Acquisition is a strategic process where companies obtain another business to expand their market reach, resources, or capabilities. Understanding the complexities of due diligence, valuation, and integration can significantly impact the success of your acquisition efforts. Explore the full article to learn how to navigate acquisitions effectively and maximize their benefits.

Table of Comparison

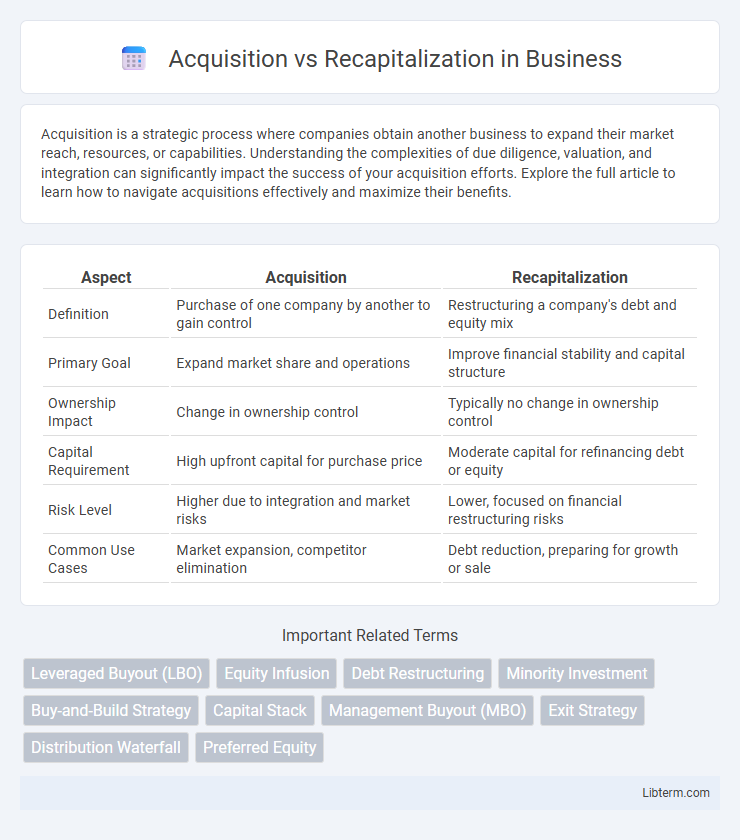

| Aspect | Acquisition | Recapitalization |

|---|---|---|

| Definition | Purchase of one company by another to gain control | Restructuring a company's debt and equity mix |

| Primary Goal | Expand market share and operations | Improve financial stability and capital structure |

| Ownership Impact | Change in ownership control | Typically no change in ownership control |

| Capital Requirement | High upfront capital for purchase price | Moderate capital for refinancing debt or equity |

| Risk Level | Higher due to integration and market risks | Lower, focused on financial restructuring risks |

| Common Use Cases | Market expansion, competitor elimination | Debt reduction, preparing for growth or sale |

Introduction to Acquisition vs Recapitalization

Acquisition involves one company purchasing another to expand market share, access new technologies, or diversify products, often resulting in a change of control. Recapitalization is a financial restructuring strategy where a company alters its debt and equity mixture to stabilize its capital structure or fund growth without transferring ownership. Understanding these distinctions is crucial for strategic decision-making in corporate finance and private equity transactions.

Defining Acquisition: Key Concepts

Acquisition involves one company purchasing another to gain control over its assets, operations, and management, often resulting in integration or consolidation. Key concepts include the target company, acquiring firm, purchase price, and due diligence process to assess financial and operational health. This strategy enables market expansion, diversification, and enhanced competitive positioning in the industry.

Understanding Recapitalization: An Overview

Recapitalization is a financial strategy aimed at restructuring a company's capital structure by altering the mix of debt and equity to improve financial stability or fund growth initiatives. It often involves issuing new debt to buy back equity or exchanging existing debt for equity, which can optimize the cost of capital and enhance shareholder value. Understanding recapitalization requires recognizing its role in balancing leverage, improving liquidity, and supporting strategic objectives without changing ownership control as drastically as an acquisition.

Main Differences Between Acquisition and Recapitalization

Acquisition involves one company purchasing another to gain control, while recapitalization refers to restructuring a company's debt and equity mixture to stabilize its capital structure. The main difference lies in acquisition creating a change in ownership and operational control, whereas recapitalization adjusts financial leverage without transferring control. Acquisitions often aim for growth or market expansion, whereas recapitalizations focus on improving financial stability or preparing for future strategic moves.

Strategic Objectives: When to Choose Acquisition

Acquisitions are ideal when companies aim to rapidly enter new markets, acquire innovative technologies, or eliminate competitors to enhance market share. They provide strategic control over assets and capabilities, enabling faster growth compared to organic expansion. Businesses targeting immediate scale, diversification, or synergy realization prioritize acquisitions over recapitalization.

Strategic Objectives: When to Opt for Recapitalization

Recapitalization is strategically optimal when a company seeks to restructure its capital to improve financial stability, reduce debt burdens, or fund growth without ceding control to new owners. This approach prioritizes long-term solvency and shareholder value preservation, making it ideal for businesses aiming to enhance creditworthiness or prepare for future expansion without the complexities of ownership changes. Unlike acquisitions that often shift strategic control, recapitalization maintains existing leadership while realigning financial resources to meet evolving market demands.

Financial Implications of Acquisition vs Recapitalization

Acquisition often involves a significant upfront capital outlay or debt financing, impacting cash flow and leverage ratios, while recapitalization restructures existing capital by altering debt and equity proportions to improve financial stability and shareholder value. Acquisitions may lead to goodwill and integration costs, affecting balance sheets, whereas recapitalization can optimize capital structure, reduce cost of capital, and enhance credit ratings. Evaluating tax implications is crucial, as acquisitions might offer asset depreciation benefits, whereas recapitalization can provide interest tax shields through increased debt.

Impact on Ownership and Control

Acquisition typically results in a significant shift in ownership and control, where the acquiring entity gains majority stake and decision-making authority over the target company. In recapitalization, ownership changes are usually minimal or structured to maintain existing control, often involving debt or equity restructuring that preserves the current leadership's influence. The degree of control retained or transferred directly affects strategic direction and operational decision-making power within the organization.

Risks and Challenges in Both Approaches

Acquisition risks include high debt burdens, integration challenges, and potential culture clashes that can disrupt operations and erode value. Recapitalization challenges involve maintaining financial flexibility while managing increased leverage and potential dilution of existing shareholders' equity. Both approaches require careful assessment of market conditions, regulatory compliance, and strategic alignment to mitigate operational and financial uncertainties.

Choosing the Right Strategy for Your Business

Acquisition involves purchasing another company to expand market share or capabilities, while recapitalization restructures a company's debt and equity to improve financial stability or fund growth. Choosing the right strategy depends on your business goals, financial health, and market conditions, with acquisition suited for rapid expansion and recapitalization ideal for strengthening balance sheets. Evaluating cost, risk tolerance, and long-term vision ensures the selected approach maximizes value and supports sustainable growth.

Acquisition Infographic

libterm.com

libterm.com