Partnerships bring together diverse skills and resources, enabling businesses to achieve goals more efficiently and innovate effectively. By fostering trust and clear communication, partners can navigate challenges and explore new market opportunities. Discover how forming the right partnership can elevate your success in the full article.

Table of Comparison

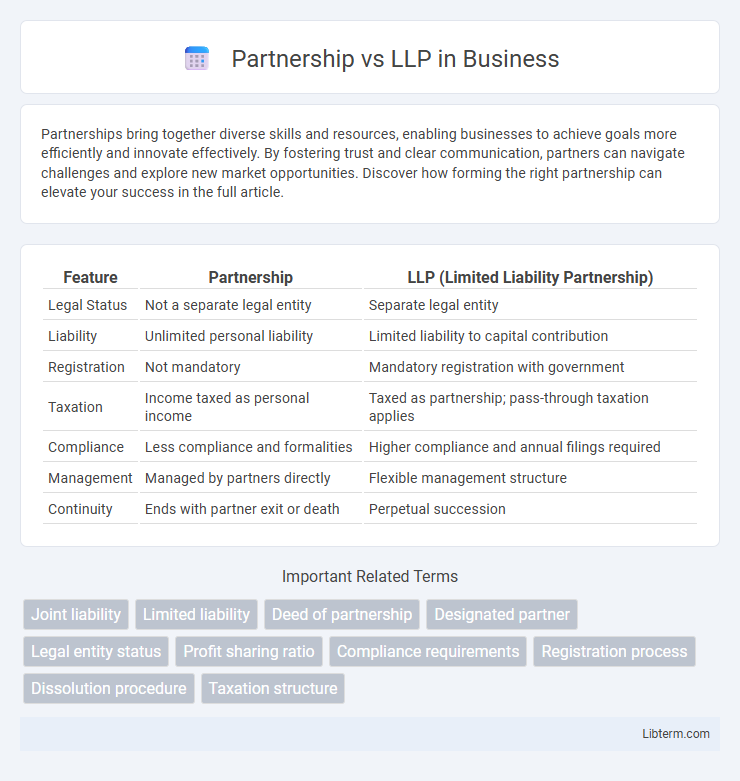

| Feature | Partnership | LLP (Limited Liability Partnership) |

|---|---|---|

| Legal Status | Not a separate legal entity | Separate legal entity |

| Liability | Unlimited personal liability | Limited liability to capital contribution |

| Registration | Not mandatory | Mandatory registration with government |

| Taxation | Income taxed as personal income | Taxed as partnership; pass-through taxation applies |

| Compliance | Less compliance and formalities | Higher compliance and annual filings required |

| Management | Managed by partners directly | Flexible management structure |

| Continuity | Ends with partner exit or death | Perpetual succession |

Introduction to Partnership and LLP

Partnership is a business structure where two or more individuals share ownership, liabilities, profits, and management responsibilities without forming a separate legal entity. Limited Liability Partnership (LLP) combines the flexibility of a partnership with limited liability protection, offering partners legal protection against personal liability for business debts. Both structures facilitate collaborative entrepreneurship, but LLPs provide distinct advantages in risk management and legal compliance.

Legal Structure and Formation

A partnership is a business structure where two or more individuals share ownership, liability, and profits without separate legal entity status, making partners personally liable for debts and obligations. A Limited Liability Partnership (LLP) combines the flexibility of a partnership with limited liability protection, legally separating the business from its partners and protecting their personal assets. Formation of a partnership typically requires minimal registration, whereas establishing an LLP involves formal registration with the state, submission of an LLP agreement, and adherence to regulatory compliance.

Ownership and Management

In a partnership, ownership and management responsibilities are typically shared equally among partners, with each partner having personal liability for business debts. An LLP (Limited Liability Partnership) provides partners with limited liability protection, separating personal assets from business obligations, while allowing for flexible management structures where partners can actively manage the firm without bearing full personal liability. Ownership in an LLP is also shared among partners, but the limited liability feature distinguishes it from a general partnership in terms of risk exposure and legal protection.

Liability of Partners

In a Partnership, partners have unlimited personal liability, meaning their personal assets can be used to settle business debts and obligations. In contrast, an LLP (Limited Liability Partnership) offers limited liability protection, restricting partners' liability to their investment in the business and safeguarding personal assets from business liabilities. This distinction makes LLPs a preferred choice for professionals seeking liability protection while maintaining partnership flexibility.

Taxation Differences

Partnership firms are taxed at a flat rate of 30% on their total income with applicable surcharge and cess, whereas Limited Liability Partnerships (LLPs) also face a flat tax rate of 30% on their income but allow for more flexible profit sharing among partners without attracting dividend distribution tax. Unlike LLPs, partners in traditional partnerships must file individual tax returns for their share of income, which is taxed at personal slab rates, potentially leading to higher overall tax liability. LLPs benefit from reduced compliance requirements and do not attract tax on profits distributed to partners, offering a more tax-efficient structure for businesses seeking limited liability and clarity in profit distribution.

Regulatory Compliance

Partnerships face fewer regulatory compliance requirements with minimal formal documentation and no mandatory filing with government authorities, whereas Limited Liability Partnerships (LLPs) must adhere to stricter regulations, including mandatory registration with the Registrar of Companies, annual filing of financial statements, and compliance with the LLP Act 2008. LLPs offer enhanced legal protection to partners by limiting personal liability, requiring transparency through statutory audits and maintenance of detailed records. Regulatory compliance in LLPs ensures better governance, reducing legal risks compared to traditional partnerships that rely primarily on internal agreements.

Flexibility in Operations

Partnerships offer greater flexibility in operations as partners can directly make decisions and adjust management roles without formal approval processes. LLPs, while providing liability protection, require adherence to a structured management framework and compliance with statutory regulations. This often results in LLPs having more rigid operational protocols compared to traditional partnerships.

Dissolution and Exit Processes

In a Partnership, dissolution occurs when any partner decides to exit, leading to the termination of the entire partnership unless otherwise agreed, whereas an LLP (Limited Liability Partnership) allows for seamless exit or dissolution of one partner without affecting the existence of the firm. The LLP structure provides a formalized exit process through an agreement, protecting the interests of remaining partners and enabling continuity. Winding up a Partnership involves settling debts and distributing assets among partners, while LLPs follow a statutory procedure under the Limited Liability Partnership Act, ensuring a clearer and more regulated dissolution framework.

Suitability for Different Businesses

Partnerships suit small businesses or professional services where personal liability and direct management involvement are acceptable, offering flexibility and simpler tax structures. LLPs are ideal for businesses requiring limited liability protection for all partners, common in legal, accounting, and consulting firms, combining operational flexibility with liability safeguards. Choosing between them depends on the need for liability protection, management structure, and regulatory compliance specific to the business type.

Key Differences: Partnership vs LLP

Partnership involves two or more individuals sharing unlimited liability and management responsibilities, whereas a Limited Liability Partnership (LLP) offers partners limited liability protection, safeguarding personal assets from business debts. In a partnership, all partners are jointly and severally liable for the firm's obligations, while in an LLP, liability is limited to the extent of each partner's capital contribution. The LLP structure also provides greater flexibility in management and compliance compared to traditional partnerships, making it a preferred choice for professional services and businesses seeking liability protection.

Partnership Infographic

libterm.com

libterm.com