A friendly takeover occurs when a company acquires another with the full approval and cooperation of both parties' management, ensuring a smooth transition and mutual benefits. This type of acquisition prioritizes maintaining positive relationships, aligning strategic goals, and preserving company culture. Discover more about how a friendly takeover can positively impact Your business strategy in the rest of this article.

Table of Comparison

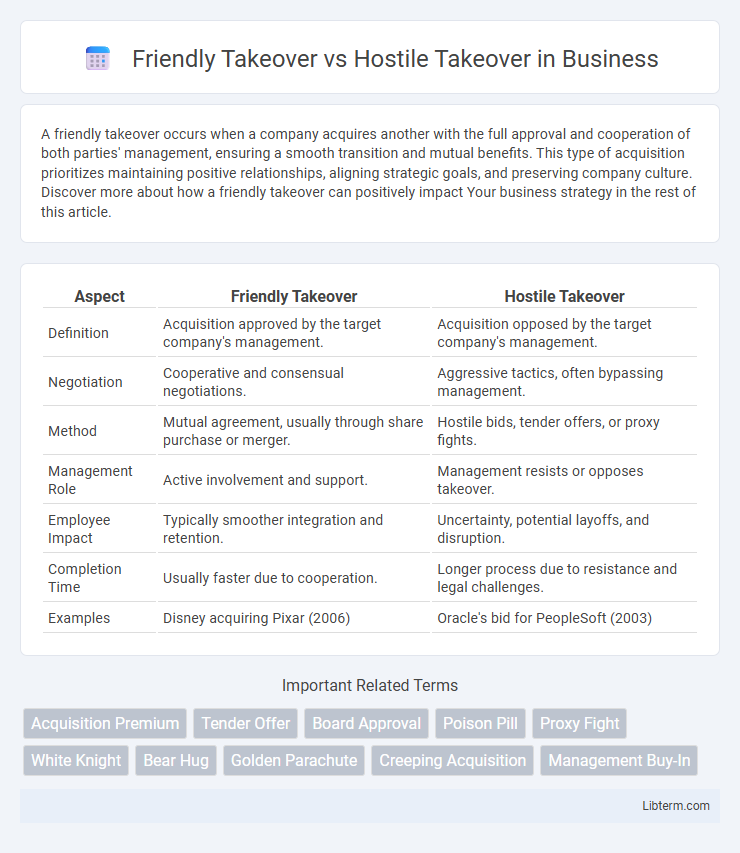

| Aspect | Friendly Takeover | Hostile Takeover |

|---|---|---|

| Definition | Acquisition approved by the target company's management. | Acquisition opposed by the target company's management. |

| Negotiation | Cooperative and consensual negotiations. | Aggressive tactics, often bypassing management. |

| Method | Mutual agreement, usually through share purchase or merger. | Hostile bids, tender offers, or proxy fights. |

| Management Role | Active involvement and support. | Management resists or opposes takeover. |

| Employee Impact | Typically smoother integration and retention. | Uncertainty, potential layoffs, and disruption. |

| Completion Time | Usually faster due to cooperation. | Longer process due to resistance and legal challenges. |

| Examples | Disney acquiring Pixar (2006) | Oracle's bid for PeopleSoft (2003) |

Introduction to Corporate Takeovers

Corporate takeovers involve acquiring control of one company by another, classified primarily as friendly or hostile based on the target company's consent. Friendly takeovers occur with the approval of the target's management and board, facilitating smoother integration and strategic alignment. Hostile takeovers proceed without management consent, often through tender offers or proxy battles, leading to potential resistance and legal challenges.

Defining Friendly Takeovers

A friendly takeover occurs when the target company's management and board of directors agree to the acquisition, facilitating a smooth negotiation process. This type of takeover emphasizes cooperation, mutual benefit, and often involves transparent communication to align both companies' strategic goals. Friendly takeovers typically result in less disruption, higher employee morale, and quicker integration compared to hostile takeovers.

Understanding Hostile Takeovers

Hostile takeovers occur when an acquiring company seeks to gain control of a target company against the wishes of its management and board of directors, often through a direct tender offer to shareholders or a proxy fight. These takeovers typically involve aggressive tactics, such as bypassing the target company's leadership to purchase a majority stake or persuade shareholders to replace existing management. Understanding hostile takeovers requires analyzing legal defenses like poison pills, shareholder rights plans, and the strategic motives behind such acquisitions, including market expansion or asset acquisition.

Key Differences Between Friendly and Hostile Takeovers

Friendly takeovers occur with the consent and cooperation of the target company's management and board of directors, ensuring a smooth acquisition process. In contrast, hostile takeovers bypass target management approval, often involving aggressive tactics like tender offers or proxy battles. Key differences include the level of negotiation, management support, and the overall approach to gaining control of the target company.

Motivations Behind Each Type of Takeover

Motivations behind a friendly takeover often include strategic alignment, synergy realization, and mutual growth prospects, with the target company's management agreeing to the acquisition to create shareholder value. In contrast, hostile takeovers are driven by aggressive acquisition goals, where the acquiring company aims to gain control despite opposition from the target's management, often seeking undervalued assets or market expansion. Both types reflect distinct corporate strategies influenced by market conditions, financial performance, and competitive positioning.

Process and Strategies Involved

Friendly takeovers involve cooperative negotiations where the acquiring company works closely with the target's management and board to reach a mutually beneficial agreement, often through direct offers and due diligence ensuring alignment of interests. Hostile takeovers bypass management approval by directly appealing to shareholders via tender offers or proxy fights, leveraging aggressive tactics such as public campaigns or leveraging legal loopholes to gain control. Strategic approaches in friendly takeovers emphasize collaboration and integration planning, while hostile takeovers focus on rapid control acquisition and overcoming defensive measures like poison pills or staggered boards.

Impact on Shareholders and Employees

Friendly takeovers often result in smoother integration, preserving employee morale and offering shareholders potential value through negotiated premiums. Hostile takeovers can create uncertainty and anxiety among employees due to abrupt management changes, while shareholders may benefit from immediate stock price increases but face long-term risks. Both types of takeovers significantly influence stakeholder confidence and company culture, impacting overall business stability.

Legal and Regulatory Considerations

Friendly takeovers generally involve regulatory approval processes that are smoother due to mutual agreement between the acquiring and target companies, facilitating compliance with antitrust laws and securities regulations. Hostile takeovers often trigger heightened legal scrutiny, including potential litigation from the target company and stricter enforcement of securities laws like tender offer rules under the Williams Act. Both takeover types require adherence to disclosure requirements mandated by the Securities and Exchange Commission (SEC) to protect shareholders and maintain market transparency.

Notable Examples of Friendly and Hostile Takeovers

The acquisition of Pixar by Disney in 2006 stands as a notable example of a friendly takeover, characterized by mutual agreement and cooperation between both companies leading to a $7.4 billion deal that enhanced Disney's creative portfolio. In contrast, the hostile takeover attempt of Yahoo by Microsoft in 2008 exemplifies a hostile takeover, where Microsoft made an unsolicited bid worth $44.6 billion, which Yahoo ultimately rejected to maintain independence. Another significant hostile takeover example is the 1988 RJR Nabisco bid by Kohlberg Kravis Roberts, executed through a leveraged buyout valued at $25 billion, considered one of the largest and most aggressive in history.

Conclusion: Choosing the Right Approach

Selecting between a friendly takeover and a hostile takeover depends on the acquiring company's strategic goals, risk tolerance, and desired outcomes. Friendly takeovers often ensure smoother integration and stakeholder cooperation, while hostile takeovers may enable quicker acquisition but involve higher conflict and legal challenges. Evaluating factors such as company culture, market conditions, and long-term value creation is essential to determine the most effective approach.

Friendly Takeover Infographic

libterm.com

libterm.com