A Management Buyout (MBO) occurs when a company's existing managers purchase a significant portion or all of the business, gaining full control and ownership. This strategic move allows managers to leverage their intimate knowledge of the company to drive growth and operational improvements. Discover how an MBO can transform your business and what key steps you need to take by reading the complete article.

Table of Comparison

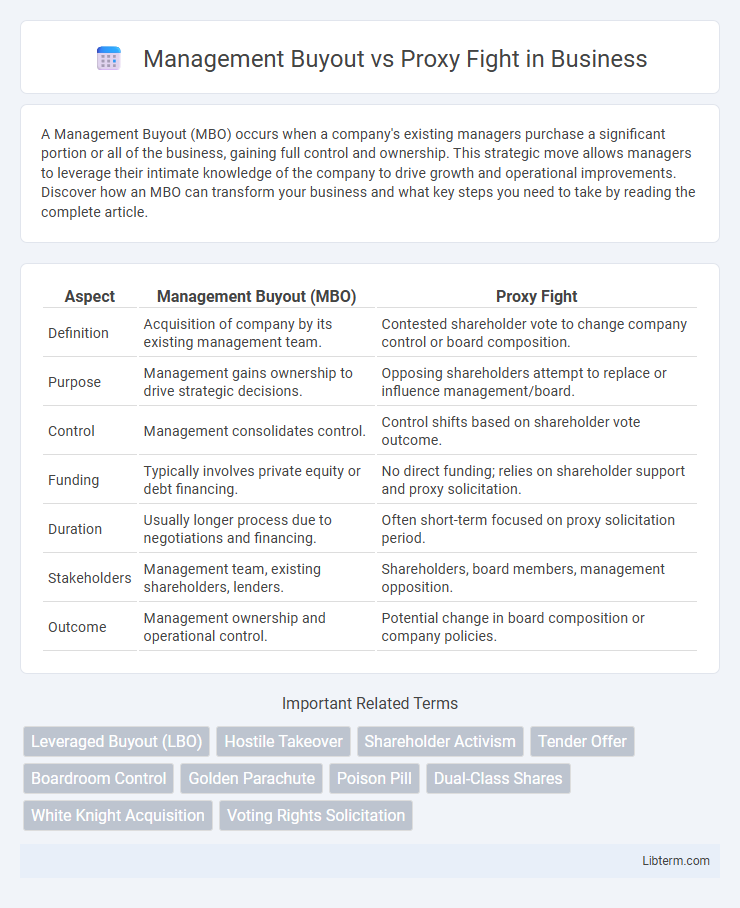

| Aspect | Management Buyout (MBO) | Proxy Fight |

|---|---|---|

| Definition | Acquisition of company by its existing management team. | Contested shareholder vote to change company control or board composition. |

| Purpose | Management gains ownership to drive strategic decisions. | Opposing shareholders attempt to replace or influence management/board. |

| Control | Management consolidates control. | Control shifts based on shareholder vote outcome. |

| Funding | Typically involves private equity or debt financing. | No direct funding; relies on shareholder support and proxy solicitation. |

| Duration | Usually longer process due to negotiations and financing. | Often short-term focused on proxy solicitation period. |

| Stakeholders | Management team, existing shareholders, lenders. | Shareholders, board members, management opposition. |

| Outcome | Management ownership and operational control. | Potential change in board composition or company policies. |

Introduction to Management Buyout and Proxy Fight

A Management Buyout (MBO) occurs when a company's existing managers acquire a significant portion or the entirety of the business, often to gain greater control and align management interests with ownership. In contrast, a Proxy Fight involves shareholders attempting to influence or replace the company's board of directors by soliciting proxy votes, typically to challenge existing management decisions or strategies. Both methods represent strategic approaches to corporate control but differ fundamentally in execution and stakeholder involvement.

Definitions: What Is a Management Buyout?

A management buyout (MBO) is a transaction where a company's existing management team acquires a significant portion or all of the business, taking control from current owners or shareholders. This process often involves securing financing to purchase the company's equity, enabling managers to align ownership with operational responsibilities. MBOs typically occur in privately-held companies or divisions preparing for a strategic shift or ownership transition.

Definitions: What Is a Proxy Fight?

A proxy fight is a corporate strategy where shareholders attempt to gain control of a company by persuading other shareholders to vote in favor of their proposed changes during a shareholder meeting. Unlike a management buyout, which involves existing management purchasing the company, a proxy fight leverages shareholder voting power to influence corporate governance without direct ownership transfer. Proxy fights often arise during disputes over company direction, board composition, or executive leadership.

Key Differences Between Management Buyout and Proxy Fight

A Management Buyout (MBO) occurs when a company's existing management acquires a significant portion or all of the business, focusing on internal control transfer and long-term operational involvement. In contrast, a Proxy Fight involves shareholders attempting to gain control by persuading other shareholders to vote for new board members, emphasizing external influence on corporate governance. Key differences include the source of control acquisition--internal management in MBO versus shareholder-driven in Proxy Fight--and the methods used, with MBO relying on negotiated purchase agreements and Proxy Fights depending on voting power and shareholder mobilization.

Motivations Behind Management Buyouts

Management buyouts (MBOs) are primarily motivated by the desire of existing management to gain control and align ownership with operational expertise, often to drive long-term strategic growth and increase company value. Unlike proxy fights, which arise from external shareholders' attempts to influence or replace the management team, MBOs are initiated internally to capitalize on perceived undervaluation or to execute a turnaround more effectively. Management's commitment to the business and insider knowledge make MBOs a strategic move to secure decision-making power and financial benefits from future company performance.

Drivers of Proxy Fights in Corporate Governance

Proxy fights in corporate governance are primarily driven by shareholder activism aiming to influence or replace board members to alter company strategy or policies. Key drivers include dissatisfaction with management performance, conflicts over mergers or acquisitions, and disputes regarding executive compensation. Unlike management buyouts, which involve internal management acquiring control, proxy fights engage external shareholders seeking to assert control through voting mechanisms.

Financial Implications: MBOs vs Proxy Fights

Management Buyouts (MBOs) typically involve significant capital investment from management combined with external financing, leading to increased leverage and potential tax benefits due to interest deductibility. Proxy fights, on the other hand, often result in high costs related to campaigning and legal fees with uncertain financial outcomes, impacting shareholder value and stock price volatility. MBOs align management's interests with long-term business performance, while proxy fights may trigger short-term market reactions and restructuring expenses.

Stakeholder Impact: Employees, Shareholders, and Leadership

Management buyouts (MBOs) often enhance employee stability by consolidating leadership and aligning management interests with company performance, benefiting shareholders through focused decision-making and potential value growth. Proxy fights create uncertainty among employees due to leadership conflicts and potential strategic shifts while shareholders face volatility as opposing factions compete for control, influencing stock prices and governance direction. Leadership in MBOs gains operational autonomy, fostering long-term planning, whereas proxy fights heighten power struggles, impacting corporate governance and strategic coherence.

Legal and Regulatory Considerations

Management buyouts (MBOs) require careful navigation of fiduciary duties, securities laws, and often necessitate regulatory filings with bodies like the SEC to ensure compliance with disclosure and antitrust regulations. Proxy fights involve soliciting shareholder votes to influence company decisions, triggering compliance with proxy solicitation rules under the Securities Exchange Act, including timely and accurate disclosure of information to avoid allegations of misleading shareholders. Both transactions require strict adherence to corporate governance standards to mitigate litigation risks and regulatory penalties.

Case Studies: Notable Management Buyouts and Proxy Fights

The 1989 management buyout of RJR Nabisco stands as a landmark case, showcasing how executives leveraged leverage buyouts to gain control amidst corporate resistance. In contrast, the 2012 proxy fight at Hewlett-Packard highlighted activist investors' use of shareholder votes to influence board composition and strategic direction. These case studies underscore the strategic complexities and shareholder dynamics inherent in management buyouts and proxy fights.

Management Buyout Infographic

libterm.com

libterm.com