Accrual accounting records revenues and expenses when they are earned or incurred, regardless of when cash transactions occur, providing a more accurate financial picture of a business. This method ensures that financial statements reflect all economic activities within a specific period, enhancing the reliability of financial reports. Explore the rest of the article to understand how accrual accounting can improve your business decision-making and financial management.

Table of Comparison

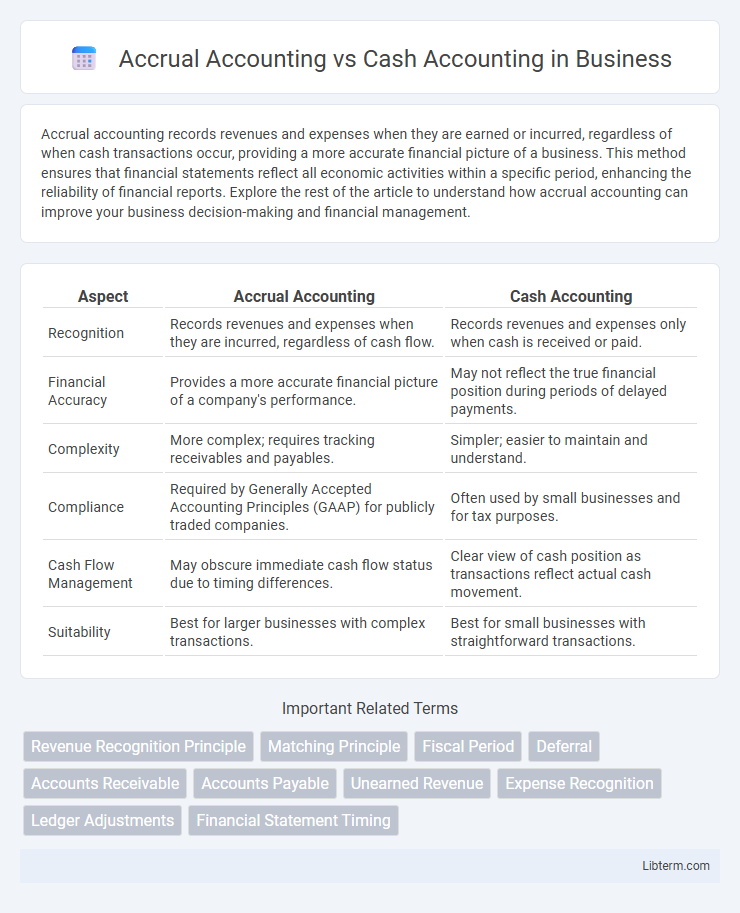

| Aspect | Accrual Accounting | Cash Accounting |

|---|---|---|

| Recognition | Records revenues and expenses when they are incurred, regardless of cash flow. | Records revenues and expenses only when cash is received or paid. |

| Financial Accuracy | Provides a more accurate financial picture of a company's performance. | May not reflect the true financial position during periods of delayed payments. |

| Complexity | More complex; requires tracking receivables and payables. | Simpler; easier to maintain and understand. |

| Compliance | Required by Generally Accepted Accounting Principles (GAAP) for publicly traded companies. | Often used by small businesses and for tax purposes. |

| Cash Flow Management | May obscure immediate cash flow status due to timing differences. | Clear view of cash position as transactions reflect actual cash movement. |

| Suitability | Best for larger businesses with complex transactions. | Best for small businesses with straightforward transactions. |

Introduction to Accrual vs Cash Accounting

Accrual accounting records revenues and expenses when they are earned or incurred, regardless of when cash transactions occur, providing a more accurate picture of a company's financial health. Cash accounting recognizes revenues and expenses only when cash is exchanged, offering simplicity but less insight into long-term financial performance. Understanding the differences between accrual and cash accounting is essential for selecting the appropriate method based on business size, complexity, and regulatory requirements.

Defining Accrual Accounting

Accrual accounting records revenues and expenses when they are earned or incurred, regardless of cash flow timing, ensuring financial statements reflect the true economic activity within a period. This method aligns with Generally Accepted Accounting Principles (GAAP), providing a more accurate picture of a company's financial health by matching income with related expenses. Unlike cash accounting, which only records transactions upon cash receipt or payment, accrual accounting supports better forecasting and compliance with regulatory requirements.

What is Cash Accounting?

Cash accounting records revenues and expenses only when cash is exchanged, providing a straightforward view of actual cash flow. It is commonly used by small businesses and sole proprietors due to its simplicity and ease of tracking immediate financial status. This method does not account for receivables or payables, potentially overlooking future financial obligations or income.

Key Differences Between Accrual and Cash Accounting

Accrual accounting records revenues and expenses when they are earned or incurred, regardless of cash flow, providing a more accurate financial picture over time. Cash accounting recognizes transactions only when cash changes hands, offering simplicity but potentially obscuring true financial health. Businesses with complex operations or inventory typically prefer accrual accounting for compliance and decision-making, while small businesses often use cash accounting for ease and immediate cash flow tracking.

Pros and Cons of Accrual Accounting

Accrual accounting provides a more accurate financial picture by recognizing revenues and expenses when they are earned or incurred, which improves financial analysis and long-term planning. It can be complex to implement and requires more detailed record-keeping, potentially increasing administrative costs. Small businesses may find it challenging due to cash flow tracking difficulties, but it is essential for companies seeking compliance with GAAP and better stakeholder reporting.

Pros and Cons of Cash Accounting

Cash accounting offers simplicity and clarity by recording transactions only when cash changes hands, making it ideal for small businesses with straightforward finances. However, it can distort financial health by failing to account for receivables and payables, potentially misleading stakeholders about true profitability and cash flow. This method also limits the ability to match revenues with expenses accurately, which can hinder effective financial planning and analysis.

Suitability: Who Should Use Each Method?

Accrual accounting suits businesses with complex transactions, inventory, or those seeking accurate financial insights, as it records revenues and expenses when incurred. Small businesses, freelancers, or those prioritizing straightforward cash flow management typically benefit from cash accounting, which tracks actual cash received and paid. Regulatory requirements often mandate accrual accounting for publicly traded companies, while many startups and sole proprietors prefer cash accounting for its simplicity.

Impact on Financial Reporting and Decision-Making

Accrual accounting records revenues and expenses when they are earned or incurred, providing a more accurate picture of a company's financial health and enabling better forecasting and strategic decision-making. Cash accounting only recognizes transactions when cash is exchanged, which can distort short-term financial performance and limit insights into future obligations or receivables. The choice between accrual and cash accounting significantly impacts financial reporting transparency, tax planning, and stakeholders' ability to assess business profitability and liquidity.

Tax Implications of Each Accounting Method

Accrual accounting recognizes income and expenses when they are earned or incurred, resulting in taxable income being reported in the period it is generated, which can accelerate tax liabilities even if cash has not been received. Cash accounting, on the other hand, records revenues and expenses only when cash transactions occur, allowing businesses to manage taxable income and potentially defer tax payments by timing cash flows. The choice between accrual and cash accounting significantly impacts tax planning strategies, affecting cash flow management, eligibility for deductions, and compliance with IRS reporting requirements.

Choosing the Right Accounting Method for Your Business

Selecting the appropriate accounting method depends on your business size, complexity, and financial goals. Accrual accounting offers a more accurate financial picture by recognizing revenues and expenses when they are incurred, making it ideal for larger businesses or those seeking external financing. Cash accounting provides simplicity and immediate cash flow tracking, often preferred by small businesses or sole proprietors with straightforward transactions.

Accrual Accounting Infographic

libterm.com

libterm.com