A parent company is an organization that owns enough voting stock in another company to control its management and operations. This control allows the parent company to influence strategic decisions and consolidate financial results. Discover how understanding parent companies can impact your business insights by reading the rest of the article.

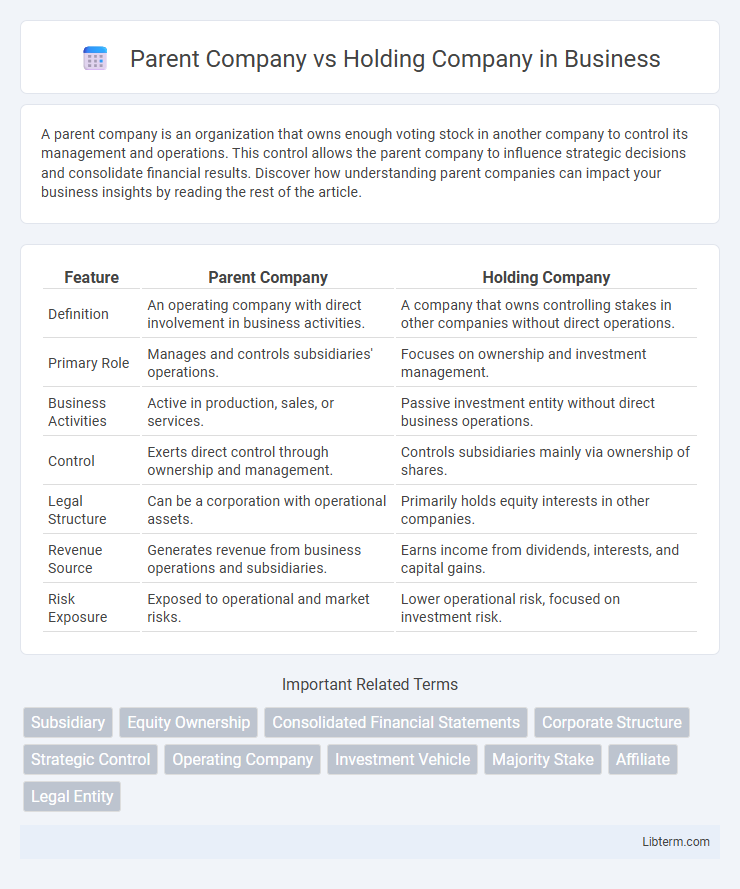

Table of Comparison

| Feature | Parent Company | Holding Company |

|---|---|---|

| Definition | An operating company with direct involvement in business activities. | A company that owns controlling stakes in other companies without direct operations. |

| Primary Role | Manages and controls subsidiaries' operations. | Focuses on ownership and investment management. |

| Business Activities | Active in production, sales, or services. | Passive investment entity without direct business operations. |

| Control | Exerts direct control through ownership and management. | Controls subsidiaries mainly via ownership of shares. |

| Legal Structure | Can be a corporation with operational assets. | Primarily holds equity interests in other companies. |

| Revenue Source | Generates revenue from business operations and subsidiaries. | Earns income from dividends, interests, and capital gains. |

| Risk Exposure | Exposed to operational and market risks. | Lower operational risk, focused on investment risk. |

Introduction to Parent and Holding Companies

Parent companies directly control one or more subsidiaries by owning a majority of their voting stock, providing management oversight and strategic direction. Holding companies primarily exist to own shares of other companies without engaging in day-to-day operations, focusing on investment and risk management. Both entities play crucial roles in corporate structures, influencing governance, financial reporting, and asset protection.

Defining Parent Company

A parent company is an entity that owns enough voting stock in another company to control management and operations, typically holding more than 50% of the shares. It directly influences the subsidiary's strategic decisions, financial policies, and overall governance without necessarily engaging in the day-to-day activities. Unlike holding companies that primarily exist to own assets and investments, parent companies often participate actively in the business operations of their subsidiaries.

Defining Holding Company

A holding company is a corporate entity that owns a controlling interest in one or more subsidiary companies, without directly engaging in their operational activities. Unlike a parent company, which may actively manage its subsidiaries, a holding company primarily exists to control assets and investments. This structure allows for centralized ownership, risk management, and strategic oversight across diverse business operations.

Key Differences Between Parent and Holding Companies

A parent company directly owns enough voting stock to control another company, typically managing its operations and making strategic decisions, whereas a holding company primarily exists to own shares of other companies without direct involvement in daily management. Parent companies often operate subsidiary businesses within the same industry, while holding companies diversify investments across various sectors to spread risk. Key differences include the extent of control and operational involvement, with parent companies actively managing subsidiaries and holding companies focusing on ownership and financial oversight.

Ownership and Control Mechanisms

A parent company directly owns a majority of another company's shares, granting it significant control over management decisions and operations through voting rights and board member appointments. A holding company primarily exists to own controlling interests in subsidiaries without engaging in their day-to-day operations, leveraging ownership stakes to influence strategic direction. Both structures maintain control via equity ownership but differ in operational involvement and legal responsibilities.

Legal Structure and Formation

A parent company directly owns enough voting stock in another company to control its policies and management. A holding company exists primarily to own shares of other companies without producing goods or services itself, often created through consolidation of assets for legal and financial advantages. Legal structures differ as parent companies may operate actively while holding companies maintain a passive role, influencing tax liabilities and regulatory compliance.

Financial Responsibilities and Liabilities

Parent companies have direct financial responsibilities for their subsidiaries, including consolidating financial statements and managing overall debt obligations. Holding companies primarily hold controlling interests in other companies but typically do not engage in day-to-day operations, limiting their direct financial liabilities. In case of insolvency, parent companies may be liable for subsidiary debts, whereas holding companies usually bear financial responsibilities only up to their investment amounts.

Strategic Roles in Business Expansion

A parent company directly controls its subsidiaries and plays an integral strategic role in business expansion by actively managing operations, resources, and market entry efforts to drive growth. Holding companies focus on owning controlling interests in various businesses, facilitating expansion through diversified investments and risk management without engaging in day-to-day operations. Both structures leverage strategic influence but differ in operational involvement and asset management approaches to scale business portfolios.

Advantages and Disadvantages

A parent company directly controls one or more subsidiaries and can streamline decision-making, increase market power, and improve resource allocation but faces risks of legal liability and operational complexity. A holding company primarily exists to own shares in other companies, offering advantages like limited liability exposure, tax benefits, and easier diversification, but it may lack direct control over daily operations and face regulatory scrutiny. Choosing between them depends on factors such as desired control, liability considerations, and strategic investment goals.

Choosing the Right Structure for Your Business

Choosing the right structure between a parent company and a holding company depends on your business goals and asset management needs. A parent company often operates its subsidiaries directly, allowing for centralized control and streamlined operations, while a holding company primarily owns shares in other companies, providing liability protection and tax advantages. Evaluating factors such as regulatory requirements, financial strategy, and long-term business expansion is crucial for making an informed decision.

Parent Company Infographic

libterm.com

libterm.com