Loan financing offers a strategic way to secure capital for personal or business needs without sacrificing ownership or equity. By understanding interest rates, repayment terms, and loan types, you can make informed decisions that align with your financial goals. Explore the rest of this article to discover how loan financing can work best for your situation.

Table of Comparison

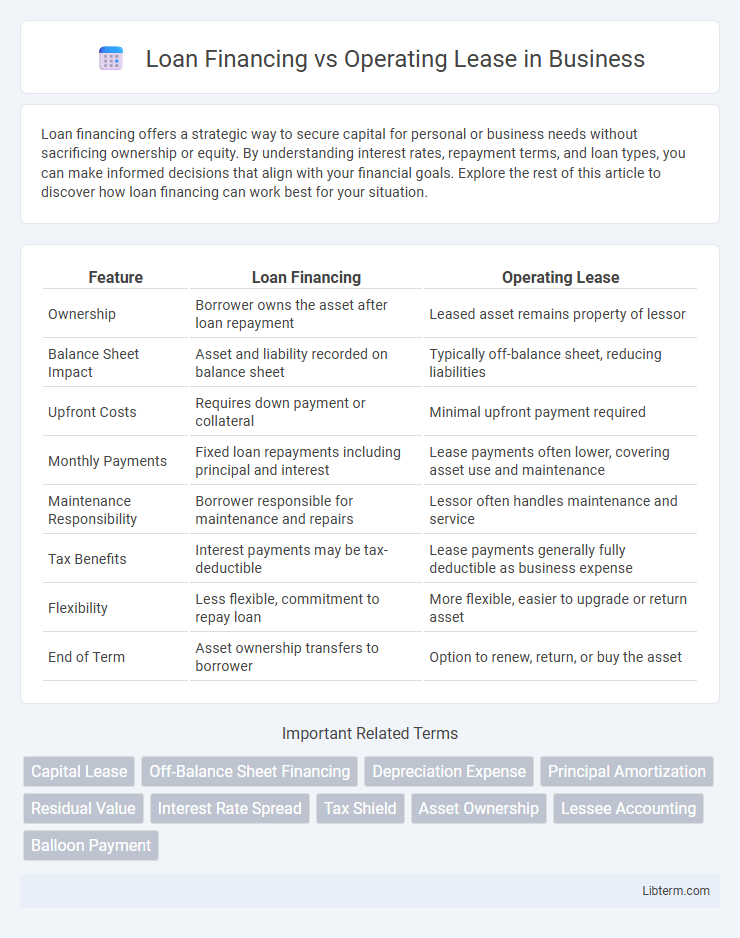

| Feature | Loan Financing | Operating Lease |

|---|---|---|

| Ownership | Borrower owns the asset after loan repayment | Leased asset remains property of lessor |

| Balance Sheet Impact | Asset and liability recorded on balance sheet | Typically off-balance sheet, reducing liabilities |

| Upfront Costs | Requires down payment or collateral | Minimal upfront payment required |

| Monthly Payments | Fixed loan repayments including principal and interest | Lease payments often lower, covering asset use and maintenance |

| Maintenance Responsibility | Borrower responsible for maintenance and repairs | Lessor often handles maintenance and service |

| Tax Benefits | Interest payments may be tax-deductible | Lease payments generally fully deductible as business expense |

| Flexibility | Less flexible, commitment to repay loan | More flexible, easier to upgrade or return asset |

| End of Term | Asset ownership transfers to borrower | Option to renew, return, or buy the asset |

Introduction to Loan Financing and Operating Lease

Loan financing provides businesses with immediate capital through borrowed funds, allowing ownership of assets with repayment structured over time, including interest and principal. Operating leases, however, offer the use of assets without ownership, typically involving shorter-term contracts and off-balance-sheet accounting benefits. Both methods impact cash flow management and financial statements differently, influencing strategic decisions in asset acquisition.

Key Differences Between Loan Financing and Operating Lease

Loan financing involves borrowing funds to purchase an asset, creating ownership and asset depreciation benefits alongside interest costs. Operating lease provides access to an asset without ownership, resulting in off-balance-sheet treatment and flexible lease terms with periodic payments. Major differences include balance sheet impact, tax treatment, asset control, and end-of-term options, with loan financing reflecting asset ownership and lease financing emphasizing use rights.

How Loan Financing Works

Loan financing involves borrowing a specific amount from a lender to purchase an asset, with repayment structured over a fixed term including interest. The borrower gains immediate ownership and benefits from asset depreciation and potential tax deductions. Loan financing requires monthly payments that cover both principal and interest, impacting cash flow but ultimately leading to full ownership at the end of the term.

Understanding Operating Lease Structures

Operating lease structures are designed to provide businesses with asset usage without ownership transfer, typically featuring shorter terms relative to asset life and off-balance-sheet treatment under certain accounting standards. These leases include service and maintenance responsibilities retained by the lessor, enhancing cost predictability and operational flexibility for lessees. Understanding key elements like lease term, payment schedules, and residual value assumptions is essential for evaluating the financial and operational impacts compared to loan financing options.

Pros and Cons of Loan Financing

Loan financing offers ownership of the asset, allowing for depreciation benefits and eventual full control after loan repayment, which can improve long-term equity. However, it requires significant upfront capital, higher monthly payments, and exposes the borrower to risks of asset obsolescence and maintenance costs. Unlike operating leases, loan financing increases balance sheet liabilities and can impact cash flow flexibility due to fixed repayment schedules.

Pros and Cons of Operating Lease

Operating leases offer flexibility with lower upfront costs and off-balance-sheet financing, improving financial ratios and preserving capital for other investments. However, these leases often result in higher overall costs compared to loan financing, lack ownership benefits such as asset depreciation and tax deductions, and may impose usage restrictions and penalties for early termination. Companies must weigh the trade-offs between improved cash flow management and limited control over the leased asset when considering operating leases.

Financial Impact: Balance Sheet and Tax Implications

Loan financing increases liabilities and assets on the balance sheet by recording both the loan amount and the purchased asset, impacting debt-to-equity ratios and potentially limiting borrowing capacity. Operating leases, classified off-balance-sheet under previous accounting standards, now require right-of-use asset and lease liability recognition under ASC 842 and IFRS 16, affecting financial ratios and debt levels. Tax implications differ as loan financing allows depreciation and interest expense deductions, while operating leases generally permit lease payments as tax-deductible expenses, influencing taxable income and cash flow management strategies.

Suitability for Different Types of Businesses

Loan financing suits businesses seeking asset ownership and long-term investment, especially capital-intensive industries like manufacturing and real estate development. Operating leases benefit companies prioritizing flexibility and lower upfront costs, such as startups and service firms requiring the latest technology without ownership burdens. Financially conservative firms often prefer leases to preserve capital and avoid depreciation risk, while businesses aiming for asset control lean toward loans.

Decision Factors: When to Choose Loan Financing or Operating Lease

Decision factors for choosing loan financing or operating lease hinge on ownership preference, financial flexibility, and tax implications. Loan financing suits businesses aiming for asset ownership and long-term use, offering depreciation benefits and equity buildup, while operating leases appeal to those prioritizing lower upfront costs, off-balance-sheet treatment, and easy asset upgrades. Evaluating cash flow impact, asset lifecycle, and accounting goals guides the optimal selection between loan financing and operating lease.

Conclusion: Choosing the Right Option for Your Business

Selecting between loan financing and operating lease depends on your business's financial goals, asset management preferences, and cash flow considerations. Loan financing often suits businesses aiming for asset ownership and long-term savings, while operating leases provide flexibility and lower upfront costs, benefiting companies prioritizing operational efficiency. Careful analysis of tax implications, balance sheet impact, and usage duration ensures the optimal choice aligns with your strategic objectives and financial health.

Loan Financing Infographic

libterm.com

libterm.com