Neutral cash conversion maintains a balance between cash inflows and outflows, ensuring your business has steady liquidity without holding excessive cash reserves. This approach optimizes working capital by converting receivables and inventory into cash at a consistent pace, supporting operational stability. Explore the rest of the article to understand how mastering neutral cash conversion can enhance your financial efficiency.

Table of Comparison

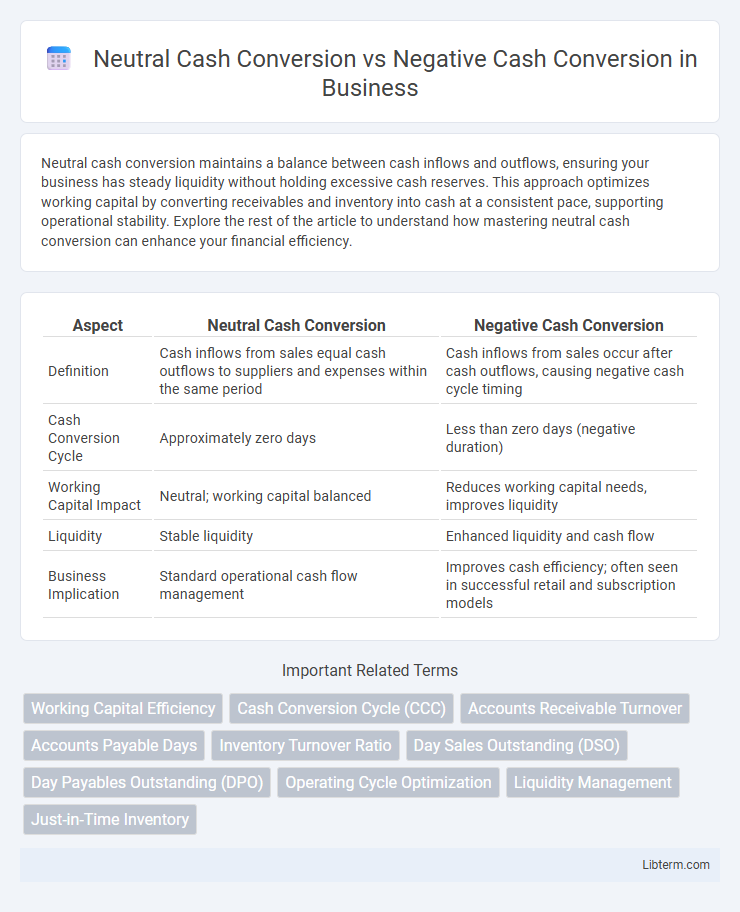

| Aspect | Neutral Cash Conversion | Negative Cash Conversion |

|---|---|---|

| Definition | Cash inflows from sales equal cash outflows to suppliers and expenses within the same period | Cash inflows from sales occur after cash outflows, causing negative cash cycle timing |

| Cash Conversion Cycle | Approximately zero days | Less than zero days (negative duration) |

| Working Capital Impact | Neutral; working capital balanced | Reduces working capital needs, improves liquidity |

| Liquidity | Stable liquidity | Enhanced liquidity and cash flow |

| Business Implication | Standard operational cash flow management | Improves cash efficiency; often seen in successful retail and subscription models |

Understanding Cash Conversion Cycles

Neutral cash conversion cycles indicate a balanced period where a company's inventory turnover and receivables collection align closely with its payables schedule, neither tying up nor generating excess cash. Negative cash conversion cycles occur when a firm collects cash from sales before paying its suppliers, enhancing liquidity and operational efficiency. Understanding cash conversion cycles allows businesses to optimize working capital by managing inventory, receivables, and payables to improve cash flow and reduce financing needs.

Defining Neutral Cash Conversion

Neutral cash conversion occurs when a company's cash inflows from sales precisely match its cash outflows for expenses, resulting in a zero net cash conversion cycle. This balance means the business neither gains nor loses working capital in the operating cycle, maintaining steady liquidity. By contrast, negative cash conversion indicates a company collects cash faster than it pays its suppliers, improving cash flow efficiency.

Exploring Negative Cash Conversion

Negative Cash Conversion occurs when a company receives cash from customers before paying its suppliers, resulting in a cash conversion cycle shorter than zero days. This efficient working capital management improves liquidity by minimizing the need for external financing and accelerating cash flow. Companies with negative cash conversion leverage strong vendor terms and rapid receivables collection to optimize operational cash flow and fuel growth.

Key Differences Between Neutral and Negative Cash Conversion

Neutral cash conversion occurs when a company's cash inflow from receivables aligns closely with its cash outflow for payables, resulting in a balanced working capital cycle. Negative cash conversion indicates that a business collects cash from customers faster than it pays its suppliers, effectively using suppliers' funds to finance operations and improve liquidity. The key difference lies in cash flow timing: neutral cash conversion maintains equilibrium in cash cycles, while negative cash conversion accelerates cash collections relative to payments, enhancing cash flow efficiency.

Industries with Neutral Cash Conversion Cycles

Industries with neutral cash conversion cycles, such as retail and consumer goods, efficiently balance receivables, payables, and inventory turnover, resulting in cash inflows closely matching cash outflows. This equilibrium allows businesses to maintain steady liquidity without relying heavily on external financing. Conversely, industries with negative cash conversion cycles, like e-commerce, collect cash from customers before paying suppliers, enhancing cash flow but requiring optimized receivables and payables management.

Industries Benefiting from Negative Cash Conversion

Industries such as retail, technology, and consumer goods benefit from negative cash conversion by receiving payments from customers before paying suppliers, effectively using customer funds for operational liquidity. E-commerce giants and subscription-based services frequently leverage negative cash conversion to optimize cash flow and reduce financing costs. This financial strategy enhances working capital management and supports rapid business scaling in competitive markets.

Impacts on Working Capital Management

Neutral cash conversion indicates that a company's receivables and payables periods are balanced, resulting in stable working capital without excessive financing needs. Negative cash conversion cycles allow companies to collect cash from customers before paying suppliers, enhancing liquidity and reducing reliance on external funding. In contrast, positive cash conversion cycles can strain working capital, requiring businesses to manage cash flows carefully to avoid liquidity shortfalls.

Long-Term Business Implications

Neutral cash conversion indicates a balanced cash flow cycle where a business efficiently manages receivables, inventory, and payables without excessive strain on liquidity, supporting sustainable operations and steady growth. Negative cash conversion means the company collects cash from customers before paying suppliers, enhancing working capital and providing a buffer for long-term investments and expansion. Over the long term, neutral cash conversion ensures operational stability while negative cash conversion offers a competitive advantage by improving cash availability and reducing reliance on external financing.

Strategies to Achieve Negative Cash Conversion

Achieving negative cash conversion requires efficient working capital management, where businesses accelerate accounts payable while delaying accounts receivable collection without harming supplier relations or customer satisfaction. Strategies include negotiating extended payment terms with suppliers, optimizing inventory turnover through just-in-time practices, and implementing dynamic receivables management such as early payment discounts or digital invoicing to speed up cash inflows. Leveraging technology for real-time financial monitoring and employing data analytics to forecast cash flows enhance precision in balancing payables and receivables, driving a negative cash conversion cycle that improves liquidity and operational efficiency.

Choosing the Right Cash Conversion Approach

Neutral cash conversion indicates a balance where a company's cash inflows from operating activities closely match its cash outflows, maintaining steady liquidity without strain. Negative cash conversion means the company collects cash from customers before paying suppliers, improving cash flow and working capital efficiency. Choosing the right cash conversion approach depends on industry standards, operational cycles, and the company's ability to manage supplier and customer payment terms effectively.

Neutral Cash Conversion Infographic

libterm.com

libterm.com