A commodity contract specifies the terms for buying or selling raw materials such as oil, gold, or agricultural products at a future date, helping manage price risks in volatile markets. These contracts play a crucial role in stabilizing income for producers and ensuring supply for consumers by locking in prices ahead of time. Explore the rest of this article to understand how commodity contracts can protect Your investments and optimize trading strategies.

Table of Comparison

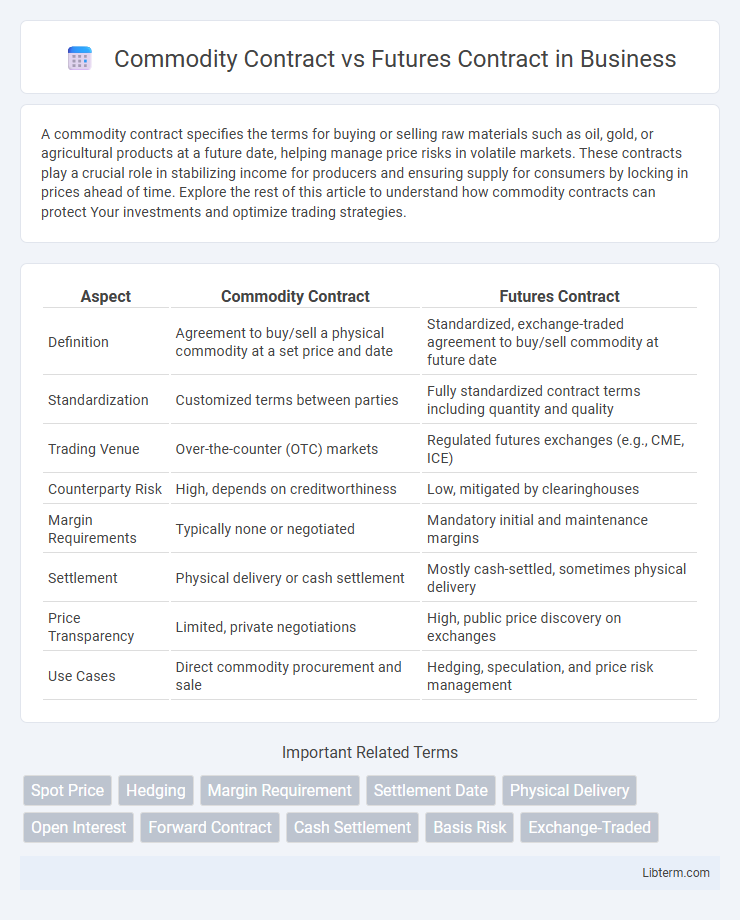

| Aspect | Commodity Contract | Futures Contract |

|---|---|---|

| Definition | Agreement to buy/sell a physical commodity at a set price and date | Standardized, exchange-traded agreement to buy/sell commodity at future date |

| Standardization | Customized terms between parties | Fully standardized contract terms including quantity and quality |

| Trading Venue | Over-the-counter (OTC) markets | Regulated futures exchanges (e.g., CME, ICE) |

| Counterparty Risk | High, depends on creditworthiness | Low, mitigated by clearinghouses |

| Margin Requirements | Typically none or negotiated | Mandatory initial and maintenance margins |

| Settlement | Physical delivery or cash settlement | Mostly cash-settled, sometimes physical delivery |

| Price Transparency | Limited, private negotiations | High, public price discovery on exchanges |

| Use Cases | Direct commodity procurement and sale | Hedging, speculation, and price risk management |

Introduction to Commodity Contracts and Futures Contracts

Commodity contracts are agreements to buy or sell a specific quantity of a physical commodity, such as oil, gold, or wheat, at a predetermined price and date, facilitating risk management and price discovery. Futures contracts, standardized and traded on regulated exchanges, obligate the buyer to purchase and the seller to deliver the commodity or its cash equivalent at a future date, making them essential tools for hedging and speculation. Both types of contracts play a critical role in commodity markets by providing liquidity, transparency, and price benchmarks.

Defining Commodity Contracts

Commodity contracts represent legally binding agreements to buy or sell a specified quantity of a physical commodity, such as agricultural products, metals, or energy resources, at a predetermined price and date. These contracts often involve the physical delivery of the commodity upon expiration, distinguishing them from futures contracts, which are standardized and traded on exchanges with the possibility of cash settlement or physical delivery. Understanding commodity contracts is essential for producers and consumers aiming to hedge price risks in volatile markets.

What Are Futures Contracts?

Futures contracts are standardized agreements traded on regulated exchanges to buy or sell a specific quantity of a commodity or financial instrument at a predetermined price on a future date. These contracts ensure price transparency, liquidity, and risk management for participants such as producers, consumers, and investors. Unlike commodity contracts that may be privately negotiated, futures contracts guarantee settlement through clearinghouses, minimizing counterparty risk.

Key Differences Between Commodity Contracts and Futures Contracts

Commodity contracts involve agreements to buy or sell physical goods like metals, energy, or agricultural products, while futures contracts are standardized agreements traded on exchanges to buy or sell a specific quantity of a commodity or financial instrument at a predetermined price on a future date. Futures contracts include margin requirements, standardized contract sizes, and are regulated by exchanges such as the CME Group, whereas commodity contracts may be privately negotiated without standardization or exchange oversight. The key difference lies in liquidity and risk management, with futures contracts offering greater market transparency and the ability to hedge price risk more effectively than typical commodity contracts.

Purpose and Use Cases: Commodities vs. Futures

Commodity contracts facilitate the direct purchase or sale of physical goods like oil, gold, or agricultural products, often used by producers and consumers to hedge against price volatility and ensure supply stability. Futures contracts represent standardized agreements traded on exchanges to buy or sell specific commodities or financial instruments at predetermined prices and dates, widely utilized by investors and speculators to manage risk or profit from price movements. While commodity contracts focus on actual delivery and physical transfer, futures contracts emphasize trading liquidity and financial speculation without necessarily involving the product's physical exchange.

Risk Management in Commodity and Futures Contracts

Commodity contracts provide direct exposure to physical assets, allowing producers and consumers to hedge price volatility by locking in prices, thereby managing supply chain risks effectively. Futures contracts, standardized and traded on regulated exchanges, offer enhanced liquidity and transparency, enabling market participants to mitigate price risk through margin requirements and daily settlement processes. Both instruments serve as essential tools in risk management by providing mechanisms to transfer price uncertainty away from exposed parties in commodity markets.

Margin Requirements: How They Differ

Commodity contracts typically require initial margin deposits based on a percentage of the contract's total value, designed to cover potential losses during the contract period. Futures contracts have standardized margin requirements set by exchanges, often lower than commodity contracts, reflecting daily mark-to-market settlements and reduced credit risk. The margin for futures is adjusted daily to reflect market fluctuations, whereas commodity contracts may have more flexible, negotiated margin terms between parties.

Settlement Methods: Physical vs. Cash Settlement

Commodity contracts often involve physical settlement where the actual goods like crude oil, gold, or agricultural products are delivered upon contract expiration, ensuring tangible asset exchange. Futures contracts can be settled via physical delivery or cash settlement, with the latter involving a cash payment based on the difference between contract price and market price, allowing traders to avoid handling the underlying commodity. Cash settlement is prevalent in financial futures and index futures, providing greater flexibility and liquidity without the complexities of physical exchange.

Regulatory Frameworks for Commodities and Futures

Commodity contracts and futures contracts fall under distinct but overlapping regulatory frameworks primarily enforced by the Commodity Futures Trading Commission (CFTC) in the United States. Commodity contracts often include a wider range of agreements involving physical goods and can be subject to regulations under the Commodity Exchange Act (CEA), while futures contracts specifically involve standardized agreements traded on regulated exchanges with strict oversight on transparency and market integrity. Both regulatory frameworks aim to prevent market manipulation, ensure fair trading practices, and provide protections to market participants through registration, reporting requirements, and compliance enforcement.

Choosing Between Commodity and Futures Contracts

Choosing between commodity contracts and futures contracts depends on investment goals and risk tolerance; commodity contracts often involve direct ownership and physical delivery, while futures contracts are standardized agreements traded on exchanges with the option for cash settlement. Investors seeking price exposure with leverage and lower initial capital often prefer futures contracts due to their liquidity and hedging capabilities. Commodity contracts suit those prioritizing actual product acquisition or inventory management in markets such as agriculture, energy, or metals.

Commodity Contract Infographic

libterm.com

libterm.com