Extended cash conversion cycles can significantly impact a company's liquidity by increasing the time between outlay of cash and cash recovery from sales. Managing your working capital efficiently during this period is critical to sustaining operations and funding growth. Explore the rest of the article to learn strategies for optimizing your cash conversion cycle and improving financial health.

Table of Comparison

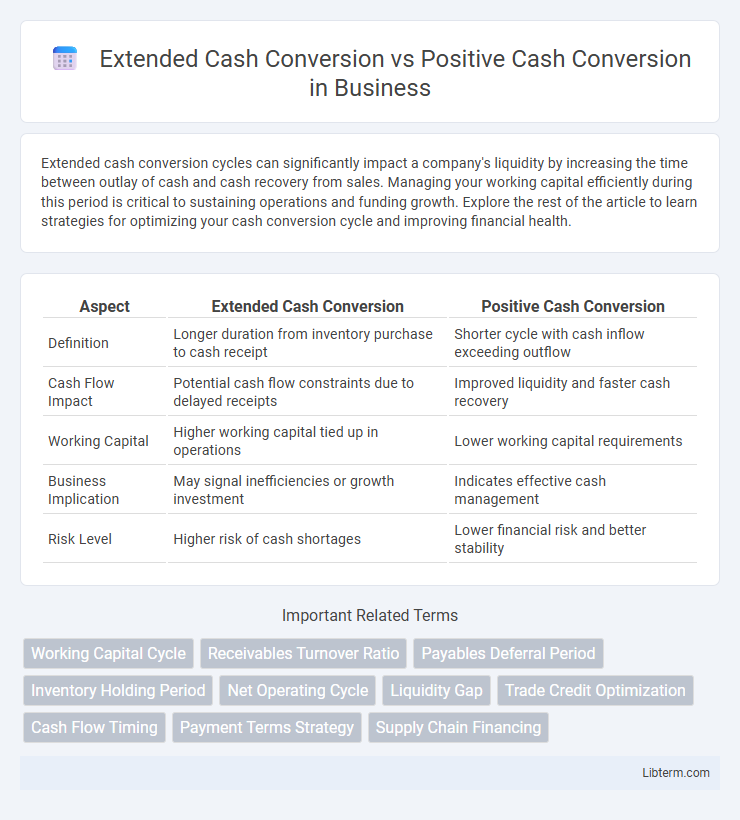

| Aspect | Extended Cash Conversion | Positive Cash Conversion |

|---|---|---|

| Definition | Longer duration from inventory purchase to cash receipt | Shorter cycle with cash inflow exceeding outflow |

| Cash Flow Impact | Potential cash flow constraints due to delayed receipts | Improved liquidity and faster cash recovery |

| Working Capital | Higher working capital tied up in operations | Lower working capital requirements |

| Business Implication | May signal inefficiencies or growth investment | Indicates effective cash management |

| Risk Level | Higher risk of cash shortages | Lower financial risk and better stability |

Understanding Cash Conversion Concepts

Extended Cash Conversion refers to a longer cash conversion cycle, indicating more time between outlay of cash and recovery from sales, which can strain liquidity. Positive Cash Conversion reflects efficient management where operating cash inflows exceed outflows within a cycle, enhancing cash flow health. Understanding cash conversion metrics aids businesses in optimizing working capital by balancing inventory turnover, receivables, and payables.

What is Extended Cash Conversion?

Extended Cash Conversion refers to the lengthened period it takes for a company to convert its investments in inventory and other resources into cash flows from sales, reflecting a slower cycle from outlay to revenue realization. This metric is crucial for assessing the efficiency of working capital management, as it highlights delays in receivables collection or inventory turnover. A prolonged Extended Cash Conversion period can indicate liquidity challenges, impacting a company's operational flexibility and financial health.

What is Positive Cash Conversion?

Positive cash conversion occurs when a company efficiently turns its net income into actual cash flow from operations, indicating strong operational liquidity and effective management of receivables, inventory, and payables. This metric reflects a business's ability to generate sufficient cash to fund operations without relying on external financing. Contrastingly, extended cash conversion denotes a longer cash conversion cycle, which can strain cash flow and increase working capital requirements.

Key Differences Between Extended and Positive Cash Conversion

Extended Cash Conversion measures the total time a company takes to convert its investments in inventory and other resources into cash flows from sales, often highlighting longer operational cycles. Positive Cash Conversion emphasizes a scenario where the cash conversion cycle is less than zero, meaning the company collects cash from sales before it has to pay its suppliers, leading to improved liquidity. Key differences include the cash timing impact, with Extended Cash Conversion typically indicating longer capital lock-up, whereas Positive Cash Conversion signifies efficient cash flow management and reduced working capital requirements.

Advantages of Extended Cash Conversion

Extended Cash Conversion improves working capital management by lengthening the time between outflows and inflows, allowing businesses to hold onto cash longer. This approach enhances liquidity, reducing reliance on external financing and enabling better investment opportunities. Companies benefit from increased financial flexibility and stronger cash flow stability compared to Positive Cash Conversion cycles.

Benefits of Positive Cash Conversion

Positive cash conversion improves liquidity by ensuring a company generates enough cash from operations to cover its short-term liabilities, leading to stronger financial stability. It enhances operational efficiency through faster receivables collection and optimized inventory management, reducing working capital requirements. This positive cash flow enables reinvestment in growth opportunities, debt reduction, and increased shareholder value.

Impact on Working Capital Management

Extended Cash Conversion Cycle (CCC) indicates a longer duration between cash outflows and inflows, leading to higher working capital requirements and increased financing costs. Positive Cash Conversion, where operational cash inflows exceed outflows promptly, enhances liquidity and reduces dependency on external funding. Efficient management of these cycles directly improves cash flow predictability and operational efficiency in working capital management.

Best Practices for Optimizing Cash Conversion

Optimizing cash conversion requires a strategic focus on reducing the extended cash conversion cycle by accelerating receivables and managing payables efficiently. Implementing best practices such as automated invoicing, dynamic discounting, and real-time inventory tracking enhances liquidity and minimizes working capital tied up in operations. Leveraging data analytics to forecast cash flows and align operational activities ensures a positive cash conversion cycle that supports sustainable business growth.

Real-world Examples: Extended vs Positive Cash Conversion

Extended cash conversion cycles, such as those seen in capital-intensive industries like manufacturing, often result in companies holding inventory and receivables longer, exemplified by automotive firms like Ford. Positive cash conversion cycles occur when companies collect cash from customers faster than they pay suppliers, demonstrated by tech giants like Apple with efficient inventory turnover and supplier payment terms. These contrasting cycles impact liquidity management and operational efficiency, influencing company strategies and financial health in real-world business scenarios.

Choosing the Right Cash Conversion Strategy

Extended cash conversion focuses on lengthening the cash conversion cycle to maximize working capital efficiency, often by delaying payables while managing receivables and inventory carefully. Positive cash conversion emphasizes accelerating receivables and minimizing inventory holding periods to generate cash swiftly and sustain liquidity. Choosing the right cash conversion strategy requires analyzing industry norms, company cash flow needs, and supplier-customer relationship dynamics to optimize operational cash flow and maintain financial stability.

Extended Cash Conversion Infographic

libterm.com

libterm.com