Initial Public Offering (IPO) marks a company's first sale of stock to the public, transforming private businesses into publicly traded entities. This process can significantly boost capital, increase visibility, and provide liquidity for early investors. Discover how an IPO can impact your investment strategy and what to expect throughout the offering journey in the rest of this article.

Table of Comparison

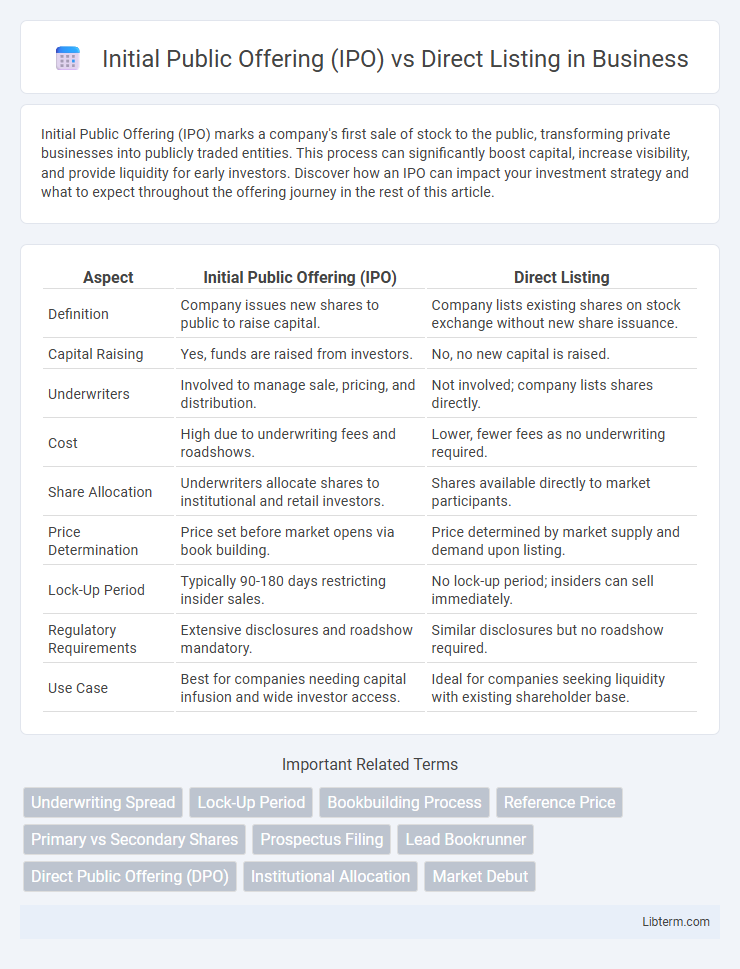

| Aspect | Initial Public Offering (IPO) | Direct Listing |

|---|---|---|

| Definition | Company issues new shares to public to raise capital. | Company lists existing shares on stock exchange without new share issuance. |

| Capital Raising | Yes, funds are raised from investors. | No, no new capital is raised. |

| Underwriters | Involved to manage sale, pricing, and distribution. | Not involved; company lists shares directly. |

| Cost | High due to underwriting fees and roadshows. | Lower, fewer fees as no underwriting required. |

| Share Allocation | Underwriters allocate shares to institutional and retail investors. | Shares available directly to market participants. |

| Price Determination | Price set before market opens via book building. | Price determined by market supply and demand upon listing. |

| Lock-Up Period | Typically 90-180 days restricting insider sales. | No lock-up period; insiders can sell immediately. |

| Regulatory Requirements | Extensive disclosures and roadshow mandatory. | Similar disclosures but no roadshow required. |

| Use Case | Best for companies needing capital infusion and wide investor access. | Ideal for companies seeking liquidity with existing shareholder base. |

Introduction to IPOs and Direct Listings

Initial Public Offerings (IPOs) involve a company issuing new shares to the public for the first time, typically underwritten by investment banks to raise capital. Direct Listings allow existing shareholders to sell their shares directly on the stock exchange without issuing new stock or raising funds. IPOs generally provide capital infusion and market exposure, whereas direct listings offer liquidity and reduced underwriting costs without diluting ownership.

Key Differences Between IPOs and Direct Listings

Initial Public Offerings (IPOs) involve underwriting by investment banks, which set an offering price and allocate shares to investors, whereas Direct Listings allow companies to list existing shares on the stock exchange without issuing new shares or raising capital. IPOs typically include a lock-up period preventing insiders from selling shares immediately, while Direct Listings impose no such lock-up, enabling more immediate trading by insiders. Furthermore, IPOs incur underwriting fees and extensive regulatory preparation, whereas Direct Listings reduce costs by avoiding underwriting fees and simplifying the listing process.

How the IPO Process Works

The IPO process involves underwriters who help companies issue new shares, set an offering price, and allocate shares to institutional investors through a book-building process. In contrast, a direct listing allows existing shareholders to sell shares directly on the public market without issuing new shares or involving underwriters, eliminating price-setting mechanisms. IPOs typically include a roadshow to generate investor interest, while direct listings rely on market demand to determine share pricing at the opening trade.

Understanding Direct Listing Mechanics

Direct listing allows companies to sell existing shares directly to the public without issuing new shares, bypassing traditional underwriting processes. Unlike Initial Public Offerings (IPOs), direct listings eliminate lock-up periods and associated dilution, enabling immediate liquidity for shareholders. This mechanism relies heavily on market demand and investor interest to determine share pricing on the first trading day.

Advantages of Choosing an IPO

Choosing an Initial Public Offering (IPO) offers companies the advantage of raising substantial capital through the sale of new shares to investors, which supports growth and expansion initiatives. IPOs provide price stabilization via underwriters, reducing volatility compared to direct listings where no new shares are issued. The structured process of an IPO also enhances market visibility and investor confidence, facilitating a smoother transition to public trading.

Benefits of Opting for a Direct Listing

Direct listings enable companies to access public markets without issuing new shares, preserving existing ownership structures and avoiding dilution. This method reduces underwriting fees, offering a cost-effective alternative compared to traditional Initial Public Offerings (IPOs). Companies benefit from increased liquidity and price discovery driven directly by market demand, enhancing transparency and investor participation.

Potential Risks and Challenges

Initial Public Offerings (IPOs) involve underwriters and can face risks such as price volatility and dilution of shares, which may impact investor confidence and valuation stability. Direct Listings bypass underwriters, leading to challenges like limited price discovery and potential lack of liquidity, increasing market volatility. Both methods expose companies to regulatory scrutiny and market unpredictability, requiring careful strategic planning to mitigate financial and reputational risks.

Cost Comparison: IPO vs Direct Listing

Initial Public Offerings (IPOs) typically involve substantial underwriting fees, often around 7% of the capital raised, leading to higher overall costs for companies going public. In contrast, Direct Listings eliminate underwriting fees by allowing existing shareholders to sell shares directly to the public, significantly reducing expenses. While IPOs incur additional marketing and regulatory compliance costs, Direct Listings primarily focus on legal and advisory fees, making them a more cost-effective option for companies not raising new capital.

Suitability: Which Route Fits Your Company?

Companies seeking public market entry must evaluate suitability based on capital needs, control preferences, and market conditions; IPOs typically fit firms requiring significant capital infusion and willing to undergo underwriting and lock-up periods, offering structured price discovery and investor relations support. Direct listings suit mature companies with strong brand recognition and sufficient cash reserves aiming to avoid dilution and reduce underwriting costs, as they allow existing shareholders to sell shares directly without raising new capital. Assessing growth stage, liquidity goals, and tolerance for pricing volatility guides choosing between IPO and direct listing for optimal market debut alignment.

Notable Case Studies and Market Trends

Notable case studies like Spotify's 2018 direct listing and Beyond Meat's 2019 IPO highlight distinct market approaches, with Spotify avoiding underwriter fees and Beyond Meat leveraging traditional roadshows to build investor confidence. Market trends indicate a rising preference for direct listings among tech firms aiming for cost efficiency and immediate liquidity, while IPOs continue dominating sectors seeking broad capital access. Data from 2023 shows a 30% increase in direct listings on major exchanges, reflecting evolving investor appetite and regulatory support.

Initial Public Offering (IPO) Infographic

libterm.com

libterm.com