Bonds are fixed-income securities that provide regular interest payments and return the principal at maturity, making them essential for diversifying investment portfolios and managing risk. They vary by issuer type, credit quality, and maturity, allowing investors to tailor their choices to fit financial goals and market conditions. Explore the article to understand how bonds can enhance your investment strategy and financial security.

Table of Comparison

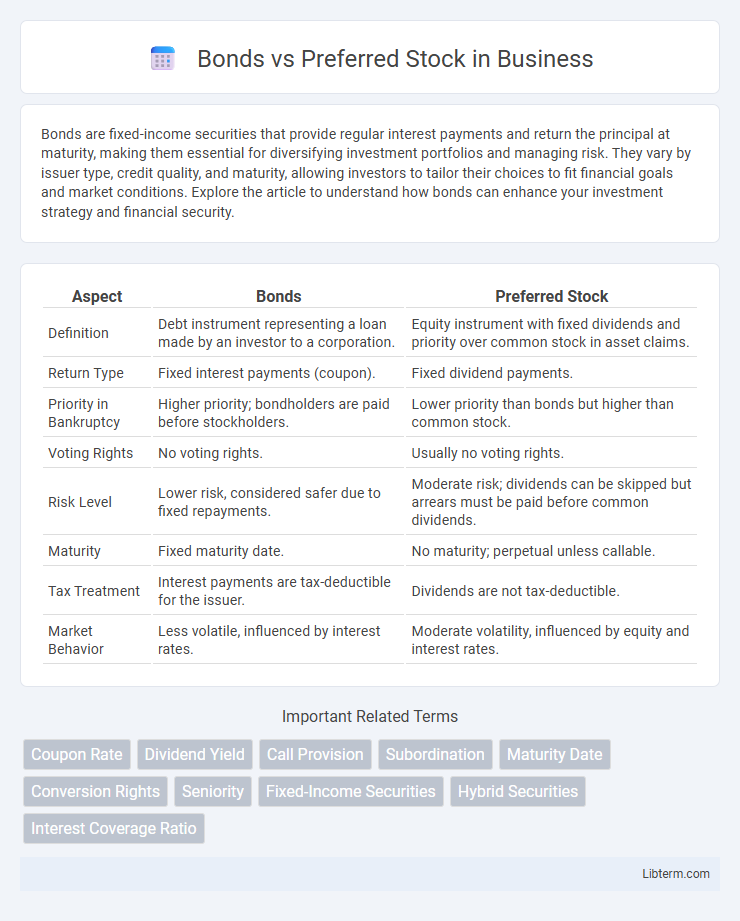

| Aspect | Bonds | Preferred Stock |

|---|---|---|

| Definition | Debt instrument representing a loan made by an investor to a corporation. | Equity instrument with fixed dividends and priority over common stock in asset claims. |

| Return Type | Fixed interest payments (coupon). | Fixed dividend payments. |

| Priority in Bankruptcy | Higher priority; bondholders are paid before stockholders. | Lower priority than bonds but higher than common stock. |

| Voting Rights | No voting rights. | Usually no voting rights. |

| Risk Level | Lower risk, considered safer due to fixed repayments. | Moderate risk; dividends can be skipped but arrears must be paid before common dividends. |

| Maturity | Fixed maturity date. | No maturity; perpetual unless callable. |

| Tax Treatment | Interest payments are tax-deductible for the issuer. | Dividends are not tax-deductible. |

| Market Behavior | Less volatile, influenced by interest rates. | Moderate volatility, influenced by equity and interest rates. |

Introduction to Bonds and Preferred Stock

Bonds represent debt securities where investors lend money to issuers, typically corporations or governments, in exchange for periodic interest payments and the return of principal at maturity. Preferred stock is a hybrid security with features of both equity and debt, offering fixed dividend payments and priority over common stockholders in asset claims during liquidation. Both instruments serve as alternative financing options with distinct risk, return, and ownership implications for investors.

Key Differences Between Bonds and Preferred Stock

Bonds represent debt instruments where investors receive fixed interest payments and priority repayment upon issuer default, while preferred stock constitutes equity with fixed dividends but subordinate claims in bankruptcy. Bonds typically have a set maturity date, whereas preferred stock can be perpetual without a maturity date. Unlike bonds, preferred stock dividends may be skipped without triggering default, affecting income predictability for investors.

Risk and Return Comparison

Bonds generally offer lower risk and fixed returns through regular interest payments, making them more secure investments compared to preferred stock. Preferred stock carries higher risk as dividends are not guaranteed and may be suspended, but it typically provides higher potential returns through dividend yields and capital appreciation. Investors favor bonds for capital preservation and preferred stock for a balance of income and growth potential with moderate risk.

Dividend vs. Interest Payments

Bonds provide fixed interest payments to investors, typically paid semi-annually, representing a legal obligation of the issuer, while preferred stock pays dividends that can vary and are not legally required. Interest on bonds is taxed as ordinary income, whereas preferred stock dividends may qualify for favorable tax treatment under qualified dividend rules. Bondholders have priority over preferred shareholders in claims on assets and earnings, especially regarding payments during financial distress or liquidation.

Priority in Liquidation

Bonds hold the highest priority in liquidation, as bondholders are creditors entitled to repayment before any equity holders receive funds. Preferred stock ranks below bonds but above common stock, granting preferred shareholders a fixed claim on assets and dividends prior to common shareholders during liquidation. This hierarchy ensures that bondholders recover their investments first, followed by preferred shareholders, with common shareholders receiving any residual value last.

Tax Considerations

Bonds typically offer tax-deductible interest expenses for issuing companies, lowering their taxable income, while preferred stock dividends are paid from after-tax earnings and provide no tax deduction. Investors receiving bond interest generally pay taxes at ordinary income rates, whereas qualified dividends from preferred stock may benefit from lower tax rates. Careful analysis of these tax implications is essential for corporate financing strategies and investor portfolio optimization.

Suitability for Different Types of Investors

Bonds offer fixed interest payments and lower risk, making them suitable for conservative investors seeking steady income and capital preservation. Preferred stock provides potential for higher dividends and equity-like upside, attracting investors willing to accept moderate risk for enhanced income and some growth potential. Risk tolerance, income needs, and investment goals determine whether bonds or preferred stock align better with an investor's portfolio strategy.

Market Volatility and Price Fluctuations

Bonds typically exhibit lower price volatility compared to preferred stock due to their fixed interest payments and priority during liquidation. Preferred stock prices fluctuate more with market conditions and interest rate changes, making them sensitive to economic shifts. Investors seeking stability may prefer bonds, while those willing to tolerate higher volatility for potentially higher income might choose preferred stock.

Pros and Cons of Bonds

Bonds provide fixed interest payments, offering predictable income and lower risk compared to preferred stock, which is beneficial for conservative investors seeking stability. They have higher priority in asset claims during bankruptcy, enhancing security, but typically lack the potential for capital appreciation that preferred stock might offer through dividend growth. However, bonds are sensitive to interest rate fluctuations, potentially causing price volatility, and missed interest payments can severely impact borrower creditworthiness.

Pros and Cons of Preferred Stock

Preferred stock offers fixed dividend payments, providing a stable income stream often higher than common stock dividends, along with priority over common stockholders in asset distribution during liquidation. However, preferred stocks typically lack voting rights, limiting shareholders' influence on corporate decisions, and their dividend payments can be suspended without triggering default, making them less secure than bonds. Unlike bonds, preferred stocks do not have a maturity date, which means investors may face liquidity challenges and potential price volatility in the stock market.

Bonds Infographic

libterm.com

libterm.com