Crowdfunding platforms enable entrepreneurs and creators to raise funds by reaching a broad audience online, connecting project ideas with potential backers. These platforms streamline the funding process, offering tools for campaign management, marketing, and payment processing to maximize reach and impact. Discover how you can leverage crowdfunding effectively by exploring the rest of this article.

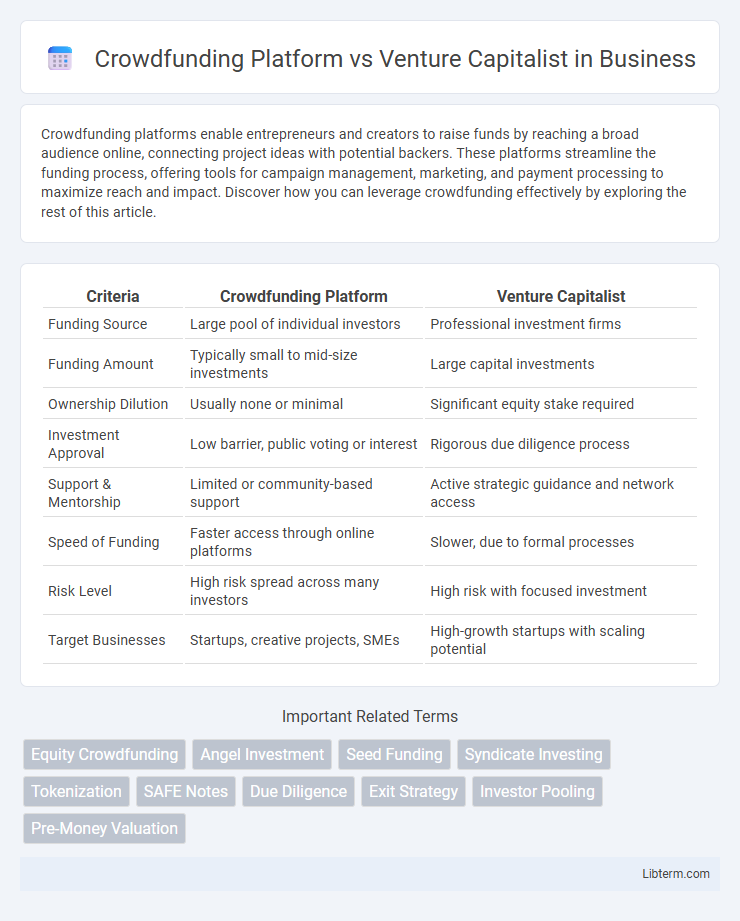

Table of Comparison

| Criteria | Crowdfunding Platform | Venture Capitalist |

|---|---|---|

| Funding Source | Large pool of individual investors | Professional investment firms |

| Funding Amount | Typically small to mid-size investments | Large capital investments |

| Ownership Dilution | Usually none or minimal | Significant equity stake required |

| Investment Approval | Low barrier, public voting or interest | Rigorous due diligence process |

| Support & Mentorship | Limited or community-based support | Active strategic guidance and network access |

| Speed of Funding | Faster access through online platforms | Slower, due to formal processes |

| Risk Level | High risk spread across many investors | High risk with focused investment |

| Target Businesses | Startups, creative projects, SMEs | High-growth startups with scaling potential |

Understanding Crowdfunding Platforms

Crowdfunding platforms offer entrepreneurs direct access to a broad audience of individual investors by leveraging the power of online communities and social media, enabling fundraising through small contributions from numerous backers. Unlike venture capitalists, who provide significant capital in exchange for equity and often demand control or strategic influence, crowdfunding allows founders to retain full ownership while validating market interest. These platforms also offer diverse funding models, such as rewards-based, equity-based, and donation-based crowdfunding, which cater to different business needs and investor motivations.

What Is a Venture Capitalist?

A venture capitalist (VC) is an investor who provides capital to startups and early-stage companies with high growth potential in exchange for equity or ownership stakes. Venture capitalists typically seek businesses with scalable innovations and robust market opportunities, offering not only funding but also strategic guidance and industry connections. Unlike crowdfunding platforms that gather small investments from a broad audience, venture capitalists focus on large, high-risk investments aimed at significant returns.

Key Differences Between Crowdfunding and Venture Capital

Crowdfunding platforms allow entrepreneurs to raise capital from a large number of individual investors, often in exchange for early product access or small equity stakes, while venture capitalists provide significant funding in return for substantial equity and active involvement in company decisions. Crowdfunding typically involves lower investment amounts spread across many backers, offering broader market validation, whereas venture capital demands rigorous due diligence and aims for high growth with concentrated ownership. The speed and accessibility of crowdfunding contrast with the longer, relationship-driven process of securing venture capital funding.

Funding Process: How Each Method Works

Crowdfunding platforms enable entrepreneurs to raise capital by collecting small investments from a large number of individual backers through online campaigns, often involving rewards or pre-sales to incentivize participation. Venture capitalists provide funding by investing large sums of money directly into startups in exchange for equity, following a rigorous process of due diligence, valuation, and negotiations. The crowdfunding process typically offers quicker access to funds with less stringent approval criteria, while venture capital funding involves thorough evaluation and strategic partnership considerations.

Accessibility for Startups and Entrepreneurs

Crowdfunding platforms provide startups and entrepreneurs with greater accessibility by allowing them to raise capital directly from a diverse pool of individual backers, often with minimal upfront costs or stringent requirements. Venture capitalists typically require startups to demonstrate strong market potential, proven traction, and scalable business models, creating higher barriers to entry. This accessibility difference enables early-stage companies to validate ideas and gather funds more quickly through crowdfunding, while venture capital focuses on more mature businesses with higher growth prospects.

Investment Size and Potential Returns

Crowdfunding platforms typically attract smaller investment amounts from a large pool of individual backers, often ranging from $10 to several thousand dollars per investor, offering diverse but generally lower potential returns compared to venture capitalists. Venture capitalists commit substantial sums, usually from hundreds of thousands to millions of dollars, in exchange for equity stakes that hold the potential for significantly higher returns through company growth and eventual exit events. The investment size correlates directly with risk and reward profiles, where venture capital investments are riskier but promise higher returns, whereas crowdfunding investments offer more accessible entry points with modest return expectations.

Level of Investor Involvement

Crowdfunding platforms typically involve a large number of small investors who contribute funds with minimal direct involvement in business operations. Venture capitalists, on the other hand, provide significant funding accompanied by active participation in strategic decision-making and company growth. This heightened level of involvement from venture capitalists often includes mentorship, networking, and hands-on management support.

Risk Factors and Mitigation Strategies

Crowdfunding platforms distribute financial risks across numerous small investors, minimizing individual exposure while allowing startups to validate market demand early. Venture capitalists assume higher risk by investing substantial funds in fewer ventures, relying on detailed due diligence and active involvement to mitigate potential losses. Risk mitigation in crowdfunding centers on diversified investment portfolios and transparent campaign information, whereas venture capital mitigates risk through rigorous evaluation, strategic guidance, and staged funding tied to performance milestones.

Pros and Cons of Crowdfunding Platforms

Crowdfunding platforms offer entrepreneurs access to a diverse pool of small investors, enabling rapid capital generation without giving up significant equity or control. However, they require substantial marketing effort, have variable success rates, and expose ideas to public scrutiny, risking imitation. Compared to venture capitalists, crowdfunding provides more democratic funding options but lacks the strategic mentorship and larger financial backing that VCs typically offer.

Pros and Cons of Venture Capitalists

Venture capitalists offer significant funding and strategic expertise, enabling startups to scale rapidly and access extensive industry networks, but they often demand substantial equity and influence over company decisions. Their rigorous due diligence process ensures thorough vetting, yet this can delay funding and exclude early-stage or high-risk ventures. While VCs provide growth capital and mentorship, founders may face pressure to prioritize short-term financial returns over long-term innovation.

Crowdfunding Platform Infographic

libterm.com

libterm.com