Direct listing offers a cost-effective alternative to traditional IPOs by allowing companies to sell existing shares directly to the public without issuing new ones. This method enhances liquidity and provides greater price transparency, benefiting both the company and investors. Explore the full article to understand how a direct listing could impact your investment strategy.

Table of Comparison

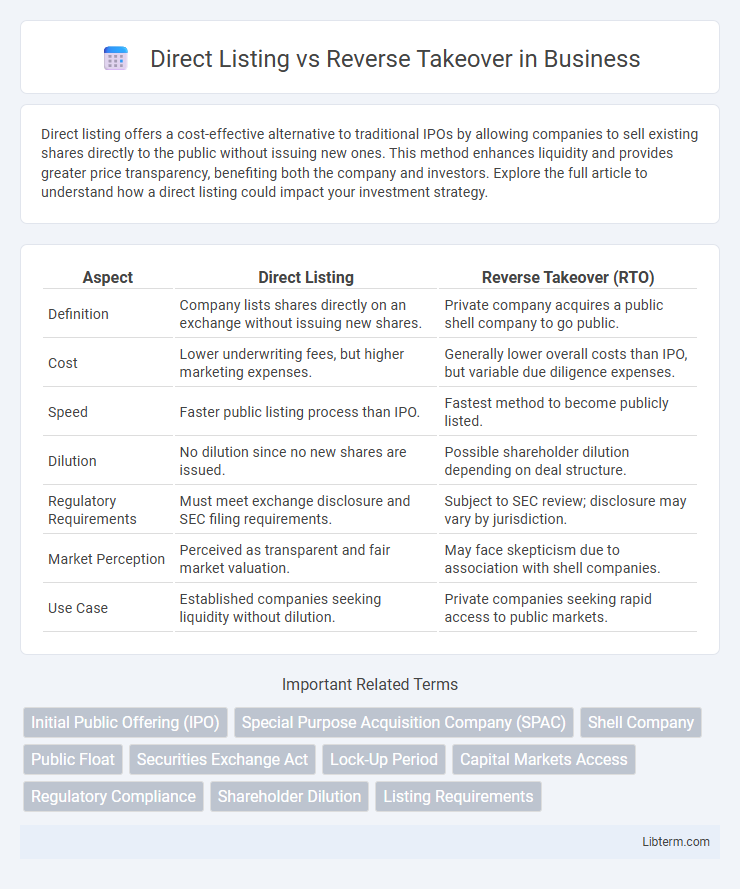

| Aspect | Direct Listing | Reverse Takeover (RTO) |

|---|---|---|

| Definition | Company lists shares directly on an exchange without issuing new shares. | Private company acquires a public shell company to go public. |

| Cost | Lower underwriting fees, but higher marketing expenses. | Generally lower overall costs than IPO, but variable due diligence expenses. |

| Speed | Faster public listing process than IPO. | Fastest method to become publicly listed. |

| Dilution | No dilution since no new shares are issued. | Possible shareholder dilution depending on deal structure. |

| Regulatory Requirements | Must meet exchange disclosure and SEC filing requirements. | Subject to SEC review; disclosure may vary by jurisdiction. |

| Market Perception | Perceived as transparent and fair market valuation. | May face skepticism due to association with shell companies. |

| Use Case | Established companies seeking liquidity without dilution. | Private companies seeking rapid access to public markets. |

Introduction to Direct Listing and Reverse Takeover

Direct listing allows a company to go public by offering existing shares directly to the market without issuing new shares or raising capital, providing liquidity for current shareholders while avoiding underwriting fees. Reverse takeover involves a private company acquiring a publicly listed shell company to bypass the traditional initial public offering (IPO) process, gaining a faster route to public markets. Both methods serve as alternative strategies to traditional IPOs with distinct regulatory and financial implications.

Key Definitions: What is a Direct Listing?

A Direct Listing is a method for a company to go public by selling existing shares directly to the public without issuing new shares or raising capital. It allows existing shareholders to sell their stocks on a public exchange without underwriters or traditional IPO roadshows. This process provides increased liquidity, transparency, and typically lower costs compared to conventional IPOs.

Key Definitions: What is a Reverse Takeover?

A Reverse Takeover (RTO) is a process where a private company acquires a publicly listed company to bypass the lengthy and costly initial public offering (IPO) process. This method allows the private company to gain instant public listing, access to capital markets, and enhanced liquidity by merging its operations into the publicly traded entity. RTOs are commonly used by smaller companies seeking faster entry into stock exchanges without meeting standard IPO requirements.

Primary Differences Between Direct Listing and Reverse Takeover

Direct listing allows a company to go public by offering existing shares directly on a stock exchange without underwriters or issuing new shares, preserving ownership and avoiding dilution. Reverse takeover involves a private company acquiring a publicly listed shell company to bypass the traditional IPO process, enabling faster market access but often with potential regulatory complexities. Key differences include the direct listing's transparency and market-driven price discovery versus the reverse takeover's strategic acquisition route with possible integration challenges.

Advantages of Direct Listing

Direct listing offers companies the advantage of faster market entry without the need for underwriters, reducing costs significantly compared to traditional IPOs and reverse takeovers. It enables existing shareholders to sell shares immediately, enhancing liquidity and price discovery directly on the exchange. Direct listings maintain company control and transparency, avoiding the complex regulatory and shareholder approval processes often involved in reverse takeovers.

Advantages of Reverse Takeover

Reverse takeovers offer a faster and more cost-effective route for private companies to go public compared to traditional initial public offerings (IPOs). This method provides immediate access to public capital markets without the extensive regulatory scrutiny and underwriting fees associated with direct listings. Companies benefit from increased liquidity, enhanced valuation transparency, and a streamlined pathway to public market presence through reverse takeovers.

Disadvantages and Risks of Direct Listing

Direct listing carries the risk of limited capital raised since no new shares are issued, potentially constraining growth opportunities compared to traditional IPOs. It exposes companies to heightened market volatility and price fluctuations as there are fewer underwriters stabilizing the stock price post-listing. Furthermore, the lack of a lock-up period in direct listings can lead to immediate large sell-offs by insiders, increasing stock price unpredictability and investor uncertainty.

Disadvantages and Risks of Reverse Takeover

Reverse Takeover (RTO) carries significant risks such as potential hidden liabilities in the target company, which can lead to undisclosed financial problems after the transaction. The lack of thorough regulatory scrutiny compared to traditional IPOs increases the chance of compliance issues and investor distrust. Market perception often views RTOs as less transparent and riskier, potentially resulting in lower stock liquidity and valuation challenges.

Suitability: Which Companies Should Consider Each Method?

Direct listings suit established companies with strong brand recognition and substantial public interest, as they allow existing shareholders to sell shares without raising new capital. Reverse takeovers are ideal for smaller or private firms seeking a quicker, less expensive public entry by merging with an existing publicly traded shell company. Companies valuing faster market access and lower regulatory hurdles often prefer reverse takeovers, while those prioritizing market transparency and investor confidence lean toward direct listings.

Recent Trends and Case Studies in Direct Listings and Reverse Takeovers

Recent trends show increased adoption of direct listings by tech companies seeking cost-efficient public entry without dilution, exemplified by Spotify's 2018 debut and Roblox's 2021 direct listing success. Reverse takeovers remain popular among smaller firms aiming for faster public access, with examples like DraftKings' 2020 reverse merger fueling its rapid market entry. Market analysis highlights direct listings' appeal for established brands with strong investor demand, contrasted by reverse takeovers' effectiveness for emerging companies requiring expedited regulatory approval.

Direct Listing Infographic

libterm.com

libterm.com