The duty of obedience requires individuals and organizations to adhere strictly to laws, regulations, and governing principles to ensure ethical and legal compliance. This obligation safeguards integrity and accountability by preventing unauthorized actions or decisions. Explore the rest of the article to understand how you can uphold this critical responsibility effectively.

Table of Comparison

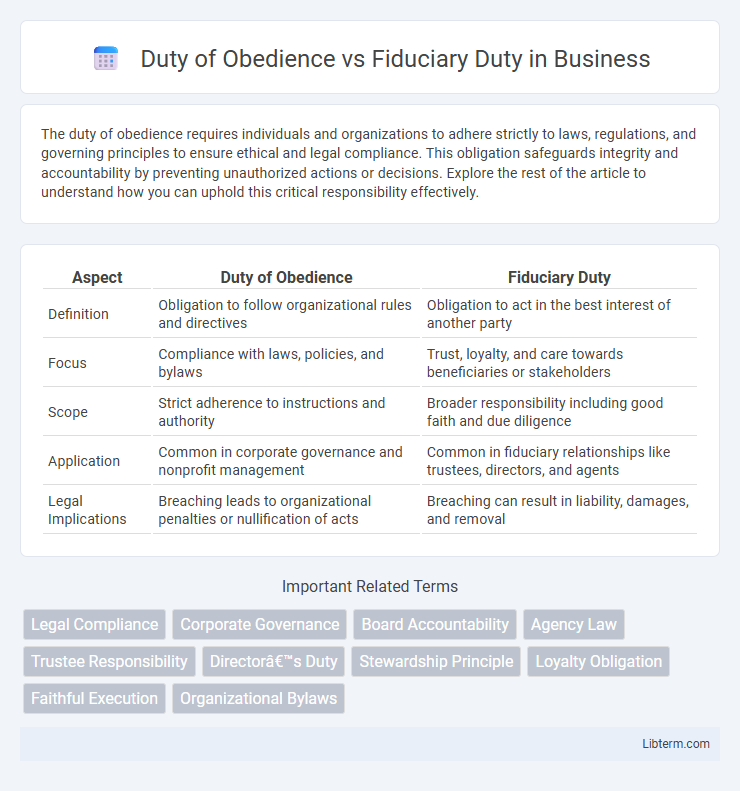

| Aspect | Duty of Obedience | Fiduciary Duty |

|---|---|---|

| Definition | Obligation to follow organizational rules and directives | Obligation to act in the best interest of another party |

| Focus | Compliance with laws, policies, and bylaws | Trust, loyalty, and care towards beneficiaries or stakeholders |

| Scope | Strict adherence to instructions and authority | Broader responsibility including good faith and due diligence |

| Application | Common in corporate governance and nonprofit management | Common in fiduciary relationships like trustees, directors, and agents |

| Legal Implications | Breaching leads to organizational penalties or nullification of acts | Breaching can result in liability, damages, and removal |

Understanding Fiduciary Duty: An Overview

Fiduciary duty requires an individual to act in the best interest of another party, prioritizing loyalty and care above personal gain, often seen in trustee-beneficiary or corporate director-shareholder relationships. Duty of obedience mandates strict compliance with laws, regulations, and organizational policies, ensuring actions align with the governing documents and legal frameworks. Understanding fiduciary duty involves recognizing its broader scope, encompassing loyalty, good faith, and prudence beyond mere obedience to rules, emphasizing ethical and responsible decision-making to protect the beneficiary's interests.

Defining the Duty of Obedience in Organizational Governance

The Duty of Obedience in organizational governance requires directors and officers to ensure the organization adheres strictly to its mission, bylaws, and applicable laws. This duty mandates compliance with the legal framework and prescribed regulations, preventing actions that exceed the organization's authorized scope. Unlike Fiduciary Duty, which emphasizes loyalty and care in managing assets, the Duty of Obedience safeguards the organization's integrity by upholding its foundational purposes.

Key Differences Between Duty of Obedience and Fiduciary Duty

Duty of Obedience requires strictly adhering to the organization's mission and governing documents, ensuring actions align with established rules and regulations. Fiduciary Duty encompasses a broader responsibility, including the duties of care and loyalty, mandating decision-makers act in the best interests of the organization with prudence and honesty. Key differences lie in scope: Duty of Obedience focuses on compliance and lawfulness, whereas Fiduciary Duty involves ethical judgment and protection of organizational assets.

Legal Foundations of Fiduciary Responsibility

The legal foundations of fiduciary responsibility are rooted in common law principles that impose strict duties on fiduciaries to act in the best interest of their beneficiaries, including the duty of obedience which requires adherence to governing documents and laws. Fiduciaries must exercise loyalty and care, ensuring their decisions align with the beneficiary's goals and comply with statutory and contractual obligations. Courts enforce these obligations through equitable remedies to prevent conflicts of interest, mismanagement, or deviation from authorized purposes.

Duty of Obedience: Alignment with Mission and Bylaws

The Duty of Obedience requires directors and officers to ensure all organizational activities strictly comply with the mission statement and bylaws, preventing unauthorized deviation from the established purpose. This duty mandates adherence to legal and ethical standards, reinforcing governance structures that maintain organizational integrity and accountability. Failure to uphold the Duty of Obedience can result in legal penalties and loss of public trust, emphasizing its critical role in nonprofit and corporate governance.

Overlapping Responsibilities: Where Obedience Meets Fiduciary Duty

The duty of obedience requires directors to act within the scope of an organization's mission and comply with its governing documents, ensuring legal and ethical adherence. Fiduciary duty encompasses the broader responsibility to act in the best interests of the organization, including duties of care and loyalty. These responsibilities overlap as directors must faithfully execute decisions consistent with both organizational objectives and fiduciary principles to safeguard assets and uphold trust.

Real-World Examples: Fiduciary vs. Obedience in Practice

In real-world scenarios, fiduciary duty requires corporate officers to prioritize shareholders' best interests by making decisions that maximize value, such as a CEO rejecting a lucrative acquisition offer that undervalues the company. Duty of obedience mandates strict compliance with organizational bylaws and legal regulations, exemplified by nonprofits ensuring all activities align with their mission statements and IRS rules to maintain tax-exempt status. Conflicts arise when fiduciary obligations push for bold financial strategies that may skirt rigid compliance, highlighting the tension between innovation and regulatory adherence in governance.

Consequences of Breaching Duty of Obedience or Fiduciary Duty

Breaching the duty of obedience can lead to legal penalties, invalidation of corporate actions, and loss of organizational tax-exempt status, undermining the entity's compliance with laws and regulations. Violating fiduciary duty, which includes duties of care and loyalty, often results in lawsuits for damages, personal liability, and removal from positions of trust, jeopardizing the fiduciary's professional reputation and financial standing. Both breaches compromise stakeholder trust and can severely impact an organization's operational integrity and financial health.

Best Practices for Directors and Trustees

Directors and trustees must prioritize the Duty of Obedience by ensuring organizational actions comply with governing laws, bylaws, and mission statements, while fiduciary duty demands prudent financial management and loyalty to beneficiaries. Best practices include regular training on legal and ethical responsibilities, implementing robust oversight mechanisms, and maintaining transparent documentation to safeguard accountability. Emphasizing clear policies for conflict of interest, risk management, and strategic decision-making strengthens governance and upholds both duties effectively.

Enhancing Accountability: Training for Board Members

Training for board members on the duty of obedience and fiduciary duty enhances accountability by clarifying legal and ethical responsibilities in governance. Emphasizing compliance with organizational missions and prudent financial management ensures decisions align with both regulatory standards and stakeholders' best interests. Structured education on these duties helps mitigate risks of mismanagement and strengthens overall board effectiveness.

Duty of Obedience Infographic

libterm.com

libterm.com