Net profit margin measures the percentage of revenue that remains as profit after all expenses are deducted, providing insight into a company's financial health and operational efficiency. Understanding this key performance indicator helps you evaluate how effectively a business converts sales into actual profit. Explore the rest of the article to learn how to calculate and improve your net profit margin.

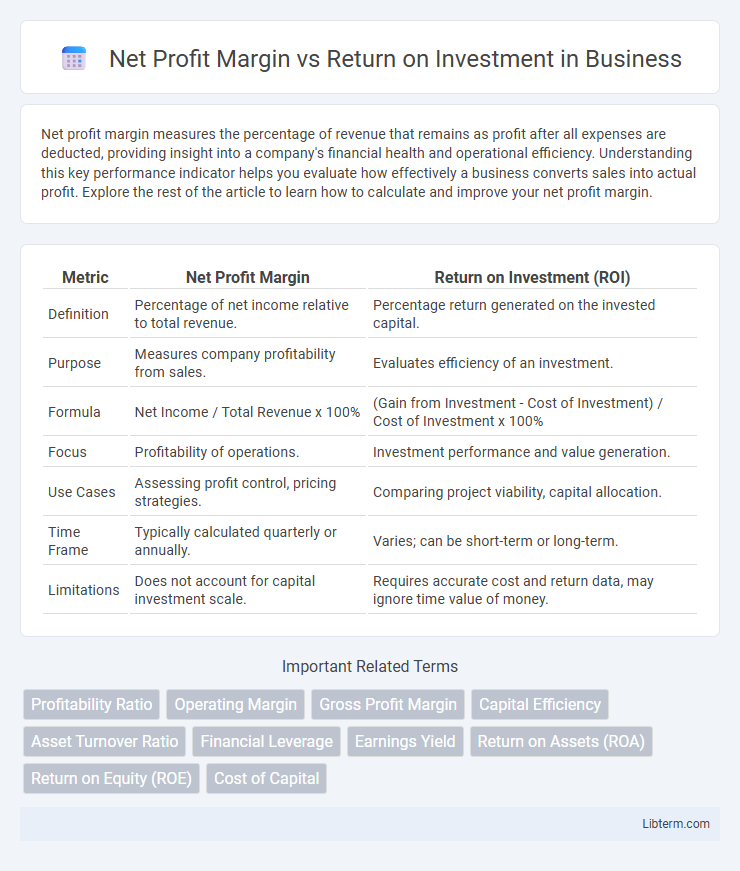

Table of Comparison

| Metric | Net Profit Margin | Return on Investment (ROI) |

|---|---|---|

| Definition | Percentage of net income relative to total revenue. | Percentage return generated on the invested capital. |

| Purpose | Measures company profitability from sales. | Evaluates efficiency of an investment. |

| Formula | Net Income / Total Revenue x 100% | (Gain from Investment - Cost of Investment) / Cost of Investment x 100% |

| Focus | Profitability of operations. | Investment performance and value generation. |

| Use Cases | Assessing profit control, pricing strategies. | Comparing project viability, capital allocation. |

| Time Frame | Typically calculated quarterly or annually. | Varies; can be short-term or long-term. |

| Limitations | Does not account for capital investment scale. | Requires accurate cost and return data, may ignore time value of money. |

Introduction to Net Profit Margin and Return on Investment

Net Profit Margin measures the percentage of revenue that remains as profit after all expenses are deducted, indicating a company's profitability efficiency. Return on Investment (ROI) evaluates the gain or loss generated relative to the investment's cost, reflecting the effectiveness of capital utilization. Both metrics are critical for assessing financial performance but focus on different aspects: profitability versus investment efficiency.

Defining Net Profit Margin

Net Profit Margin measures the percentage of revenue that remains as profit after all expenses, taxes, and costs are deducted, reflecting a company's operational efficiency and profitability. It is calculated by dividing net profit by total revenue and is crucial for assessing how well a business controls costs relative to its sales. Unlike Return on Investment (ROI), which evaluates overall investment effectiveness, Net Profit Margin specifically highlights profit generation from core business activities.

Understanding Return on Investment (ROI)

Return on Investment (ROI) measures the efficiency of an investment by comparing net profit to the initial capital invested, expressed as a percentage. Unlike Net Profit Margin, which focuses on profitability relative to sales revenue, ROI assesses the overall return generated from total investment costs. Analyzing ROI enables businesses to evaluate project performance and allocate resources toward the most profitable ventures.

Key Differences Between Net Profit Margin and ROI

Net Profit Margin measures the percentage of revenue that remains as profit after all expenses are deducted, reflecting operational efficiency and profitability. Return on Investment (ROI) calculates the gain or loss generated on an investment relative to its cost, indicating overall investment performance and capital efficiency. Key differences include Net Profit Margin's focus on profitability from sales activities, while ROI evaluates the effectiveness of investment decisions over time.

Importance of Net Profit Margin in Business Analysis

Net Profit Margin measures the percentage of revenue remaining after all expenses, highlighting a company's efficiency in generating profit from sales, which is crucial for assessing operational viability. Return on Investment (ROI) evaluates the profitability of investments by relating net returns to the invested capital, providing insight into strategic financial decisions. In business analysis, Net Profit Margin is important because it directly reflects core business profitability and cost management, enabling stakeholders to identify trends and optimize pricing or expense control.

The Role of ROI in Investment Decisions

Return on Investment (ROI) is a critical metric in investment decisions, measuring the efficiency and profitability of investments relative to their cost. Unlike Net Profit Margin, which evaluates company profitability from sales, ROI focuses on the overall return generated from specific investments, aiding investors in comparing diverse opportunities. By quantifying gains relative to invested capital, ROI helps prioritize projects that maximize financial performance and strategic growth.

How to Calculate Net Profit Margin and ROI

Net Profit Margin is calculated by dividing net profit by total revenue and multiplying the result by 100 to express it as a percentage, reflecting the profitability of a company relative to its total sales. Return on Investment (ROI) is determined by subtracting the initial investment cost from the final value of the investment, dividing this by the initial investment cost, and then multiplying by 100 to get a percentage that measures the efficiency of the investment. Both metrics are crucial for assessing business performance, with Net Profit Margin focusing on operational profitability and ROI emphasizing investment returns.

Pros and Cons of Using Net Profit Margin

Net Profit Margin offers a clear measure of profitability by showing what percentage of revenue remains as profit after all expenses, making it useful for assessing operational efficiency. It provides a straightforward comparison across companies and industries but may overlook factors like capital structure and investment scale. The main drawback is its inability to reflect the overall effectiveness of invested capital, which is better captured by Return on Investment (ROI).

Advantages and Limitations of ROI

Return on Investment (ROI) offers a straightforward metric to evaluate the efficiency of capital allocation, helping businesses compare profitability across different projects or investments. Advantages of ROI include its simplicity and versatility in assessing overall financial performance, making it a valuable tool for strategic decision-making. However, ROI's limitations involve its inability to account for the time value of money, risk factors, or long-term impacts, potentially leading to misleading conclusions if used in isolation without considering Net Profit Margin or other financial ratios.

Choosing the Right Metric: Net Profit Margin vs ROI

Choosing the right metric between Net Profit Margin and Return on Investment (ROI) depends on your financial analysis goals, where Net Profit Margin reveals profitability efficiency by expressing net income as a percentage of total revenue, highlighting operational effectiveness. ROI measures the gain or loss generated on an investment relative to its cost, providing insight into the return efficiency of capital deployment in different projects or assets. Businesses focused on operational performance prioritize Net Profit Margin, while those evaluating overall investment outcomes lean toward ROI for strategic decision-making.

Net Profit Margin Infographic

libterm.com

libterm.com