A Tax Clearance Certificate verifies that an individual or business has met all tax obligations and cleared outstanding taxes with the relevant authorities. It is essential for bidding on government contracts, renewing licenses, or conducting major financial transactions to ensure compliance and credibility. Discover how obtaining your Tax Clearance Certificate can streamline your financial activities by reading the rest of this article.

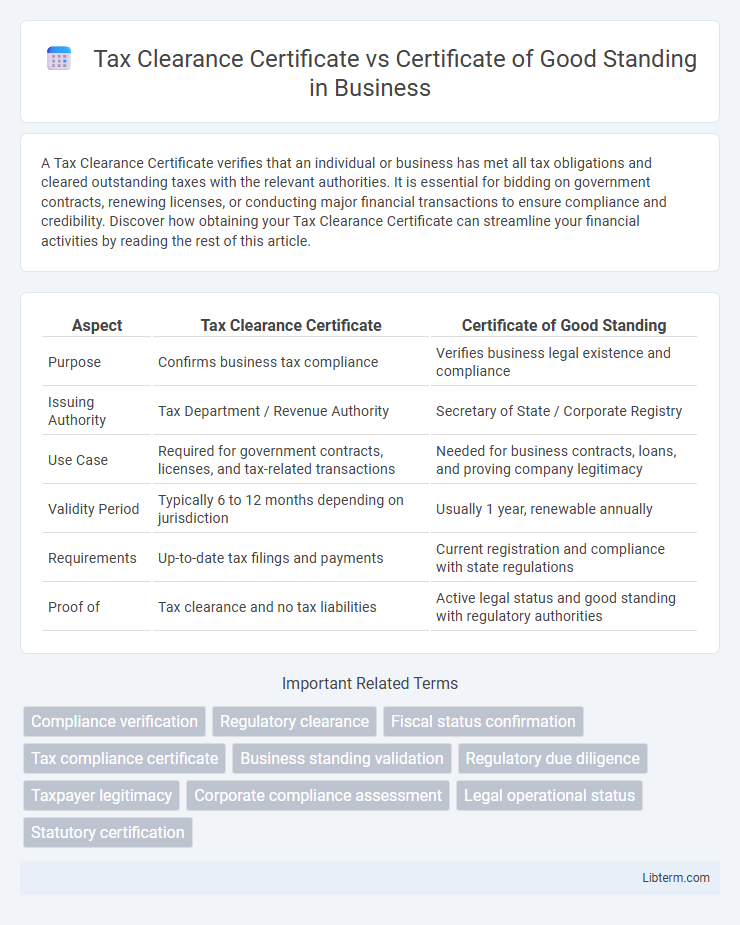

Table of Comparison

| Aspect | Tax Clearance Certificate | Certificate of Good Standing |

|---|---|---|

| Purpose | Confirms business tax compliance | Verifies business legal existence and compliance |

| Issuing Authority | Tax Department / Revenue Authority | Secretary of State / Corporate Registry |

| Use Case | Required for government contracts, licenses, and tax-related transactions | Needed for business contracts, loans, and proving company legitimacy |

| Validity Period | Typically 6 to 12 months depending on jurisdiction | Usually 1 year, renewable annually |

| Requirements | Up-to-date tax filings and payments | Current registration and compliance with state regulations |

| Proof of | Tax clearance and no tax liabilities | Active legal status and good standing with regulatory authorities |

Introduction to Tax Clearance Certificate and Certificate of Good Standing

A Tax Clearance Certificate verifies that a business or individual has fulfilled all tax obligations and paid all taxes due to the relevant tax authority. A Certificate of Good Standing confirms that a company is legally registered, compliant with state regulations, and authorized to operate. Both documents serve distinct purposes: the Tax Clearance Certificate ensures tax compliance, while the Certificate of Good Standing validates the entity's lawful status and operational legitimacy.

Definition of Tax Clearance Certificate

A Tax Clearance Certificate is an official document issued by a tax authority confirming that an individual or business has fulfilled all tax obligations and has no outstanding tax liabilities. It serves as proof of compliance with tax laws and is often required for government contracts, business registrations, or financial transactions. Unlike a Certificate of Good Standing, which verifies a company's legal status and compliance with state regulations, a Tax Clearance Certificate specifically addresses tax compliance status.

Definition of Certificate of Good Standing

A Certificate of Good Standing is an official document issued by a state agency confirming a business entity is properly registered, up-to-date with filings, and compliant with state regulations. Unlike a Tax Clearance Certificate, which verifies a company's tax obligations are settled, a Certificate of Good Standing primarily serves to demonstrate legal existence and operational compliance. This certificate is often required for business transactions, licensing, or expansion into new jurisdictions.

Key Differences Between the Two Certificates

A Tax Clearance Certificate verifies that an individual or business has fulfilled all tax obligations and has no outstanding tax liabilities with the tax authorities. In contrast, a Certificate of Good Standing confirms that a company is legally registered, compliant with state regulations, and authorized to conduct business within its jurisdiction. While the Tax Clearance Certificate focuses solely on tax compliance, the Certificate of Good Standing encompasses overall legal status and operational legitimacy.

Purpose and Use Cases of Tax Clearance Certificates

Tax Clearance Certificates serve as official documents issued by tax authorities to confirm that an individual or business has fulfilled all tax obligations and has no outstanding tax liabilities. These certificates are primarily used during business transactions, applying for government contracts, or regulatory compliance to demonstrate financial credibility and tax compliance. In contrast, a Certificate of Good Standing verifies that a company is properly registered, has met ongoing filing requirements, and is authorized to conduct business within a jurisdiction.

Purpose and Use Cases of Certificates of Good Standing

Certificates of Good Standing verify a business's legal existence and confirm compliance with state requirements, making them essential for opening bank accounts, securing financing, and bidding on government contracts. Unlike Tax Clearance Certificates, which specifically attest to no outstanding tax liabilities, Certificates of Good Standing demonstrate ongoing operational status and adherence to regulatory obligations. These certificates are crucial for business expansions, mergers, and licensing processes to ensure credibility and trustworthiness in commercial activities.

Requirements for Obtaining a Tax Clearance Certificate

Obtaining a Tax Clearance Certificate requires submitting all outstanding tax returns, settling any tax liabilities, and providing proof of compliance with relevant tax laws to the tax authority. Businesses or individuals must typically apply through the official tax agency platform or office and may need to furnish supporting documents such as financial statements or payment receipts. Meeting these requirements ensures that taxpayers are in good standing with the tax department before receiving the Tax Clearance Certificate.

Requirements for Obtaining a Certificate of Good Standing

A Certificate of Good Standing requires that a business entity be properly registered, maintain up-to-date filings with the state, and have no outstanding legal or financial obligations such as unpaid taxes or fees. Proof of compliance with state statutory requirements, including timely submission of annual reports and payment of franchise taxes, is essential for issuance. The certificate affirms that the entity exists legally and is authorized to conduct business within the jurisdiction.

Importance for Businesses and Individuals

A Tax Clearance Certificate verifies that a business or individual has fulfilled all tax obligations, essential for securing government contracts, loans, and avoiding legal penalties. A Certificate of Good Standing confirms that a corporation complies with state regulations and maintains its active status, crucial for credibility with investors, banks, and clients. Both documents enhance trust and operational legitimacy, supporting financial transactions and regulatory compliance for businesses and individuals.

How to Choose the Right Certificate for Your Needs

Selecting the appropriate certificate depends on your specific business requirements: a Tax Clearance Certificate verifies that all tax obligations have been met, essential for government contracts and regulatory compliance, while a Certificate of Good Standing confirms that your company is legally registered and authorized to operate, often required for business transactions or expansions. Assess whether your primary need is to demonstrate tax compliance or corporate legitimacy by reviewing the purpose of your request and the issuing authority's criteria. Consulting with a legal or financial advisor can help tailor the choice to your operational goals and ensure seamless business continuity.

Tax Clearance Certificate Infographic

libterm.com

libterm.com