A trailing stop is a dynamic order designed to protect your profits by automatically adjusting the stop price as the market moves in your favor. This tool helps manage risk by locking in gains without needing constant supervision of the market. Explore the rest of the article to understand how a trailing stop can enhance your trading strategy.

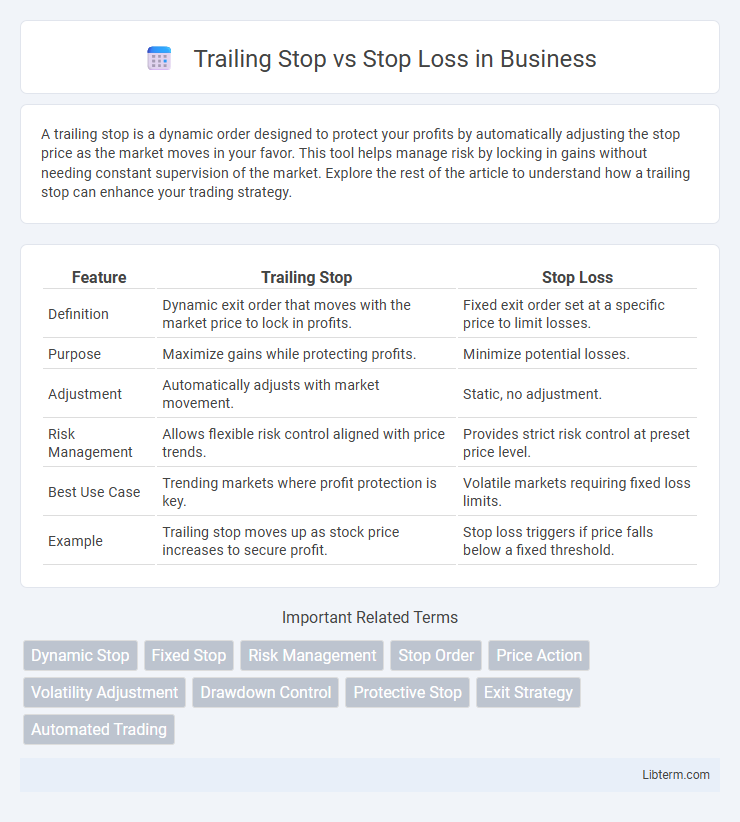

Table of Comparison

| Feature | Trailing Stop | Stop Loss |

|---|---|---|

| Definition | Dynamic exit order that moves with the market price to lock in profits. | Fixed exit order set at a specific price to limit losses. |

| Purpose | Maximize gains while protecting profits. | Minimize potential losses. |

| Adjustment | Automatically adjusts with market movement. | Static, no adjustment. |

| Risk Management | Allows flexible risk control aligned with price trends. | Provides strict risk control at preset price level. |

| Best Use Case | Trending markets where profit protection is key. | Volatile markets requiring fixed loss limits. |

| Example | Trailing stop moves up as stock price increases to secure profit. | Stop loss triggers if price falls below a fixed threshold. |

Introduction to Trailing Stop and Stop Loss

Trailing Stop and Stop Loss are essential risk management tools in trading designed to limit potential losses and protect profits. A Stop Loss sets a fixed price level at which a position is closed to prevent further losses, while a Trailing Stop dynamically adjusts the stop price based on market movement, allowing a position to remain open as long as prices move favorably. Both mechanisms help traders control risk, but Trailing Stops provide flexibility by locking in gains as the market trend progresses.

Definition of Trailing Stop

A trailing stop is a dynamic exit order that adjusts automatically with the price movement, maintaining a set distance below (for long positions) or above (for short positions) the current market price to lock in profits while allowing for potential gains. Unlike a fixed stop loss, which remains at a predetermined price level, a trailing stop moves in favor of the trade, minimizing losses if the market reverses. This mechanism helps traders manage risk by combining protection and flexibility in volatile markets.

Definition of Stop Loss

Stop loss is a predefined order to sell a security once its price falls to a certain level, designed to limit an investor's loss on a position. It provides a fixed exit point to manage risk in volatile markets, ensuring losses do not exceed a specified amount. Unlike trailing stops, stop loss orders do not adjust with market movements and remain set at the initial trigger price.

Key Differences Between Trailing Stop and Stop Loss

Trailing stop dynamically adjusts with the price movement, allowing profits to run while limiting losses, whereas a stop loss is fixed at a preset price level to limit losses without adapting to market fluctuations. Trailing stops follow a set percentage or dollar amount below the asset's highest price, enabling automatic locking in of gains, while stop losses trigger a sell order once the price reaches a specific threshold regardless of prior gains. The key difference lies in trailing stops offering flexible risk management tailored to price trends, compared to the static, predefined protection provided by stop loss orders.

Pros and Cons of Trailing Stop

Trailing stops provide dynamic protection by adjusting the stop price as the market price moves favorably, allowing traders to lock in profits while limiting losses. However, trailing stops can be triggered prematurely in volatile markets, potentially closing positions before the true trend reverses. They also require active management or sophisticated algorithms to effectively balance risk and reward compared to fixed stop loss orders.

Pros and Cons of Stop Loss

Stop loss orders help limit potential losses by automatically selling an asset once it reaches a predetermined price, providing a clear exit strategy and protecting capital from market downturns. However, stop loss orders can trigger prematurely during market volatility or fluctuations, potentially causing an investor to exit a position too early and miss out on potential gains. The fixed nature of stop loss orders lacks flexibility compared to trailing stops, which adjust according to price movements, but stop loss remains crucial for risk management in volatile markets.

When to Use Trailing Stop

Use a trailing stop when you want to protect unrealized profits while allowing a trade to continue gaining value during favorable market trends. Trailing stops are ideal for volatile markets where price fluctuations occur, helping to lock in gains without prematurely closing a position. This strategy is beneficial when you expect a trend to persist but want automatic downside protection to limit potential losses.

When to Use Stop Loss

Use a stop loss when you need to limit potential losses in highly volatile markets or when holding positions overnight to protect against unexpected price gaps. Stop losses are essential for traders who want to define a maximum acceptable loss on a trade and maintain strict risk management rules. They are most effective in stable market conditions where predefined exit points help prevent emotional decision-making.

Common Mistakes to Avoid

Trailing stops are often misconfigured with overly tight percentages, causing premature execution during normal price fluctuations, while stop losses frequently suffer from being placed too close to the entry point, resulting in unnecessary losses. Many traders also neglect to adjust trailing stops as the market moves favorably, missing the opportunity to lock in profits and protect gains effectively. Failing to consider market volatility and ignoring proper risk management principles are critical errors that undermine the effectiveness of both trailing stops and stop losses.

Which is Best: Trailing Stop or Stop Loss?

A trailing stop dynamically adjusts with price movements, allowing traders to lock in profits while limiting losses, making it ideal for volatile markets or trending stocks. Stop loss provides a fixed exit point, offering clear risk management but lacks flexibility in capturing potential upside gains. Choosing between trailing stop and stop loss depends on trading strategy, risk tolerance, and market conditions, with trailing stops generally favored for maximizing gains and stop losses preferred for strict risk control.

Trailing Stop Infographic

libterm.com

libterm.com