Tag-along rights protect minority shareholders by allowing them to join in the sale if majority owners decide to sell their shares, ensuring fair treatment and equal opportunity. These rights prevent minority investors from being left behind or forced into unfavorable situations. Explore the article to understand how tag-along rights can safeguard your investments and what legal considerations apply.

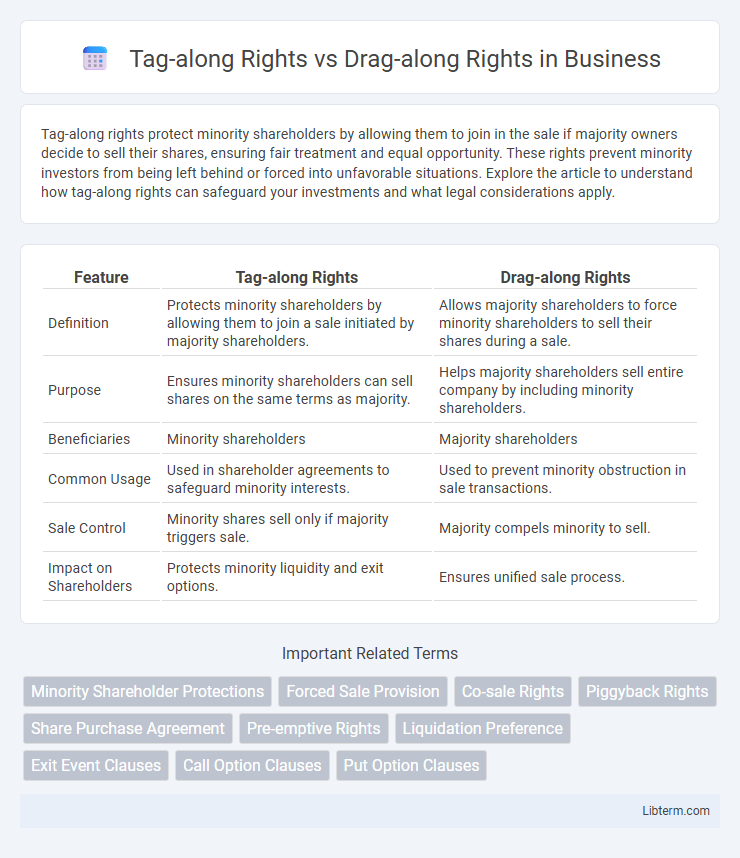

Table of Comparison

| Feature | Tag-along Rights | Drag-along Rights |

|---|---|---|

| Definition | Protects minority shareholders by allowing them to join a sale initiated by majority shareholders. | Allows majority shareholders to force minority shareholders to sell their shares during a sale. |

| Purpose | Ensures minority shareholders can sell shares on the same terms as majority. | Helps majority shareholders sell entire company by including minority shareholders. |

| Beneficiaries | Minority shareholders | Majority shareholders |

| Common Usage | Used in shareholder agreements to safeguard minority interests. | Used to prevent minority obstruction in sale transactions. |

| Sale Control | Minority shares sell only if majority triggers sale. | Majority compels minority to sell. |

| Impact on Shareholders | Protects minority liquidity and exit options. | Ensures unified sale process. |

Introduction to Tag-along and Drag-along Rights

Tag-along rights ensure minority shareholders can join a sale initiated by majority shareholders, protecting their investment by allowing them to sell their shares under the same terms as the majority. Drag-along rights compel minority shareholders to sell their shares when a majority decides to sell the company, facilitating a smooth transfer of ownership without minority obstruction. Both rights are essential in shareholder agreements to balance control and protect the interests of different classes of investors.

Defining Tag-along Rights

Tag-along rights protect minority shareholders by allowing them to join in the sale of shares if majority shareholders sell their stake, ensuring they can exit under the same terms. These rights prevent minority investors from being left behind in a transaction that changes company control. Typically included in shareholder agreements, tag-along rights maintain equitable treatment and liquidity for minority holders during ownership changes.

Defining Drag-along Rights

Drag-along rights enable majority shareholders to compel minority shareholders to join in the sale of a company, ensuring a streamlined transaction to attract buyers with full ownership. These rights protect majority stakeholders by preventing minority shareholders from blocking or diluting the sale process, thereby enhancing deal certainty. Typically included in shareholder agreements, drag-along provisions specify conditions, notice requirements, and sale terms to balance interests among all parties involved.

Key Differences Between Tag-along and Drag-along Rights

Tag-along rights grant minority shareholders the option to join a sale by majority shareholders, ensuring they can sell their shares under the same terms. Drag-along rights empower majority shareholders to compel minority shareholders to participate in a sale, facilitating smoother transactions with outside buyers. The key difference lies in voluntary inclusion for tag-along rights versus mandatory participation for drag-along rights, impacting minority shareholder control during ownership changes.

Importance in Venture Capital and Private Equity Deals

Tag-along rights protect minority investors by allowing them to join in the sale of shares, ensuring they receive fair exit opportunities alongside majority shareholders. Drag-along rights empower majority investors to compel minority shareholders to sell their stakes during acquisition events, streamlining deal closures and maximizing valuation. Both rights are crucial in venture capital and private equity deals for balancing control, protecting investor interests, and facilitating smooth exit strategies.

Benefits of Tag-along Rights for Minority Shareholders

Tag-along rights protect minority shareholders by ensuring they can sell their shares alongside majority shareholders under the same terms, preventing them from being left behind during a buyout. This right enhances bargaining power and liquidity for minority investors, reducing the risk of unfavorable changes in ownership or control. It provides a safeguard against potential marginalization in mergers or acquisitions, maintaining equitable treatment in exit events.

Benefits of Drag-along Rights for Majority Shareholders

Drag-along rights empower majority shareholders to compel minority shareholders to join in the sale of the company, ensuring a smooth transaction and maximizing the overall sale price. These rights prevent minority shareholders from blocking or delaying a sale, facilitating faster exit strategies and increased liquidity for majority stakeholders. Consequently, drag-along rights enhance control and leverage for majority shareholders during mergers or acquisitions, protecting their investment and strategic interests.

Common Scenarios for Implementation

Tag-along rights commonly apply during minority shareholder exits, ensuring they can sell shares when majority owners find a buyer, thus protecting their investment and securing equivalent terms. Drag-along rights typically activate in acquisition scenarios where majority shareholders compel minority stakeholders to join the sale, streamlining transaction processes and maximizing deal value. Both rights are strategically implemented in shareholder agreements to balance control dynamics and minimize disputes during ownership transitions.

Legal Considerations and Enforceability

Tag-along rights ensure minority shareholders can sell their stake under the same conditions as majority shareholders, requiring clear contractual terms to avoid disputes. Drag-along rights compel minority shareholders to join in a sale approved by majority stakeholders, necessitating precise legal language to ensure enforceability in varying jurisdictions. Courts typically uphold these rights if explicitly documented in shareholder agreements, emphasizing the importance of compliance with corporate laws and proper procedural adherence.

Choosing the Right Provisions for Your Shareholders’ Agreement

Tag-along rights protect minority shareholders by allowing them to join a sale initiated by majority shareholders, ensuring they receive equal treatment and exit opportunities. Drag-along rights empower majority shareholders to compel minority holders to sell their shares during a transaction, facilitating smoother exits and maximizing deal value. Selecting the appropriate rights in a shareholders' agreement balances minority protection with transaction efficiency, tailored to the company's ownership structure and strategic goals.

Tag-along Rights Infographic

libterm.com

libterm.com