Stock options offer a strategic way to invest in a company's future by granting the right to buy shares at a predetermined price. Understanding how these financial instruments work can enhance your portfolio's growth potential and help manage risk effectively. Explore the rest of the article to learn how stock options can benefit your investment strategy.

Table of Comparison

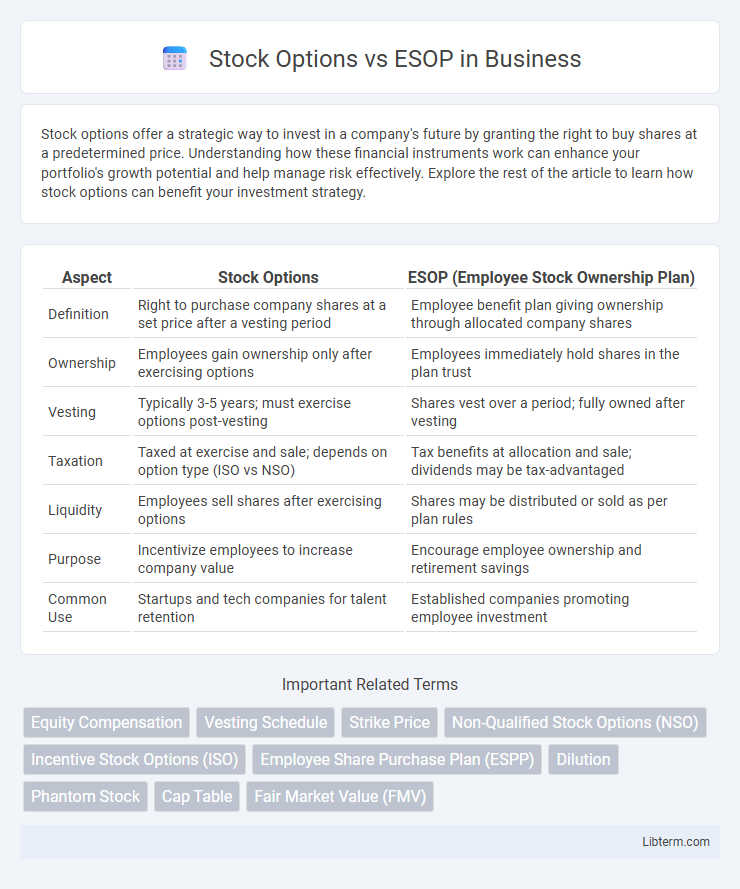

| Aspect | Stock Options | ESOP (Employee Stock Ownership Plan) |

|---|---|---|

| Definition | Right to purchase company shares at a set price after a vesting period | Employee benefit plan giving ownership through allocated company shares |

| Ownership | Employees gain ownership only after exercising options | Employees immediately hold shares in the plan trust |

| Vesting | Typically 3-5 years; must exercise options post-vesting | Shares vest over a period; fully owned after vesting |

| Taxation | Taxed at exercise and sale; depends on option type (ISO vs NSO) | Tax benefits at allocation and sale; dividends may be tax-advantaged |

| Liquidity | Employees sell shares after exercising options | Shares may be distributed or sold as per plan rules |

| Purpose | Incentivize employees to increase company value | Encourage employee ownership and retirement savings |

| Common Use | Startups and tech companies for talent retention | Established companies promoting employee investment |

Introduction to Stock Options and ESOP

Stock options grant employees the right to buy company shares at a predetermined price within a specific period, incentivizing performance and aligning employee interests with company growth. Employee Stock Ownership Plans (ESOPs) are retirement plans that provide employees with ownership stakes through company-issued stocks, fostering long-term commitment and wealth accumulation. Both tools serve as strategic equity compensation methods but differ in structure, tax implications, and ownership transferability.

Understanding Stock Options

Stock options grant employees the right to purchase company shares at a predetermined price within a specific time frame, aligning employee incentives with company performance. These options typically vest over a period, encouraging long-term commitment and offering potential financial gain if the company's stock price increases. Compared to ESOPs, stock options provide more flexibility but require employees to exercise their options and bear the risk of stock price fluctuations.

What is an ESOP?

An Employee Stock Ownership Plan (ESOP) is a retirement benefit program that provides employees with ownership interest in the company through stock allocation. Unlike stock options, which grant employees the right to purchase shares at a predetermined price, ESOPs typically allocate shares to employees' accounts based on factors such as salary or tenure, often without requiring an upfront purchase. ESOPs serve as both an employee incentive and a corporate finance strategy, fostering employee engagement and aligning their interests with company performance.

Key Differences Between Stock Options and ESOP

Stock options grant employees the right to purchase company shares at a predetermined price within a specific timeframe, providing potential financial gain if the stock value rises. Employee Stock Ownership Plans (ESOPs) are company-sponsored retirement plans that allocate actual shares to employees, fostering long-term ownership and retirement benefits. The key difference lies in stock options offering a potential purchase opportunity versus ESOPs providing direct share ownership and associated voting rights.

Eligibility Criteria for Stock Options vs ESOP

Stock options are typically granted to key employees, executives, and senior management based on performance, role, and company discretion, often requiring employment during a specific vesting period. ESOPs (Employee Stock Ownership Plans) have broader eligibility, usually extended to all full-time employees meeting tenure and service requirements, promoting widespread ownership and retirement benefits. Eligibility for stock options is more selective and performance-driven, while ESOPs emphasize inclusivity and long-term employee investment.

Tax Implications of Stock Options and ESOP

Stock options and ESOPs differ significantly in tax treatment, impacting employee financial outcomes. Stock options are generally taxed at exercise, with non-qualified stock options (NSOs) incurring ordinary income tax on the difference between exercise price and market value, while incentive stock options (ISOs) may qualify for capital gains tax if holding period requirements are met. ESOPs offer tax advantages such as tax-deferred growth and potential tax deductions for the company, with employees typically taxed on distributions at ordinary income rates unless shares are held long-term for capital gains benefits.

Benefits for Employees: Stock Options vs ESOP

Stock options provide employees the opportunity to purchase company shares at a predetermined price, enabling potential financial gains if the stock price increases. ESOPs (Employee Stock Ownership Plans) offer employees ownership stakes, often with tax advantages and retirement benefits, fostering long-term commitment and company loyalty. Both stock options and ESOPs align employee interests with company performance but differ in liquidity and tax treatment.

Company Perspectives: Choosing Stock Options or ESOP

Stock options provide companies with a flexible tool for incentivizing employees by granting the right to buy shares at a predetermined price, promoting long-term commitment and aligning employee interests with shareholder value. ESOPs (Employee Stock Ownership Plans) function as employee benefit plans that allocate company shares to employees, fostering ownership culture and offering potential tax advantages for the company. Choosing between stock options and ESOPs depends on factors such as company size, growth stage, desired employee ownership level, and tax considerations, with stock options preferred for startups aiming at high growth and ESOPs favored by mature companies seeking broader employee participation.

Potential Risks and Limitations

Stock options carry the risk of financial loss if the company's stock price declines below the exercise price, leaving employees with worthless options. ESOPs can face limitations such as lack of diversification, where employees' retirement savings are heavily tied to the company's stock performance, increasing vulnerability to business downturns. Both stock options and ESOPs may subject employees to tax complexities and potential dilution of ownership in future funding rounds.

Which is Better: Stock Options or ESOP?

Stock options provide employees the right to purchase company shares at a predetermined price, often used as an incentive to align employee interests with shareholder value. ESOPs (Employee Stock Ownership Plans) grant employees actual ownership in the company through shares, fostering long-term commitment and retirement benefits. The better choice depends on company goals: stock options suit startups aiming for rapid growth and employee motivation, while ESOPs are ideal for mature companies seeking employee retention and wealth distribution.

Stock Options Infographic

libterm.com

libterm.com