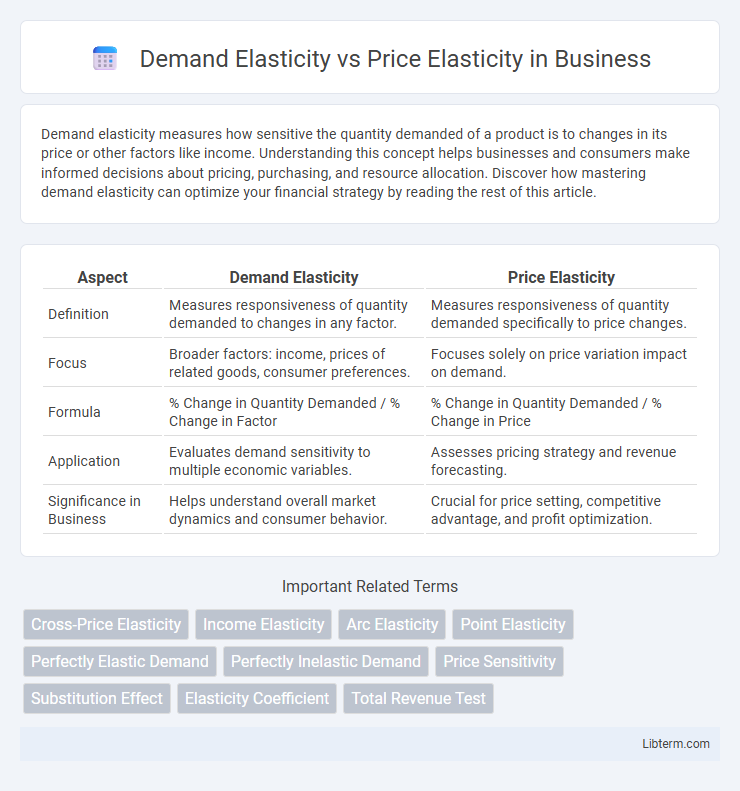

Demand elasticity measures how sensitive the quantity demanded of a product is to changes in its price or other factors like income. Understanding this concept helps businesses and consumers make informed decisions about pricing, purchasing, and resource allocation. Discover how mastering demand elasticity can optimize your financial strategy by reading the rest of this article.

Table of Comparison

| Aspect | Demand Elasticity | Price Elasticity |

|---|---|---|

| Definition | Measures responsiveness of quantity demanded to changes in any factor. | Measures responsiveness of quantity demanded specifically to price changes. |

| Focus | Broader factors: income, prices of related goods, consumer preferences. | Focuses solely on price variation impact on demand. |

| Formula | % Change in Quantity Demanded / % Change in Factor | % Change in Quantity Demanded / % Change in Price |

| Application | Evaluates demand sensitivity to multiple economic variables. | Assesses pricing strategy and revenue forecasting. |

| Significance in Business | Helps understand overall market dynamics and consumer behavior. | Crucial for price setting, competitive advantage, and profit optimization. |

Introduction to Demand Elasticity and Price Elasticity

Demand elasticity measures how consumer demand for a product changes in response to variations in factors such as price, income, or the availability of substitutes. Price elasticity of demand, a specific type of demand elasticity, quantifies the percentage change in quantity demanded relative to a percentage change in the product's price. Understanding these concepts enables businesses to optimize pricing strategies and predict consumer behavior in different market conditions.

Defining Demand Elasticity

Demand elasticity measures how the quantity demanded of a product responds to changes in various factors such as price, income, or the price of related goods. It encompasses different types, including price elasticity of demand, income elasticity of demand, and cross-price elasticity of demand, each quantifying sensitivity to specific variables. Understanding demand elasticity helps businesses and economists predict consumer behavior and make informed pricing and marketing decisions.

Understanding Price Elasticity

Price elasticity measures the responsiveness of quantity demanded to changes in price, indicating how much demand varies when the price shifts. It is calculated as the percentage change in quantity demanded divided by the percentage change in price, providing insights into consumer sensitivity and market dynamics. Understanding price elasticity helps businesses optimize pricing strategies and forecast revenue changes under different pricing scenarios.

Key Differences Between Demand Elasticity and Price Elasticity

Demand elasticity measures the responsiveness of the quantity demanded to changes in any factor influencing demand, such as income or the price of related goods, while price elasticity specifically quantifies the sensitivity of quantity demanded solely to changes in the product's own price. Demand elasticity encompasses a broader range of determinants impacting consumer purchasing behavior, whereas price elasticity isolates the effect of price variations on demand levels. Understanding these distinctions helps businesses and economists tailor pricing strategies and forecast market reactions more accurately.

Factors Influencing Demand Elasticity

Demand elasticity measures how quantity demanded responds to changes in factors like income or prices of related goods, whereas price elasticity specifically analyzes responsiveness to price changes of the same good. Key factors influencing demand elasticity include the availability of substitutes, the necessity of the product, the proportion of income spent on the good, and time horizon for consumer adjustments. Products with many close substitutes, deemed non-essential, or representing a large income share tend to exhibit higher demand elasticity.

Determinants of Price Elasticity

Price elasticity of demand measures how quantity demanded responds to price changes, heavily influenced by factors such as the availability of substitutes, necessity versus luxury status, and the proportion of income spent on the good. Goods with many close substitutes tend to have higher price elasticity, as consumers can easily switch if prices rise. Products that are necessities or have fewer substitutes exhibit lower price elasticity, reflecting less sensitivity to price fluctuations.

Real-World Examples of Demand and Price Elasticity

Demand elasticity measures how quantity demanded responds to changes in factors like income or consumer preferences, while price elasticity specifically gauges the sensitivity of demand to price changes. For instance, gasoline often exhibits inelastic price elasticity because consumers need it despite price increases, whereas luxury goods like high-end electronics showcase elastic demand as purchases drop sharply when prices rise. Real-world examples include the demand for basic food items remaining stable despite price fluctuations, contrasting with airline ticket demand, which varies significantly with price changes.

Importance of Elasticity in Business Decision-Making

Understanding demand elasticity and price elasticity is crucial for business decision-making because they reveal how sensitive consumer demand is to price changes. Accurate elasticity measurements enable firms to optimize pricing strategies, forecast revenue outcomes, and adjust production levels efficiently. Leveraging these insights helps businesses maximize profits and maintain competitive advantage in dynamic markets.

Measuring and Calculating Elasticity

Demand elasticity measures the responsiveness of quantity demanded to changes in variables such as income or the price of related goods, while price elasticity specifically quantifies the change in quantity demanded as a result of a price change. Calculating elasticity involves the formula: Elasticity = (% Change in Quantity Demanded) / (% Change in Price), capturing how sensitive consumer demand is to price fluctuations. Precise measurement requires accurate data on initial and new prices and quantities, enabling businesses to optimize pricing strategies and forecast revenue impacts effectively.

Implications of Elasticity for Market Strategy

Demand elasticity measures how quantity demanded responds to price changes, while price elasticity specifically quantifies this sensitivity in percentage terms. High elasticity indicates consumers are sensitive to price changes, prompting firms to consider competitive pricing and promotional discounts to maximize revenue. Understanding elasticity helps businesses optimize product positioning, forecast sales, and tailor marketing strategies to shifts in consumer demand.

Demand Elasticity Infographic

libterm.com

libterm.com