Stock represents ownership in a company and entitles shareholders to a portion of its profits and assets. Understanding the different types of stocks, such as common and preferred, is essential for making informed investment decisions and managing your financial portfolio effectively. Explore the rest of this article to learn how you can diversify your investments and build long-term wealth through stock ownership.

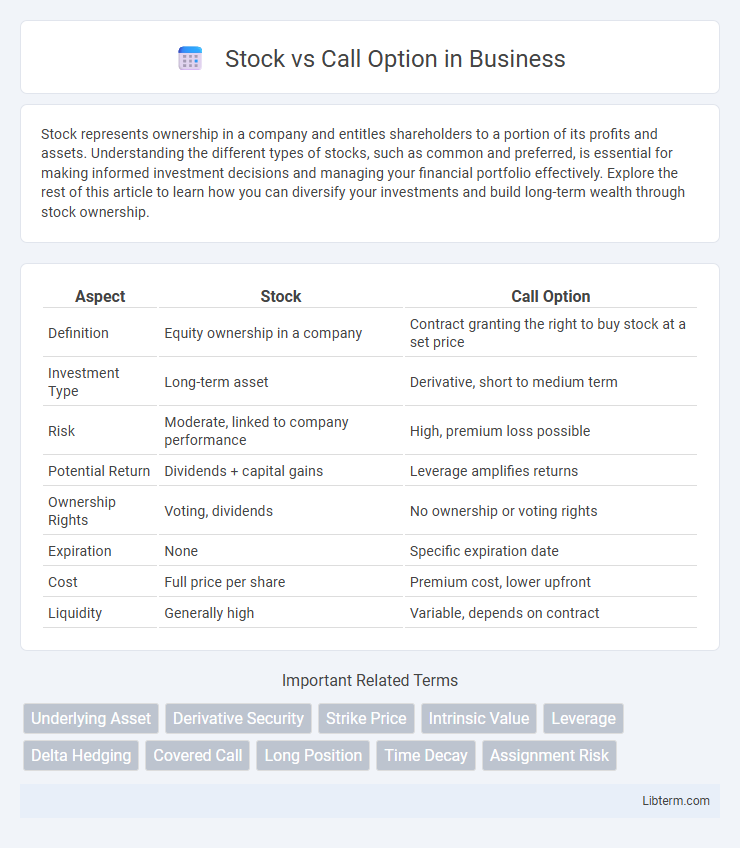

Table of Comparison

| Aspect | Stock | Call Option |

|---|---|---|

| Definition | Equity ownership in a company | Contract granting the right to buy stock at a set price |

| Investment Type | Long-term asset | Derivative, short to medium term |

| Risk | Moderate, linked to company performance | High, premium loss possible |

| Potential Return | Dividends + capital gains | Leverage amplifies returns |

| Ownership Rights | Voting, dividends | No ownership or voting rights |

| Expiration | None | Specific expiration date |

| Cost | Full price per share | Premium cost, lower upfront |

| Liquidity | Generally high | Variable, depends on contract |

Introduction to Stocks and Call Options

Stocks represent ownership shares in a corporation, granting shareholders voting rights and potential dividends based on company performance. Call options are financial contracts giving the holder the right, but not the obligation, to buy a stock at a predetermined price within a specified time frame. While stocks provide direct equity ownership, call options offer leveraged exposure to stock price movements with defined risk limited to the option premium.

Key Differences Between Stocks and Call Options

Stocks represent ownership shares in a company, providing shareholders with voting rights and potential dividends, while call options are financial contracts granting the right, but not the obligation, to buy a stock at a specified price before expiration. Stocks involve full investment with exposure to market price fluctuations, whereas call options offer leveraged exposure with limited risk confined to the premium paid. Unlike stocks, call options have expiration dates and utilize strike prices, making them tools for strategic trading rather than long-term investment.

How Stocks Work: Ownership and Value

Stocks represent ownership shares in a company, granting shareholders partial control and entitlement to dividends based on company profits. Their value fluctuates with the company's financial performance, market conditions, and investor sentiment, reflecting the underlying assets and growth potential. Unlike call options, stocks provide long-term equity participation and voting rights within the corporation.

Understanding Call Options: Contracts and Leverage

Call options are financial contracts granting the buyer the right to purchase a stock at a predetermined price before expiration, enabling leveraged exposure to the underlying asset. Unlike owning stock outright, call options require a fraction of the capital, amplifying potential returns while limiting risk to the premium paid. This leverage allows investors to control more shares with less capital, optimizing portfolio strategies for growth or hedging against price movements.

Risk and Reward Comparison: Stocks vs Call Options

Stocks offer ownership in a company with potential for long-term capital gains and dividends, carrying risks linked to market fluctuations and company performance. Call options provide leveraged exposure, enabling control of more shares with less capital but come with expiration dates, increasing the risk of total loss if the stock price does not exceed the strike price. While stocks have unlimited upside potential and typically lower risk of total loss, call options can deliver higher percentage returns but require precise timing and market movement predictions.

Cost and Capital Requirements

Stock purchases require full upfront payment of the current market price per share, resulting in higher capital requirements compared to call options. Call options grant the right to buy stock at a predetermined strike price by paying a premium, significantly lowering initial investment and capital commitment. This leverage allows investors to control more shares with less capital, but also entails potential expiration and total premium loss.

Profit Potential in Stocks vs Call Options

Stocks offer profit potential through capital appreciation and dividends, allowing investors to benefit from long-term ownership and company growth. Call options provide leveraged profit potential by controlling a larger number of shares with a smaller initial investment, amplifying gains if the stock price rises above the strike price before expiration. However, call options carry higher risk due to time decay and the possibility of expiring worthless, unlike stocks which retain intrinsic value as shares.

Liquidity and Market Accessibility

Stock trading offers higher liquidity due to its widespread availability and continuous trading on major exchanges like NYSE and NASDAQ, allowing investors to buy or sell shares instantly. Call options typically have lower liquidity as they are derivatives with fewer market participants and limited expiration dates, which can result in wider bid-ask spreads and slower trade executions. Market accessibility for stocks is straightforward, requiring only a standard brokerage account, while call options demand greater knowledge of options strategies and approval for options trading, limiting access for some retail investors.

Ideal Investors for Each Strategy

Stocks suit long-term investors seeking ownership and dividend income, benefiting from capital appreciation and voting rights. Call options attract traders aiming for leveraged exposure and potential high returns with limited upfront capital, suitable for those comfortable with higher risk and short-term strategies. Ideal investors for stocks prefer steady growth and income, while call option investors focus on speculative gains and timing market movements.

Making the Right Choice: Stocks or Call Options

Choosing between stocks and call options depends on risk tolerance, investment goals, and market outlook. Stocks provide ownership and potential dividends, offering long-term growth with lower risk, while call options grant leverage to control shares with limited capital but entail higher volatility and expiration risk. Investors seeking capital preservation and steady returns may prefer stocks, whereas those aiming for amplified gains with strategic timing often opt for call options.

Stock Infographic

libterm.com

libterm.com