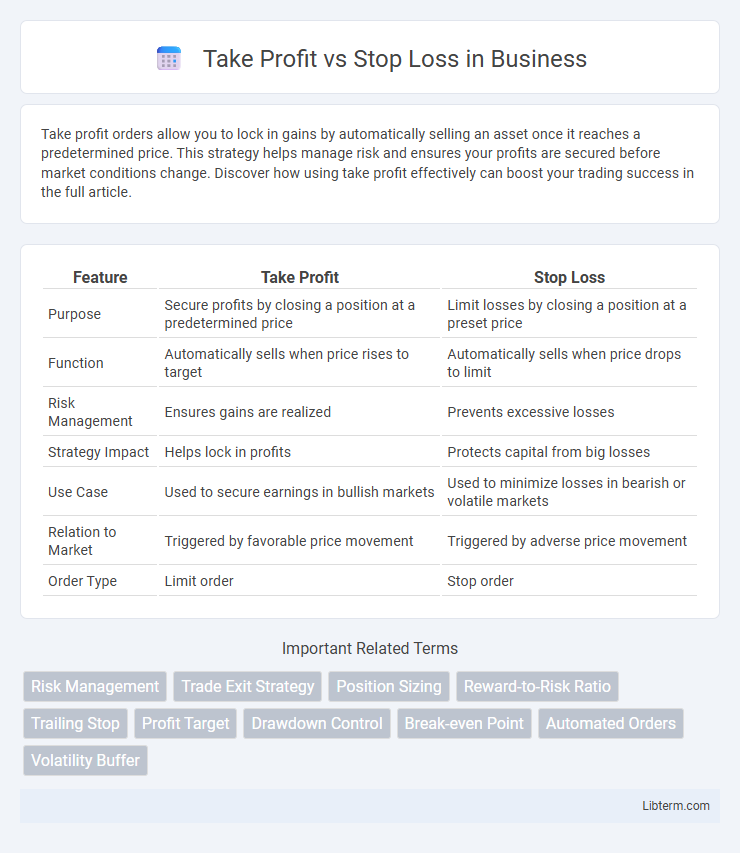

Take profit orders allow you to lock in gains by automatically selling an asset once it reaches a predetermined price. This strategy helps manage risk and ensures your profits are secured before market conditions change. Discover how using take profit effectively can boost your trading success in the full article.

Table of Comparison

| Feature | Take Profit | Stop Loss |

|---|---|---|

| Purpose | Secure profits by closing a position at a predetermined price | Limit losses by closing a position at a preset price |

| Function | Automatically sells when price rises to target | Automatically sells when price drops to limit |

| Risk Management | Ensures gains are realized | Prevents excessive losses |

| Strategy Impact | Helps lock in profits | Protects capital from big losses |

| Use Case | Used to secure earnings in bullish markets | Used to minimize losses in bearish or volatile markets |

| Relation to Market | Triggered by favorable price movement | Triggered by adverse price movement |

| Order Type | Limit order | Stop order |

Understanding Take Profit and Stop Loss

Take Profit and Stop Loss are essential risk management tools in trading, designed to automatically close positions at predetermined price levels. Take Profit secures profits by closing a trade once the market reaches a specified favorable price, ensuring gains are captured without continuous monitoring. Stop Loss limits potential losses by exiting a trade if the price moves against the trader beyond a set threshold, helping to protect capital from significant downturns.

Key Differences Between Take Profit and Stop Loss

Take Profit and Stop Loss are essential trading tools designed to manage risk and secure profits, with Take Profit automatically closing a position at a predetermined profit target, while Stop Loss limits losses by closing a trade once a specific loss threshold is reached. Take Profit ensures that traders lock in gains during favorable price movements, whereas Stop Loss protects capital by preventing excessive losses during adverse market conditions. The key difference lies in their purpose: Take Profit focuses on securing profits, and Stop Loss prioritizes loss mitigation.

The Importance of Risk Management in Trading

Effective risk management in trading relies heavily on the strategic use of Take Profit and Stop Loss orders to protect capital and optimize returns. Take Profit orders secure gains by automatically closing positions at predetermined profit levels, while Stop Loss orders limit potential losses by exiting trades when market conditions turn unfavorable. Implementing these tools systematically helps traders maintain discipline, control emotional responses, and enhance long-term profitability in volatile markets.

How to Set Effective Stop Loss Levels

Setting effective stop loss levels requires analyzing recent market volatility and support or resistance zones to minimize potential losses without exiting trades prematurely. Traders often use a percentage-based approach, such as 1-2% of their trading capital, combined with technical indicators like Average True Range (ATR) to determine optimal stop loss distances. Properly placed stop losses protect capital while allowing sufficient room for price fluctuations aligned with the asset's typical movement range.

Strategies for Calculating Take Profit Targets

Take Profit targets are often calculated using risk-reward ratios, where traders set profits at least two to three times the size of their Stop Loss to maximize potential gains while controlling risks. Another strategy involves technical analysis, identifying key resistance levels or Fibonacci retracement points as optimal take profit zones. Trailing Take Profit methods dynamically adjust targets based on market movements, allowing traders to lock in profits while maintaining upside potential.

Common Mistakes Traders Make with Stop Losses

Traders frequently set stop losses too close to the entry point, leading to premature exits caused by normal market fluctuations rather than genuine trend reversals. Another common mistake is neglecting to adjust stop losses in response to changing market conditions, which can expose positions to unnecessary risks or limit potential gains. Ignoring the importance of stop loss placement in relation to volatility and support/resistance levels often results in ineffective risk management and increased losses.

Maximizing Profits with Take Profit Orders

Take Profit orders lock in gains by automatically closing a trade once a predetermined profit level is reached, ensuring traders capitalize on favorable price movements. Setting strategic Take Profit levels based on market analysis prevents missed opportunities due to sudden reversals, thus maximizing profit potential. Effective use of Take Profit orders in conjunction with risk management tools enhances overall trading performance and portfolio growth.

Combining Take Profit and Stop Loss for Optimal Results

Combining Take Profit and Stop Loss orders enhances risk management by locking in gains while limiting potential losses in volatile markets. Utilizing precise entry, exit, and risk thresholds tailored to market conditions improves overall trading performance and capital preservation. This balanced approach supports disciplined strategies, reducing emotional decision-making and optimizing long-term profitability.

Tools and Platforms for Automated Order Management

Automated order management tools on trading platforms enable precise execution of Take Profit and Stop Loss orders, allowing traders to maximize gains and limit losses without constant market monitoring. Platforms like MetaTrader 4, NinjaTrader, and TradingView provide integrated features for setting customizable profit targets and risk thresholds that trigger automatic order closures based on predefined price levels. Advanced algorithms and APIs support dynamic adjustment of these orders in response to market volatility, enhancing real-time risk management and trading efficiency.

Best Practices for Using Take Profit and Stop Loss

Setting take profit and stop loss levels strategically enhances risk management and maximizes trading success by locking in gains and limiting losses. The best practices involve analyzing market volatility and support-resistance levels to place take profit points where price reversals are probable, while setting stop loss orders just beyond critical support or resistance to avoid premature exits. Regularly adjusting these orders based on evolving market conditions ensures disciplined trade management and improves overall profitability.

Take Profit Infographic

libterm.com

libterm.com