Private equity involves investing in private companies or purchasing public companies to delist them from stock exchanges, aiming to improve their value before selling at a profit. This strategy often includes active management and operational improvements to drive growth and increase returns. Discover how private equity can impact your investment portfolio and what you need to know to get started in this comprehensive article.

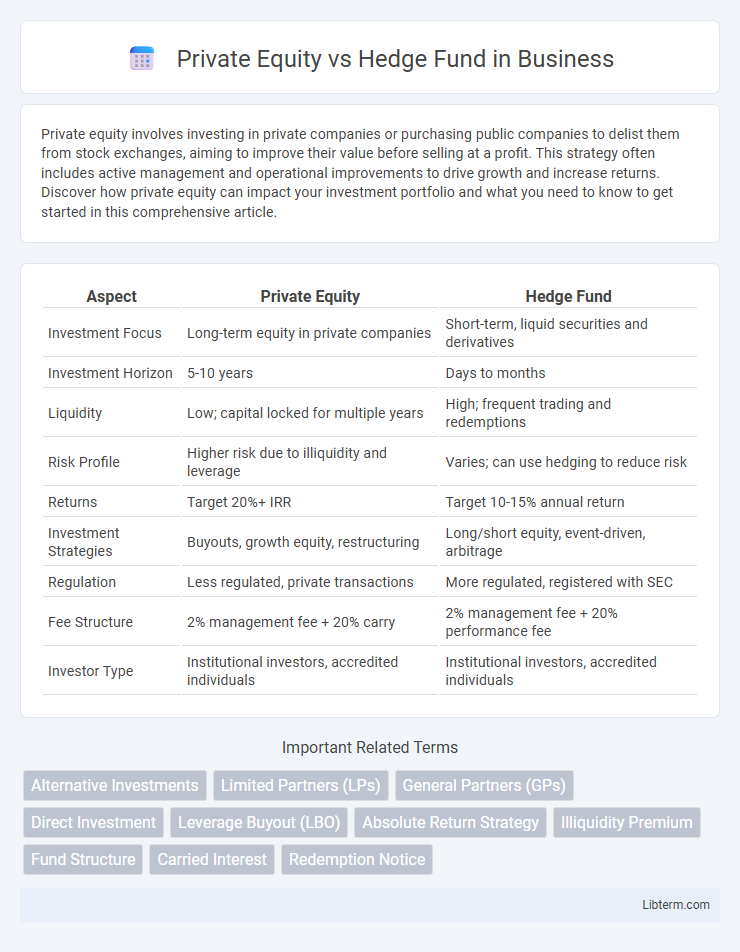

Table of Comparison

| Aspect | Private Equity | Hedge Fund |

|---|---|---|

| Investment Focus | Long-term equity in private companies | Short-term, liquid securities and derivatives |

| Investment Horizon | 5-10 years | Days to months |

| Liquidity | Low; capital locked for multiple years | High; frequent trading and redemptions |

| Risk Profile | Higher risk due to illiquidity and leverage | Varies; can use hedging to reduce risk |

| Returns | Target 20%+ IRR | Target 10-15% annual return |

| Investment Strategies | Buyouts, growth equity, restructuring | Long/short equity, event-driven, arbitrage |

| Regulation | Less regulated, private transactions | More regulated, registered with SEC |

| Fee Structure | 2% management fee + 20% carry | 2% management fee + 20% performance fee |

| Investor Type | Institutional investors, accredited individuals | Institutional investors, accredited individuals |

Overview: Private Equity vs Hedge Fund

Private Equity firms primarily invest in private companies or conduct buyouts to drive long-term value creation through operational improvements and strategic management. Hedge Funds focus on liquid assets, employing diverse strategies such as long/short equity, arbitrage, and derivatives to generate high returns with shorter investment horizons. Both asset classes cater to sophisticated investors but differ significantly in investment structure, risk profiles, and liquidity.

Definitions and Core Characteristics

Private equity involves direct investments in private companies or buyouts with the goal of long-term value creation through active management and operational improvements. Hedge funds primarily engage in liquid asset trading, employing diverse strategies like long-short equity, arbitrage, and derivatives to generate short-term returns. Both vehicle types target high-net-worth investors but differ significantly in investment horizon, liquidity, and risk profiles.

Investment Strategies Compared

Private equity primarily invests in acquiring and restructuring private companies, focusing on long-term value creation through operational improvements and strategic growth. Hedge funds employ diverse trading strategies, including long/short equity, arbitrage, and derivatives, aiming for high liquidity and short-term gains across various asset classes. Both differ significantly in investment horizon, risk tolerance, and portfolio composition, reflecting their unique approaches to capital deployment and return generation.

Fund Structure and Lifespan

Private equity funds typically operate as closed-end investment vehicles with a fixed lifespan of 7 to 10 years, during which capital is committed, invested in portfolio companies, and eventually exited. Hedge funds, by contrast, are often open-ended structures allowing continuous investor subscriptions and redemptions, offering more liquidity and flexibility. The fund structure impacts investment strategy, with private equity emphasizing long-term value creation and hedge funds focusing on diverse, often short-term, market opportunities.

Capital Commitment and Liquidity

Private equity typically requires a long-term capital commitment, locking investors' funds for periods often ranging from 7 to 10 years, with limited liquidity until exits occur. Hedge funds generally offer greater liquidity, allowing investors to redeem shares monthly or quarterly, depending on the fund's terms. The capital commitment in private equity is less flexible but targets higher returns through active management and operational improvements, while hedge funds emphasize more frequent trading and market liquidity.

Risk and Return Profiles

Private equity typically involves long-term investments in private companies, offering potentially higher returns but with lower liquidity and higher risk due to market and operational uncertainties. Hedge funds employ diversified, often short-term strategies including leverage, derivatives, and arbitrage to generate returns, aiming for higher liquidity but facing risks from market volatility and complex financial instruments. The risk-return profile of private equity leans towards illiquid, high-risk assets with substantial upside, while hedge funds balance moderate to high risk with more flexible, liquid investment approaches.

Regulatory Environment

Private equity firms typically face less regulatory scrutiny compared to hedge funds, as they engage primarily in long-term investments with less frequent trading activity. Hedge funds operate under stricter regulations from the SEC, including detailed reporting requirements and compliance with the Investment Advisers Act of 1940, due to their higher risk profiles and short-term trading strategies. The differing regulatory frameworks reflect the distinct investment horizons and risk exposure associated with private equity and hedge funds.

Investor Types and Minimum Requirements

Private equity firms primarily attract institutional investors such as pension funds, endowments, and high-net-worth individuals due to their long-term investment horizon and higher minimum investment thresholds, often starting at $1 million or more. Hedge funds cater to accredited investors seeking liquidity and diversification, with minimum investments typically ranging from $100,000 to $500,000, depending on the fund's strategy and structure. Both investment vehicles require investors to meet certain net worth or income criteria, ensuring suitability for sophisticated investors.

Fee Structures and Incentive Models

Private equity firms typically charge a 2% management fee on committed capital and a 20% carry on profits, aligning incentives with long-term value creation through equity ownership. Hedge funds commonly employ a 1.5% to 2% management fee on assets under management and a 20% performance fee based on annual returns, incentivizing short-term gains and portfolio volatility management. The fee structures reflect different investment horizons, with private equity emphasizing sustained growth and hedge funds targeting market-responsive strategies.

Choosing Between Private Equity and Hedge Funds

Choosing between private equity and hedge funds depends on investment goals, risk tolerance, and time horizon. Private equity offers long-term capital appreciation through direct investments in private companies, often requiring extended lock-up periods and active management. Hedge funds provide more liquidity and diverse strategies, including equities, derivatives, and arbitrage, appealing to investors seeking shorter-term returns and greater flexibility.

Private Equity Infographic

libterm.com

libterm.com