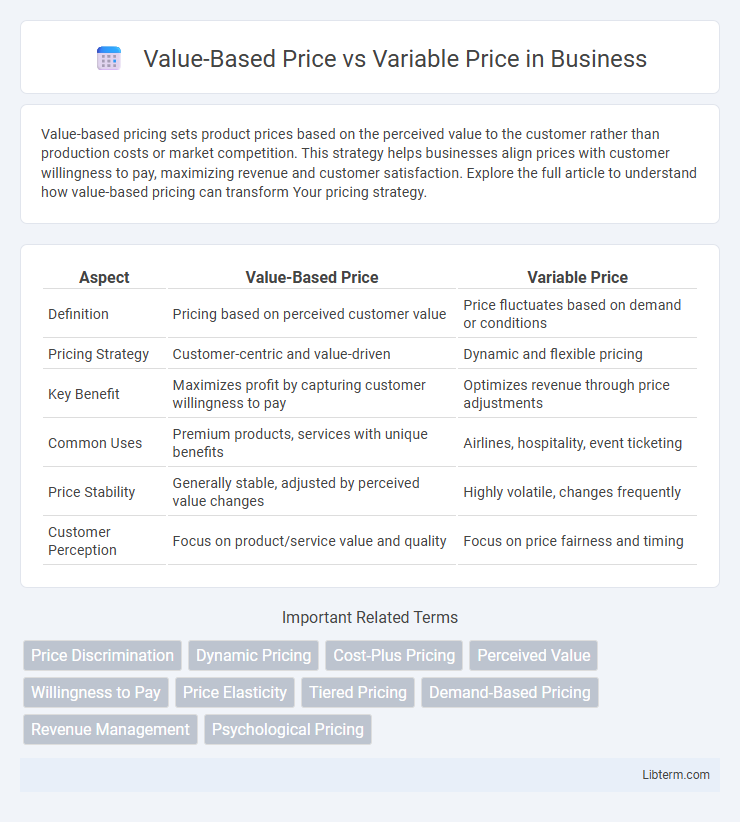

Value-based pricing sets product prices based on the perceived value to the customer rather than production costs or market competition. This strategy helps businesses align prices with customer willingness to pay, maximizing revenue and customer satisfaction. Explore the full article to understand how value-based pricing can transform Your pricing strategy.

Table of Comparison

| Aspect | Value-Based Price | Variable Price |

|---|---|---|

| Definition | Pricing based on perceived customer value | Price fluctuates based on demand or conditions |

| Pricing Strategy | Customer-centric and value-driven | Dynamic and flexible pricing |

| Key Benefit | Maximizes profit by capturing customer willingness to pay | Optimizes revenue through price adjustments |

| Common Uses | Premium products, services with unique benefits | Airlines, hospitality, event ticketing |

| Price Stability | Generally stable, adjusted by perceived value changes | Highly volatile, changes frequently |

| Customer Perception | Focus on product/service value and quality | Focus on price fairness and timing |

Understanding Value-Based Pricing

Value-based pricing sets product or service prices based on perceived customer value rather than production costs, aiming to maximize profit by aligning price with customer willingness to pay. This pricing strategy relies on in-depth market research, customer insights, and competitive analysis to accurately assess the benefits and unique value drivers that justify higher prices. Companies implementing value-based pricing often achieve better customer satisfaction and increased revenue by emphasizing product differentiation and value communication.

Defining Variable Pricing Strategies

Variable pricing strategies adjust product or service prices based on factors like demand, customer segments, or timing, allowing businesses to optimize revenue dynamically. This approach contrasts with value-based pricing, which sets prices primarily on perceived customer value and benefits rather than fluctuating market conditions. Techniques such as surge pricing, discounting, and personalized offers are common examples within variable pricing frameworks.

Key Differences Between Value-Based and Variable Pricing

Value-based pricing sets prices based on the perceived value to the customer, emphasizing customer benefits and willingness to pay, while variable pricing adjusts prices according to external factors such as demand fluctuations, time, or customer segments. The key difference lies in value-based pricing prioritizing customer-centric value assessment, whereas variable pricing focuses on market-driven price changes. Value-based pricing results in stable, value-aligned prices, and variable pricing leads to dynamic pricing models that respond to real-time market conditions.

Advantages of Value-Based Pricing

Value-based pricing maximizes profitability by aligning prices with the perceived value customers assign to a product, leading to higher revenue compared to cost-based or variable pricing models. This strategy enhances customer satisfaction and loyalty by reflecting the product's benefits and unique features instead of merely covering costs or fluctuating demand. Companies adopting value-based pricing gain a competitive edge through improved market positioning and more efficient resource allocation.

Pros and Cons of Variable Pricing

Variable pricing offers flexibility by adjusting prices based on demand, customer segments, or market conditions, enabling businesses to maximize profits and respond quickly to competitive pressures. However, it may lead to customer dissatisfaction due to perceived unfairness, increased complexity in pricing management, and potential erosion of brand value if prices fluctuate too frequently or unpredictably. Compared to value-based pricing, which aligns price with customer-perceived value, variable pricing risks alienating loyal customers and complicating long-term revenue forecasting.

Factors Influencing Pricing Strategy Choice

Value-based pricing centers on customer perception of product worth and willingness to pay, while variable pricing adjusts based on factors like demand, competition, and market conditions. Key factors influencing the choice between these strategies include the nature of the product or service, customer segmentation, cost structure, and competitive landscape. Companies prioritize value-based pricing when differentiation and brand strength are high, whereas variable pricing suits markets with fluctuating demand and price sensitivity.

Impact on Customer Perception and Loyalty

Value-based pricing enhances customer perception by aligning prices with perceived product benefits and quality, fostering greater trust and brand loyalty. Variable pricing, which fluctuates based on demand or customer segments, can create uncertainty and reduce customer loyalty if perceived as inconsistent or unfair. Consistent alignment of price with value strengthens emotional connections, encourages repeat purchases, and improves long-term customer retention.

Profitability and Revenue Implications

Value-based pricing enhances profitability by aligning prices with customer perceived value, often leading to higher margins and sustainable revenue growth. Variable pricing adjusts prices based on demand fluctuations, maximizing short-term revenue but potentially reducing profit consistency. Companies employing value-based pricing benefit from improved customer loyalty and long-term profitability, while those using variable pricing can capitalize on market conditions to optimize immediate revenue streams.

Industry Examples: Value-Based vs Variable Pricing

In the software industry, value-based pricing is exemplified by Salesforce, which sets prices based on the perceived business value its CRM solutions deliver, ensuring clients pay proportionally to the benefits gained. Conversely, in the airline sector, variable pricing is prevalent, with companies like Delta Air Lines adjusting ticket prices dynamically based on demand, time, and seat availability to maximize revenue. These examples highlight how value-based pricing focuses on customer-perceived value, whereas variable pricing leverages market conditions and real-time data to set prices.

Choosing the Right Pricing Model for Your Business

Value-based pricing centers on setting prices based on customer perceived value, maximizing profitability by aligning price with demand and product benefits. Variable pricing adjusts costs dynamically according to market conditions, customer segments, or purchase volume, ensuring flexibility and competitive advantage. Selecting the right pricing model requires analyzing customer behavior, product uniqueness, and market competition to optimize revenue and customer satisfaction.

Value-Based Price Infographic

libterm.com

libterm.com