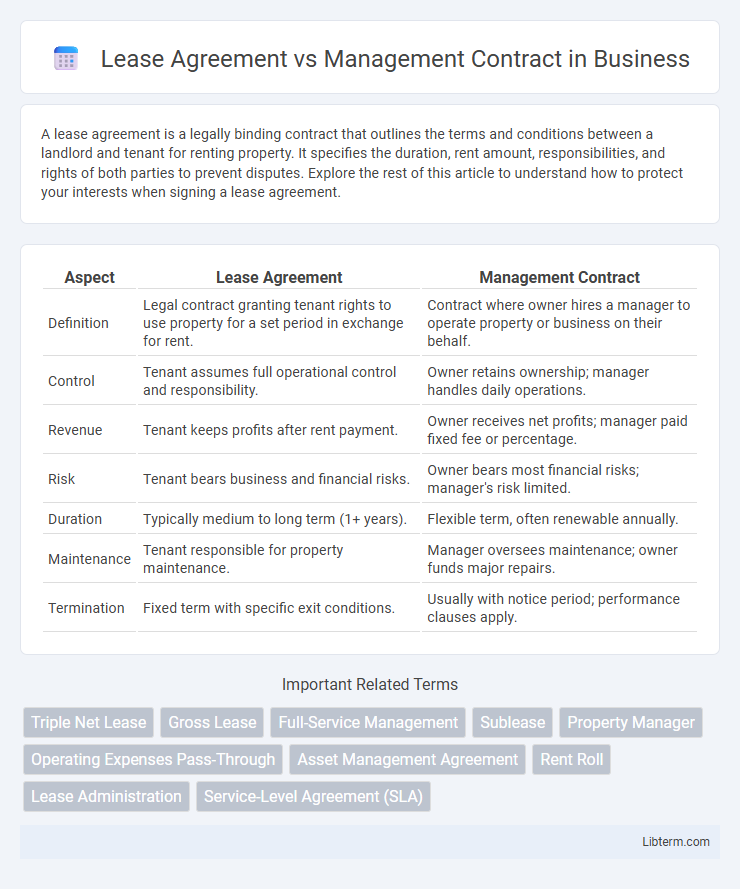

A lease agreement is a legally binding contract that outlines the terms and conditions between a landlord and tenant for renting property. It specifies the duration, rent amount, responsibilities, and rights of both parties to prevent disputes. Explore the rest of this article to understand how to protect your interests when signing a lease agreement.

Table of Comparison

| Aspect | Lease Agreement | Management Contract |

|---|---|---|

| Definition | Legal contract granting tenant rights to use property for a set period in exchange for rent. | Contract where owner hires a manager to operate property or business on their behalf. |

| Control | Tenant assumes full operational control and responsibility. | Owner retains ownership; manager handles daily operations. |

| Revenue | Tenant keeps profits after rent payment. | Owner receives net profits; manager paid fixed fee or percentage. |

| Risk | Tenant bears business and financial risks. | Owner bears most financial risks; manager's risk limited. |

| Duration | Typically medium to long term (1+ years). | Flexible term, often renewable annually. |

| Maintenance | Tenant responsible for property maintenance. | Manager oversees maintenance; owner funds major repairs. |

| Termination | Fixed term with specific exit conditions. | Usually with notice period; performance clauses apply. |

Understanding Lease Agreements

Lease agreements define a contractual relationship where the lessee obtains the right to use an asset, typically property, for a specified period in exchange for rent payments. These agreements outline obligations, rights, duration, and terms for maintenance, repairs, and renewal options. Understanding lease agreements is essential for accurately allocating responsibilities and ensuring compliance with legal and financial conditions.

Defining Management Contracts

Management contracts are legally binding agreements where one party, typically a property owner, hires a management company to operate and maintain the property on their behalf. These contracts specify the responsibilities of the management firm, including tenant relations, rent collection, maintenance, and overall property supervision, without transferring ownership rights. Unlike lease agreements, management contracts emphasize operational control and service provision rather than leasing or renting property.

Key Differences Between Lease Agreements and Management Contracts

Lease agreements grant the lessee exclusive control and operational responsibility over the property for a fixed term, often including revenue rights and maintenance duties. Management contracts allow the property owner to retain ownership while delegating daily operations, staffing, and marketing to a management company, typically compensated with a fixed fee or percentage of revenue. The primary distinction lies in control transfer, risk allocation, and financial obligations where lease agreements shift operational risk entirely to lessees, whereas management contracts maintain owner oversight with shared operational responsibilities.

Legal Responsibilities of Parties Involved

In a lease agreement, the tenant assumes primary legal responsibility for property maintenance and compliance with local regulations while the landlord retains ownership obligations. Management contracts delegate operational duties and legal liabilities to the property manager, who acts on behalf of the owner but does not hold ownership rights. Understanding these distinctions is crucial for clarifying accountability in property-related legal matters and dispute resolution.

Financial Implications and Revenue Sharing

Lease agreements involve fixed rent payments from the lessee to the lessor, providing predictable income regardless of property performance, while management contracts typically include revenue-sharing models where the manager earns a percentage of gross or net revenue, aligning incentives with property profitability. Financial risk in lease agreements is primarily borne by the lessee, as they must cover operating costs and potential revenue shortfalls, whereas management contracts shift financial risk to the lessor but offer variable income tied to operational success. Evaluating cash flow needs and risk tolerance is essential when choosing between the steady income of lease agreements and the performance-based earnings of management contracts.

Duration and Termination Clauses

Lease agreements typically have a fixed duration ranging from one to several years, with termination clauses that outline penalties or notice requirements for early termination. Management contracts often feature shorter or more flexible terms, allowing either party to terminate with specified notice periods, commonly 30 to 90 days. The clarity and specificity of duration and termination clauses in both contracts are crucial for minimizing disputes and ensuring smooth operational transitions.

Control Over Property Operations

Lease agreements transfer significant control over property operations from the owner to the lessee, who assumes responsibility for day-to-day management, tenant relations, and maintenance. In contrast, management contracts retain ownership control while delegating operational responsibilities to a property management company that acts on behalf of the owner under specified terms. The choice impacts decision-making authority, financial risk exposure, and the degree of involvement the property owner maintains in daily operations.

Risk Allocation and Liability

In a lease agreement, the lessee assumes most operational risks and liabilities, including maintenance, tenant management, and financial obligations, while the lessor retains ownership risk. A management contract allocates operational risks and liabilities primarily to the management company, which oversees daily operations and bears responsibilities such as staffing and compliance, whereas the property owner retains ownership and financial risks. Clear risk allocation in both agreements helps mitigate disputes and defines accountability for property performance and legal compliance.

Suitability: When to Choose a Lease Agreement or Management Contract

A Lease Agreement is suitable for property owners seeking fixed rental income without involvement in daily operations, ideal for long-term, stable investments in residential or commercial real estate. Management Contracts benefit owners wanting professional management expertise to maximize property performance, common in hospitality or large-scale commercial properties requiring active oversight. Choosing between the two depends on the owner's desired level of control, financial risk tolerance, and operational involvement.

Common Pitfalls and How to Avoid Them

Lease agreements often face pitfalls like unclear maintenance responsibilities and ambiguous payment terms, leading to disputes between landlords and tenants. Management contracts can suffer from vague performance metrics and insufficient communication channels, causing misaligned expectations and operational inefficiencies. Avoid these issues by clearly defining duties, setting measurable service standards, and establishing regular reporting protocols in both contract types.

Lease Agreement Infographic

libterm.com

libterm.com