investor confidence.

Impact on Shareholder Equity

Issue price above par value increases shareholder equity by generating additional paid-in capital, enhancing the company's net assets without impacting retained earnings. Conversely, issuing shares at par value only raises capital equivalent to the nominal amount, limiting the growth of equity reserves. When shares are issued below par value, which is rare and often regulated, it can decrease shareholder equity and signal potential financial distress.

Practical Examples: Issue Price vs. Par Value

A bond with a par value of $1,000 issued at $950 sells at a discount, meaning the issue price is lower than the par value, affecting the yield to maturity. Conversely, a stock with a par value of $1 might be issued at $10 per share, reflecting a premium and indicating the market's valuation above nominal value. Practical examples highlight how companies price securities based on market conditions, investor demand, and desired capital raised, resulting in issue prices that differ from the par value.

Conclusion: Choosing the Right Approach

Selecting the appropriate method between issue price and par value depends on the company's financial strategy and market conditions. Issue price reflects the actual amount investors pay, often influenced by market demand, while par value is a fixed nominal amount stated on the stock certificate. Prioritizing issue price aligns better with accurate capital raising and reflects true investor valuation, making it the preferred approach for most modern corporations.

Issue Price Infographic

libterm.com

libterm.com