Revenue represents the total income generated by a company from its business activities, primarily through sales of goods or services. Understanding how revenue impacts your financial health is crucial for effective business planning and growth strategies. Dive into the rest of the article to explore key factors that influence revenue and how to optimize it for your success.

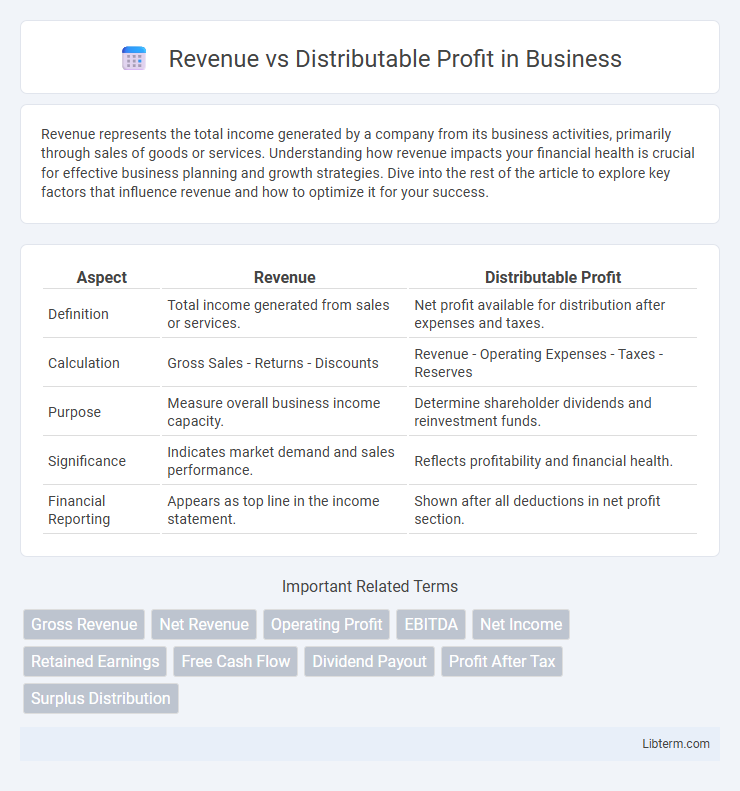

Table of Comparison

| Aspect | Revenue | Distributable Profit |

|---|---|---|

| Definition | Total income generated from sales or services. | Net profit available for distribution after expenses and taxes. |

| Calculation | Gross Sales - Returns - Discounts | Revenue - Operating Expenses - Taxes - Reserves |

| Purpose | Measure overall business income capacity. | Determine shareholder dividends and reinvestment funds. |

| Significance | Indicates market demand and sales performance. | Reflects profitability and financial health. |

| Financial Reporting | Appears as top line in the income statement. | Shown after all deductions in net profit section. |

Understanding Revenue: Definition and Importance

Revenue represents the total income generated by a company from its core business operations, including sales of goods or services, before any expenses or costs are deducted. It is a critical financial metric that measures business performance and market demand, serving as the foundation for calculating profitability and guiding strategic decision-making. Understanding revenue is essential for assessing operational efficiency, forecasting future growth, and determining the potential funds available for distribution as profit.

What is Distributable Profit?

Distributable profit refers to the portion of a company's net profit that is legally available for distribution to shareholders as dividends after accounting for all expenses, taxes, and mandatory reserves. Unlike total revenue, which reflects the gross income earned from operations, distributable profit represents the actual earnings that can be paid out without compromising the company's financial stability. This measure is essential for investors and stakeholders to assess the sustainability of dividend payments and the company's capacity to reward shareholders.

Key Differences Between Revenue and Distributable Profit

Revenue represents the total income generated from sales or services before any expenses are deducted, reflecting a company's gross earnings. Distributable profit, on the other hand, is the net profit available for distribution to shareholders after all operating costs, taxes, reserves, and liabilities have been accounted for. The key difference lies in revenue being the top-line figure indicating overall business activity, while distributable profit is the bottom-line figure indicating actual profits that can be legally distributed as dividends.

How Revenue is Generated in Business

Revenue is generated through the sale of goods or services, representing the total income before any expenses are deducted. It reflects the business's ability to attract customers and convert sales, encompassing all cash inflows from operational activities. Understanding revenue sources is crucial for analyzing overall business performance and growth potential.

Calculating Distributable Profit: Key Components

Distributable profit is calculated by deducting allowable expenses, tax liabilities, and retained earnings allocations from the total revenue generated within a specific period. Key components include net profit after tax, adjustments for non-cash charges such as depreciation, and statutory reserves required by company law. Accurate calculation ensures compliance with financial regulations and determines the actual amount available for shareholder dividends.

The Impact of Expenses on Profitability

Revenue represents the total income generated from sales or services, while distributable profit reflects the net earnings available for shareholders after deducting all expenses, including operating costs, taxes, and interest. High operating expenses significantly reduce profitability by decreasing the distributable profit margin despite strong revenue figures. Effective expense management is crucial for maximizing distributable profits and sustaining long-term financial health.

Revenue vs. Profit: Common Misconceptions

Revenue represents the total income generated from sales before any expenses are deducted, while distributable profit reflects the net earnings available for shareholders after all costs, taxes, and obligations are paid. A common misconception is equating high revenue with high profit, ignoring operational expenses and financial liabilities that reduce net earnings. Understanding the distinction between gross inflows (revenue) and the true net benefit (distributable profit) is crucial for accurate financial analysis and investment decisions.

Why Distributable Profit Matters for Stakeholders

Distributable profit represents the actual earnings available for distribution to shareholders after accounting for expenses, taxes, and legal reserves, making it a crucial metric for evaluating a company's financial health. Unlike total revenue, which indicates the gross income generated from operations, distributable profit reflects sustainable profitability and the potential for dividend payments or reinvestment, directly impacting investor confidence and stakeholder decisions. Stakeholders rely on distributable profit to assess the company's capacity to provide returns, support growth initiatives, and maintain long-term value creation.

Revenue Growth vs. Sustainable Profit Distribution

Revenue growth measures the increase in a company's sales over time, reflecting market demand and business expansion. Distributable profit represents the portion of net profit available for dividends after covering expenses, taxes, and reserves, ensuring long-term financial health. Sustainable profit distribution balances shareholder returns with reinvestment needs, supporting continued growth without compromising operational stability.

Optimizing Business Strategies for Higher Distributable Profits

Maximizing distributable profit requires analyzing the gap between total revenue and operational costs to identify efficiency improvements. Streamlining expenses while increasing high-margin revenue streams enhances cash flow available for distribution. Implementing data-driven pricing strategies and cost control measures directly boosts profitability and shareholder returns.

Revenue Infographic

libterm.com

libterm.com