Book value represents the net asset value of a company calculated by subtracting liabilities from total assets, providing a baseline measure of what shareholders might theoretically receive if the company were liquidated. This metric is crucial for investors assessing the intrinsic worth of a business relative to its market price. Explore the rest of this article to understand how book value impacts your investment decisions and financial analysis.

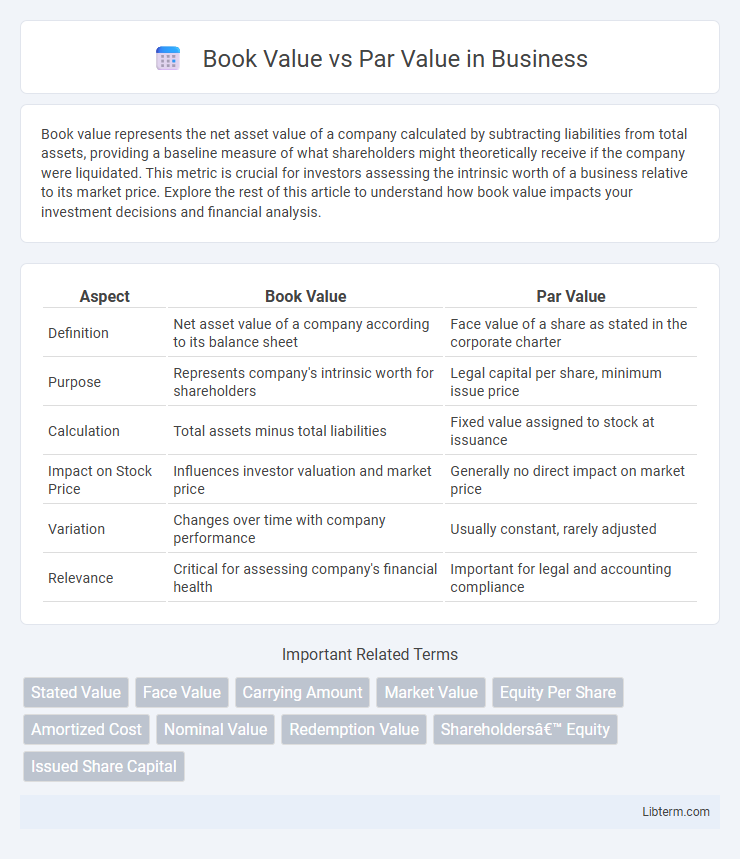

Table of Comparison

| Aspect | Book Value | Par Value |

|---|---|---|

| Definition | Net asset value of a company according to its balance sheet | Face value of a share as stated in the corporate charter |

| Purpose | Represents company's intrinsic worth for shareholders | Legal capital per share, minimum issue price |

| Calculation | Total assets minus total liabilities | Fixed value assigned to stock at issuance |

| Impact on Stock Price | Influences investor valuation and market price | Generally no direct impact on market price |

| Variation | Changes over time with company performance | Usually constant, rarely adjusted |

| Relevance | Critical for assessing company's financial health | Important for legal and accounting compliance |

Introduction to Book Value and Par Value

Book value represents the net asset value of a company calculated by subtracting total liabilities from total assets, reflecting the company's intrinsic worth on the balance sheet. Par value is the nominal or face value assigned to a share at issuance, often set at a minimal amount and used for legal and accounting purposes. Understanding the distinction between book value and par value is essential for investors assessing a stock's valuation and a company's financial health.

Definition of Book Value

Book value represents the net asset value of a company calculated as total assets minus total liabilities, reflecting the intrinsic worth of the company from an accounting perspective. It provides investors with a snapshot of what shareholders theoretically own after all debts are settled, differing fundamentally from par value, which is the nominal or face value assigned to a stock at issuance. Understanding book value helps assess whether a stock is undervalued or overvalued compared to its market price.

Definition of Par Value

Par value, also known as face value, is the nominal value assigned to a stock or bond when it is issued, representing the minimum price at which shares can be sold. It serves as a legal accounting value on a company's balance sheet and does not fluctuate with market conditions. Unlike book value, which reflects the company's net asset value per share, par value is generally a fixed, symbolic figure used for regulatory and accounting purposes.

Key Differences Between Book Value and Par Value

Book value represents the net asset value of a company calculated as total assets minus total liabilities, reflecting the intrinsic worth of a company's equity. Par value is the nominal or face value assigned to a share of stock at issuance, often set at a minimal amount for legal purposes and does not change with market conditions. Key differences include book value being a dynamic accounting measure influenced by company performance, whereas par value remains fixed and primarily serves as a legal and accounting formality.

Importance of Book Value in Financial Analysis

Book value represents a company's net asset value calculated as total assets minus total liabilities and provides insight into its intrinsic worth. It plays a crucial role in financial analysis by enabling investors to assess whether a stock is undervalued or overvalued compared to its market price. Unlike par value, which is a nominal value assigned to shares at issuance, book value reflects the company's actual financial health and long-term stability.

Role of Par Value in Corporate Finance

Par value represents the nominal value assigned to a company's stock at issuance, serving as the minimum price per share that investors must pay. In corporate finance, par value plays a critical role in legal capital requirements, ensuring that a company maintains a baseline equity level to protect creditors. Although often set at a low arbitrary amount, par value affects the calculation of stated capital and can influence dividend policies and stock issuance processes.

Book Value vs Par Value: Implications for Investors

Book value represents a company's net asset value calculated as total assets minus liabilities, reflecting the intrinsic worth per share, while par value is a nominal value assigned to shares at issuance with minimal bearing on market price. Investors prioritize book value to assess a firm's financial health and potential undervaluation, whereas par value mainly serves legal and accounting purposes without influencing investment decisions. Understanding the divergence helps investors make informed choices regarding stock valuation and risk assessment.

How Book Value Influences Stock Valuation

Book value reflects a company's net asset value calculated by subtracting liabilities from total assets, serving as a critical indicator of a stock's intrinsic worth. Investors often compare a stock's market price to its book value to assess whether the stock is overvalued or undervalued, with a price-to-book (P/B) ratio below one suggesting potential undervaluation. A strong book value relative to market price signals financial stability and can influence investment decisions by highlighting the company's ability to generate shareholder equity over time.

Par Value and Its Legal Significance

Par value represents the nominal or face value assigned to a stock or bond at issuance, often stipulated in a company's articles of incorporation. It serves as the minimum price at which shares can be issued, providing a legal floor that protects creditors by ensuring that shares are not sold below this preset value. Par value holds legal significance by establishing shareholder liability limits and helping maintain corporate capital integrity.

Conclusion: Making Informed Financial Decisions

Understanding the distinction between book value and par value is essential for making informed financial decisions, as book value reflects a company's net asset value and true financial health, while par value represents the nominal value assigned to a stock. Investors and analysts rely on book value to assess stock valuation and company stability, whereas par value primarily serves legal and accounting purposes. Prioritizing book value over par value ensures more accurate evaluations of investment opportunities and corporate worth.

Book Value Infographic

libterm.com

libterm.com