Sentiment analysis uses natural language processing and machine learning to identify emotions and opinions within text, enabling businesses to better understand customer feedback and market trends. By analyzing social media posts, reviews, and surveys, companies gain invaluable insights to improve their products and services. Discover how sentiment analysis can transform Your data into actionable strategies in the rest of this article.

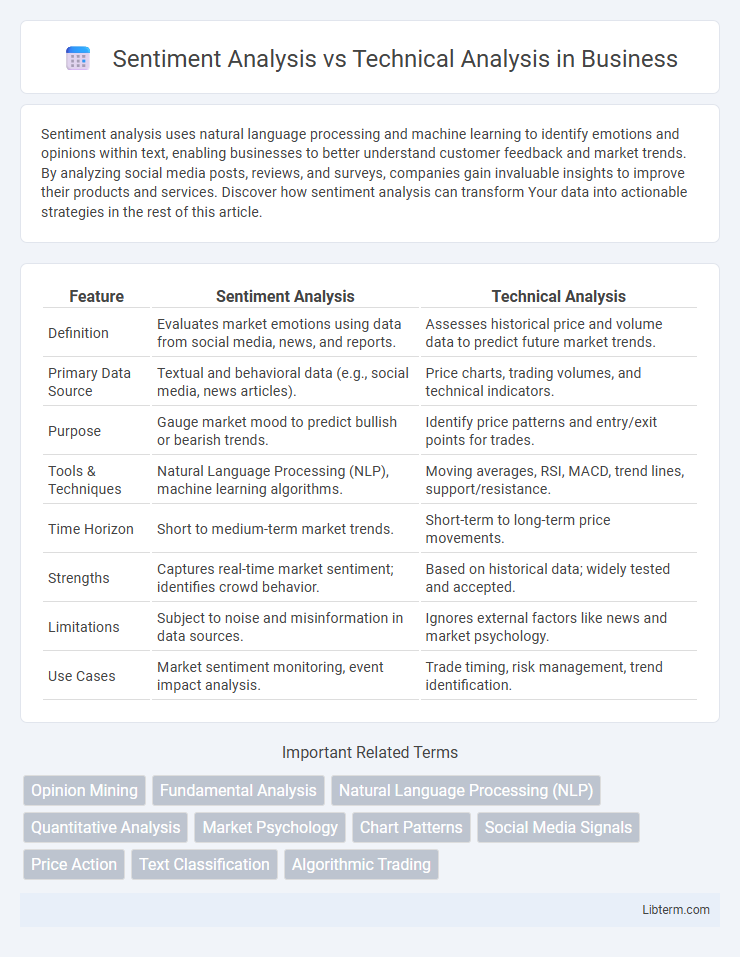

Table of Comparison

| Feature | Sentiment Analysis | Technical Analysis |

|---|---|---|

| Definition | Evaluates market emotions using data from social media, news, and reports. | Assesses historical price and volume data to predict future market trends. |

| Primary Data Source | Textual and behavioral data (e.g., social media, news articles). | Price charts, trading volumes, and technical indicators. |

| Purpose | Gauge market mood to predict bullish or bearish trends. | Identify price patterns and entry/exit points for trades. |

| Tools & Techniques | Natural Language Processing (NLP), machine learning algorithms. | Moving averages, RSI, MACD, trend lines, support/resistance. |

| Time Horizon | Short to medium-term market trends. | Short-term to long-term price movements. |

| Strengths | Captures real-time market sentiment; identifies crowd behavior. | Based on historical data; widely tested and accepted. |

| Limitations | Subject to noise and misinformation in data sources. | Ignores external factors like news and market psychology. |

| Use Cases | Market sentiment monitoring, event impact analysis. | Trade timing, risk management, trend identification. |

Introduction to Sentiment Analysis and Technical Analysis

Sentiment analysis evaluates market psychology by analyzing social media, news, and investor opinions to forecast price movements, offering insights into crowd behavior and emotional trends. Technical analysis studies historical price patterns, volume, and statistical indicators to predict future asset prices based on chart formations and momentum signals. Both methods provide distinct frameworks: sentiment analysis captures market sentiment dynamics, while technical analysis relies on empirical price data and trend identification.

Defining Sentiment Analysis in Financial Markets

Sentiment analysis in financial markets refers to the process of using natural language processing and machine learning algorithms to gauge investor emotions and opinions from news, social media, and market reports. This technique helps identify market sentiment trends, such as bullish or bearish attitudes, which influence price movements and trading decisions. Unlike technical analysis, which relies on historical price and volume data, sentiment analysis captures the psychological factors driving market behavior.

Understanding Technical Analysis: Core Principles

Technical analysis relies on historical price data and trading volume to forecast future market movements, using patterns such as support, resistance, and trend lines. Key tools include moving averages, Relative Strength Index (RSI), and candlestick charting to identify market momentum and potential reversal points. By focusing on price action rather than underlying fundamentals, technical analysis aims to provide traders with actionable insights for timing market entries and exits.

Key Differences Between Sentiment and Technical Analysis

Sentiment analysis focuses on measuring investor emotions and market psychology through data sources such as news headlines, social media, and market surveys, while technical analysis relies on historical price movements, charts, and technical indicators like moving averages or RSI to predict future price trends. Sentiment analysis aims to gauge market mood and potential reversals based on collective behavior, whereas technical analysis emphasizes patterns and statistical trends within price and volume data. The main difference lies in sentiment analysis incorporating qualitative data reflecting market sentiment, while technical analysis strictly depends on quantitative, price-based information.

Data Sources Used in Sentiment vs Technical Analysis

Sentiment analysis relies on unstructured data sources such as social media posts, news articles, blogs, and customer reviews to gauge market sentiment and investor emotions. Technical analysis uses structured data derived from historical price charts, trading volumes, and technical indicators like moving averages and relative strength index (RSI) to predict future price movements. While sentiment analysis captures real-time market mood through qualitative data, technical analysis focuses on quantitative patterns and statistical trends inherent in market price actions.

Tools and Techniques for Sentiment Analysis

Sentiment analysis utilizes natural language processing (NLP) tools, machine learning algorithms, and social media monitoring platforms to gauge market mood from news, tweets, and forums. Techniques such as lexicon-based approaches, deep learning models like LSTM and transformers, and sentiment scoring APIs enable real-time extraction of bullish or bearish sentiments. These methods contrast with technical analysis tools that rely on price charts, moving averages, and oscillators to predict market trends without interpreting textual data.

Popular Indicators in Technical Analysis

Popular indicators in technical analysis include Moving Averages, Relative Strength Index (RSI), and Bollinger Bands, which help traders identify trends, momentum, and volatility in price movements. Sentiment analysis, by contrast, evaluates market sentiment through data sources like social media, news, and surveys to gauge investor attitudes and potential market reactions. While technical analysis relies on price and volume data patterns, sentiment analysis focuses on the psychological factors impacting market behavior.

Advantages and Limitations of Sentiment Analysis

Sentiment analysis leverages natural language processing to gauge market sentiment from social media, news, and blogs, providing real-time insights into investor emotions that can predict short-term market movements. Its advantages include the ability to capture crowd psychology and emerging trends that traditional data might miss, while limitations involve the challenges of interpreting sarcasm, noise in data sources, and risks of manipulation through fake news. Unlike technical analysis, which relies on historical price patterns and statistical indicators, sentiment analysis offers a complementary perspective focused on qualitative market factors but often requires robust algorithms to ensure accuracy and relevance.

Pros and Cons of Technical Analysis

Technical analysis offers the advantage of using historical price data and volume trends to predict future market movements, making it valuable for short-term trading strategies. However, its reliance on past patterns can lead to inaccuracies in volatile or fundamentally driven markets, limiting its effectiveness during unprecedented events. While technical analysis provides clear entry and exit signals, it often overlooks underlying economic factors, potentially resulting in incomplete market assessments.

Integrating Sentiment and Technical Analysis for Better Trading Decisions

Integrating sentiment analysis with technical analysis enhances trading decisions by combining market psychology insights and price action patterns, improving prediction accuracy. Sentiment analysis interprets trader emotions and public mood from sources like social media and news, while technical analysis relies on historical price data, charts, and indicators like moving averages and RSI. The synergy of both methods enables traders to identify trend reversals, validate signals, and manage risk more effectively, leading to optimized portfolio performance.

Sentiment Analysis Infographic

libterm.com

libterm.com