Internal audit plays a crucial role in enhancing your organization's risk management, control, and governance processes by systematically evaluating operational efficiency and compliance. By identifying weaknesses and recommending improvements, internal audit ensures that your business stays aligned with regulatory standards and achieves strategic objectives. Explore the rest of this article to understand how internal audit can transform your organization's performance.

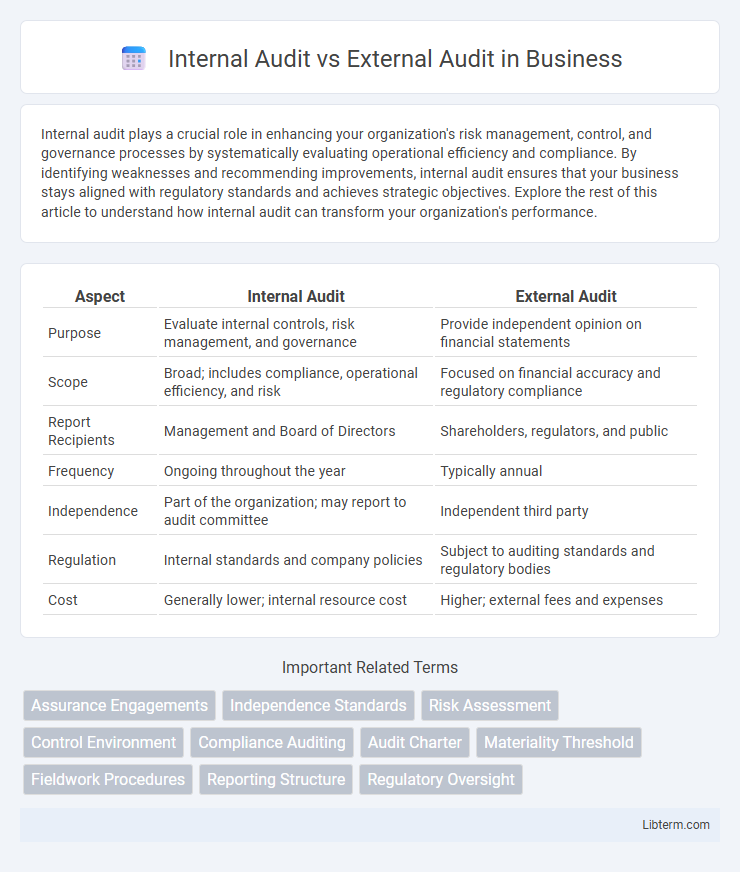

Table of Comparison

| Aspect | Internal Audit | External Audit |

|---|---|---|

| Purpose | Evaluate internal controls, risk management, and governance | Provide independent opinion on financial statements |

| Scope | Broad; includes compliance, operational efficiency, and risk | Focused on financial accuracy and regulatory compliance |

| Report Recipients | Management and Board of Directors | Shareholders, regulators, and public |

| Frequency | Ongoing throughout the year | Typically annual |

| Independence | Part of the organization; may report to audit committee | Independent third party |

| Regulation | Internal standards and company policies | Subject to auditing standards and regulatory bodies |

| Cost | Generally lower; internal resource cost | Higher; external fees and expenses |

Introduction to Internal and External Audits

Internal audits are conducted by an organization's own staff to evaluate internal controls, risk management, and governance processes, ensuring compliance with policies and operational efficiency. External audits are performed by independent auditors to provide an objective assessment of financial statements' accuracy and adherence to accounting standards, enhancing stakeholder confidence. Both audits play crucial roles in maintaining transparency, accountability, and regulatory compliance within businesses.

Key Objectives of Internal Audit

Internal audit primarily aims to evaluate and improve the effectiveness of risk management, control, and governance processes within an organization. It ensures compliance with internal policies and regulatory requirements while identifying operational inefficiencies and potential fraud. By providing ongoing assurance to management and the board, internal audit supports strategic decision-making and enhances overall organizational performance.

Primary Goals of External Audit

External audits primarily aim to provide an independent and objective evaluation of a company's financial statements, ensuring accuracy and compliance with accounting standards and regulations. They focus on detecting material misstatements, fraud, and errors to enhance the credibility of financial reporting for investors, creditors, and regulatory bodies. External auditors also assess the effectiveness of internal controls related to financial reporting to support their audit opinion.

Scope of Internal Audit versus External Audit

Internal audit focuses on evaluating an organization's internal controls, risk management processes, and compliance with policies to improve operational efficiency and governance. External audit primarily examines the accuracy and fairness of financial statements to provide an independent opinion for stakeholders, ensuring regulatory adherence and transparency. The scope of internal audit is continuous and comprehensive across all departments, while external audit scope is periodic and centered on financial reporting and statutory requirements.

Regulatory Requirements and Compliance

Internal audit functions focus on continuous monitoring and improving an organization's internal controls, risk management, and compliance with regulatory requirements, ensuring adherence to corporate policies and operational efficiency. External audits, mandated by regulatory bodies and standards such as SOX or IFRS, provide an independent assessment of financial statements to verify compliance with legal and regulatory frameworks. Both audits are essential for regulatory compliance, with internal audits driving ongoing compliance management and external audits offering objective validation to stakeholders.

Roles and Responsibilities of Internal and External Auditors

Internal auditors are responsible for evaluating an organization's internal controls, risk management processes, and governance to improve operational efficiency and ensure compliance with internal policies. External auditors focus on providing an independent and objective opinion on the accuracy and fairness of financial statements, verifying that they comply with accounting standards and regulatory requirements. Both roles involve detecting fraud and errors, but internal auditors work continuously within the organization while external auditors operate periodically as independent third parties.

Reporting Structure and Accountability

Internal audit reports directly to the organization's audit committee or senior management, ensuring independence and objectivity in evaluating internal controls and risk management processes. External audit reports to the organization's shareholders or regulatory bodies, providing an independent opinion on the accuracy and fairness of financial statements. Accountability for internal audit lies within the organization, while external auditors are accountable to external stakeholders to uphold compliance and transparency.

Frequency and Timing of Audits

Internal audits are conducted regularly throughout the fiscal year, often monthly or quarterly, to ensure ongoing compliance and operational efficiency. External audits typically occur annually, aligned with the company's financial year-end, focusing on the accuracy of financial statements and adherence to regulatory standards. Timing of internal audits allows for continuous risk assessment, whereas external audits provide an independent, periodic verification of financial health.

Advantages and Limitations of Each Audit Type

Internal audit provides ongoing evaluations of a company's risk management, control, and governance processes, offering timely insights that improve operational efficiency and ensure compliance with internal policies. However, internal audits may face limitations in independence, as auditors are employed by the organization, potentially affecting objectivity. External audit delivers an unbiased assessment of the financial statements' accuracy and adherence to regulatory standards, enhancing stakeholder confidence, but often occurs annually, limiting its effectiveness in identifying real-time operational issues.

Choosing Between Internal and External Audit for Organizations

Organizations choosing between internal and external audits must evaluate their specific needs for control, compliance, and reporting accuracy. Internal audits provide continuous, in-depth risk assessments and operational reviews tailored to internal management objectives, while external audits offer independent verification of financial statements to enhance stakeholder trust. Selecting the appropriate audit depends on factors like organizational size, regulatory requirements, and the desired level of assurance for financial transparency and internal controls.

Internal Audit Infographic

libterm.com

libterm.com