Stocks represent ownership shares in a company, allowing investors to participate in the company's growth and profits through price appreciation and dividends. Understanding stock market trends and company fundamentals can help you make informed investment decisions that align with your financial goals. Explore the rest of the article to learn how to build a successful stock portfolio and navigate market fluctuations effectively.

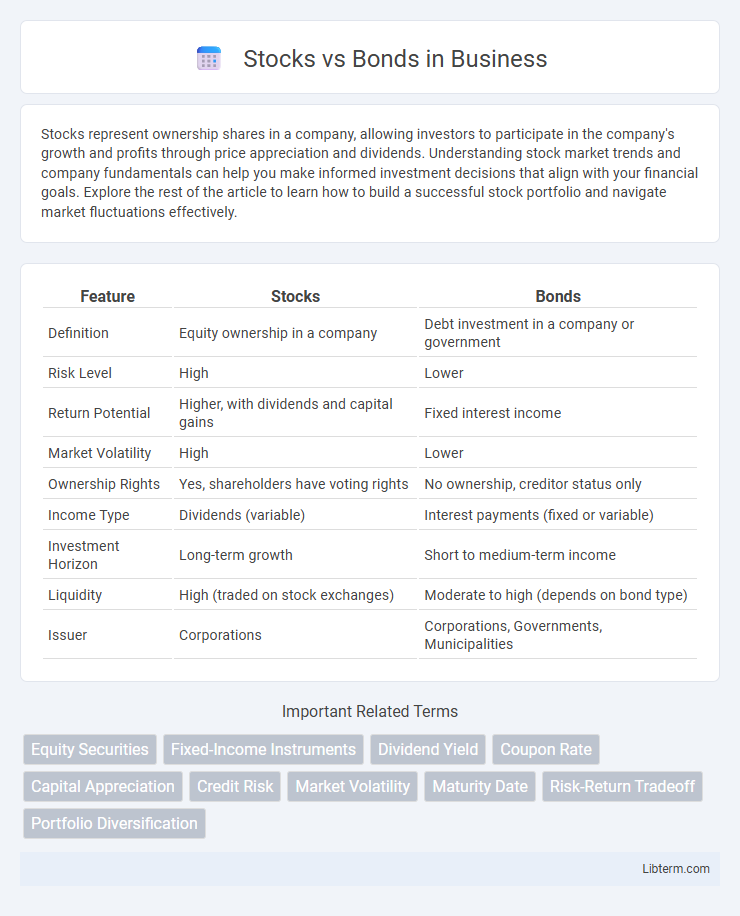

Table of Comparison

| Feature | Stocks | Bonds |

|---|---|---|

| Definition | Equity ownership in a company | Debt investment in a company or government |

| Risk Level | High | Lower |

| Return Potential | Higher, with dividends and capital gains | Fixed interest income |

| Market Volatility | High | Lower |

| Ownership Rights | Yes, shareholders have voting rights | No ownership, creditor status only |

| Income Type | Dividends (variable) | Interest payments (fixed or variable) |

| Investment Horizon | Long-term growth | Short to medium-term income |

| Liquidity | High (traded on stock exchanges) | Moderate to high (depends on bond type) |

| Issuer | Corporations | Corporations, Governments, Municipalities |

Introduction to Stocks and Bonds

Stocks represent ownership shares in a company, offering investors potential dividends and capital appreciation based on the company's performance. Bonds are debt instruments where investors lend money to an entity (corporate or government) in exchange for periodic interest payments and eventual principal repayment. Understanding the fundamental differences between stocks and bonds helps investors balance risk and return in their portfolios.

Key Differences Between Stocks and Bonds

Stocks represent equity ownership in a company, granting shareholders voting rights and potential dividends, while bonds are debt instruments where investors lend money to an entity in exchange for fixed interest payments. Stocks tend to offer higher returns with greater volatility, reflecting company performance and market fluctuations, whereas bonds typically provide more stable, lower-risk income streams with priority in asset claims during liquidation. Understanding these differences helps investors balance portfolios by aligning risk tolerance, income needs, and growth objectives effectively.

How Stocks Work

Stocks represent ownership shares in a company, providing shareholders with voting rights and a claim on the company's profits through dividends. The stock price fluctuates based on company performance, market conditions, and investor sentiment, reflecting the expected future earnings and growth potential. Investors in stocks assume higher risk compared to bonds but have the opportunity for capital appreciation and dividend income.

How Bonds Work

Bonds are debt securities issued by corporations or governments to raise capital, where investors lend money in exchange for periodic interest payments called coupons. The principal amount, also known as the face or par value, is repaid to the bondholder at maturity, which can range from short-term to long-term periods. Bond prices fluctuate based on interest rates, credit risk, and market conditions, making them a generally lower-risk, income-generating alternative to stocks.

Risk and Return: Stocks vs Bonds

Stocks generally offer higher potential returns but come with increased volatility and risk of loss, making them suitable for investors with a longer time horizon and higher risk tolerance. Bonds provide more stable income through fixed interest payments and lower risk, appealing to conservative investors seeking capital preservation and steady returns. The risk-return tradeoff between stocks and bonds plays a crucial role in portfolio diversification and asset allocation strategies.

Income Generation: Dividends vs Interest

Stocks generate income primarily through dividends, which are periodic payments made to shareholders from company profits, offering potential for income growth if the company performs well. Bonds provide income via fixed interest payments, known as coupon payments, which offer predictable and stable cash flow over the bond's term. Investors seeking regular income often balance stocks for dividend growth with bonds for consistent interest income to optimize portfolio yield and risk.

Suitability for Different Investor Profiles

Stocks suit investors seeking higher growth potential and willing to accept greater volatility and risk, ideal for those with longer time horizons and higher risk tolerance. Bonds fit conservative investors prioritizing capital preservation and steady income, especially retirees or individuals with shorter investment horizons. A balanced portfolio often combines stocks and bonds to align with varying risk appetites and financial goals.

Diversification: Blending Stocks and Bonds

Blending stocks and bonds in an investment portfolio enhances diversification by balancing growth potential and risk management. Stocks offer higher returns with greater volatility, while bonds provide steady income and lower risk, reducing overall portfolio fluctuations. This diversification strategy improves risk-adjusted returns and helps protect against market downturns.

Economic Factors Impacting Stocks and Bonds

Economic factors such as interest rates, inflation, and GDP growth significantly impact stocks and bonds differently: rising interest rates typically lead to lower bond prices but can pressure stock valuations by increasing borrowing costs. Inflation erodes bond returns because fixed interest payments lose purchasing power, while stocks may benefit if companies have pricing power to pass costs to consumers. Strong GDP growth boosts corporate earnings and stock prices, whereas bonds might face higher yields as investors demand compensation for growth-driven inflation risks.

Choosing Between Stocks and Bonds for Your Portfolio

Choosing between stocks and bonds depends on your risk tolerance, investment goals, and time horizon. Stocks offer higher growth potential through capital gains and dividends but come with increased volatility and market risk. Bonds provide steady income with lower risk, making them ideal for preserving capital and balancing portfolio volatility.

Stocks Infographic

libterm.com

libterm.com