Managerial accounting provides critical financial insights that help you make informed business decisions by analyzing costs, budgeting, and forecasting. It focuses on internal processes and performance metrics to optimize efficiency and profitability. Explore the full article to understand how managerial accounting can transform your strategic planning and operational control.

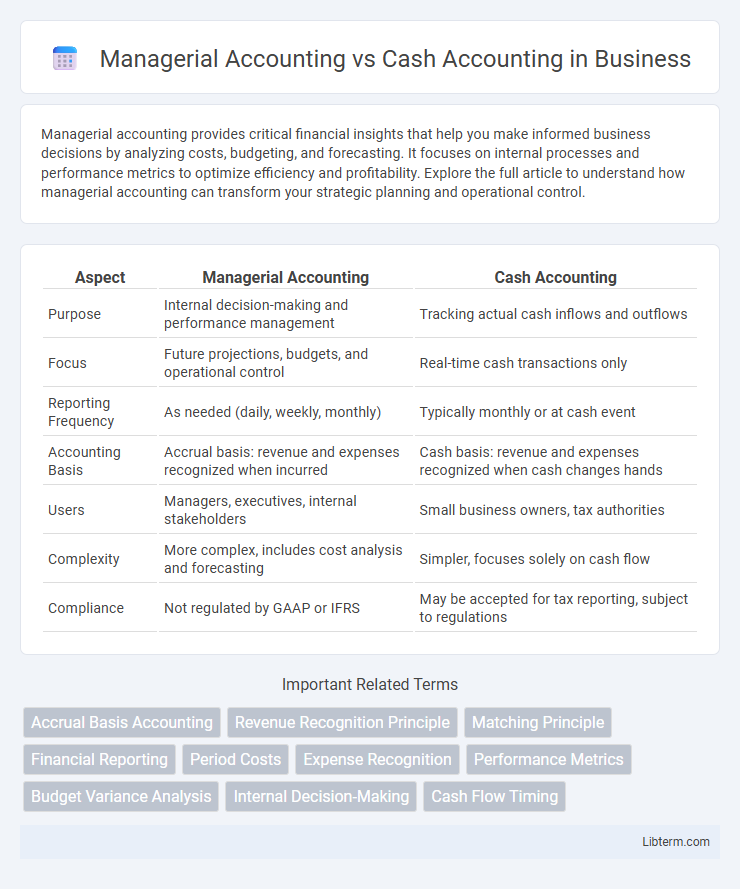

Table of Comparison

| Aspect | Managerial Accounting | Cash Accounting |

|---|---|---|

| Purpose | Internal decision-making and performance management | Tracking actual cash inflows and outflows |

| Focus | Future projections, budgets, and operational control | Real-time cash transactions only |

| Reporting Frequency | As needed (daily, weekly, monthly) | Typically monthly or at cash event |

| Accounting Basis | Accrual basis: revenue and expenses recognized when incurred | Cash basis: revenue and expenses recognized when cash changes hands |

| Users | Managers, executives, internal stakeholders | Small business owners, tax authorities |

| Complexity | More complex, includes cost analysis and forecasting | Simpler, focuses solely on cash flow |

| Compliance | Not regulated by GAAP or IFRS | May be accepted for tax reporting, subject to regulations |

Introduction to Managerial and Cash Accounting

Managerial accounting focuses on internal financial analysis, budgeting, and decision-making to help managers optimize business operations and improve profitability. Cash accounting records transactions only when cash changes hands, providing a straightforward view of cash flow and liquidity, primarily used by small businesses and for tax purposes. Understanding the differences highlights managerial accounting's emphasis on detailed financial data for strategic planning, while cash accounting offers simplicity and clarity in cash management.

Defining Managerial Accounting

Managerial accounting involves the process of identifying, measuring, analyzing, and interpreting financial information to help managers make informed business decisions and improve organizational performance. Unlike cash accounting, which records transactions only when cash changes hands, managerial accounting emphasizes internal reporting, budgeting, cost analysis, and financial planning to support strategic decision-making. This approach provides detailed insights into operational efficiency, cost control, and profitability, essential for effective management and long-term business success.

Understanding Cash Accounting

Cash accounting records transactions only when cash changes hands, providing a straightforward view of cash flow and financial position. It is ideal for small businesses and individuals who need simplicity and immediate tracking of income and expenses. Unlike managerial accounting, which includes accruals and non-cash items for detailed internal analysis, cash accounting emphasizes liquidity and actual cash availability.

Key Differences Between Managerial and Cash Accounting

Managerial accounting focuses on internal financial analysis, budgeting, and decision-making, emphasizing future projections and profitability, whereas cash accounting records transactions only when cash changes hands, providing a clear view of actual cash flow. Managerial accounting uses accrual basis accounting to match revenues and expenses in the period they occur, while cash accounting uses the cash basis approach, recognizing income and expenses upon receipt or payment. The key difference lies in managerial accounting's role in strategic planning and performance measurement, compared to cash accounting's simplicity and focus on immediate cash position.

Purpose and Scope of Managerial Accounting

Managerial accounting focuses on providing detailed financial and operational information to managers for decision-making, planning, and controlling business activities, emphasizing internal processes and performance metrics. Its scope includes budgeting, forecasting, cost analysis, and financial reporting tailored to support management in improving efficiency and achieving strategic goals. Unlike cash accounting, which records transactions based on cash flow timing, managerial accounting offers comprehensive insights beyond cash transactions, facilitating better resource allocation and long-term planning.

Application of Cash Accounting in Business

Cash accounting records transactions only when cash changes hands, making it ideal for small businesses seeking straightforward financial tracking and tax reporting. This method provides real-time insight into cash flow, enabling better management of liquidity and immediate assessment of the company's available funds. Businesses with minimal inventory and simple financial activities benefit from cash accounting due to its ease of use and clear reflection of cash position.

Decision-Making Impacts: Managerial vs Cash Accounting

Managerial accounting provides detailed financial insights, including budgets, forecasts, and performance reports, enhancing strategic decision-making by reflecting both cash and non-cash transactions. Cash accounting records only cash inflows and outflows, offering a straightforward view of liquidity but limiting its usefulness for long-term planning and investment decisions. Decision-makers relying on managerial accounting gain a comprehensive understanding of operational efficiency and profitability, while those using cash accounting may miss critical information affecting financial health and growth opportunities.

Reporting Standards and Compliance

Managerial accounting focuses on internal reporting and provides detailed financial data tailored to management's decision-making needs without adhering strictly to external compliance standards. Cash accounting records transactions only when cash is exchanged, following simpler recognition rules primarily used for tax reporting and regulatory compliance by small businesses. Managerial accounting aligns with Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS) when integrated with financial reporting, while cash accounting remains limited in meeting comprehensive reporting standards required for external stakeholders.

Advantages and Disadvantages of Each Method

Managerial accounting offers detailed insights for internal decision-making, enabling better budgeting, forecasting, and performance evaluation, but it can be complex and time-consuming to implement. Cash accounting simplifies financial tracking by recording transactions only when cash changes hands, providing straightforward and real-time cash flow information but failing to capture accounts receivable or payable, which can distort financial health. Each method suits different business needs: managerial accounting benefits organizations requiring in-depth analysis, while cash accounting works well for small businesses prioritizing simplicity and liquidity monitoring.

Choosing the Right Accounting System for Your Business

Managerial accounting provides detailed internal financial insights for decision-making, cost control, and strategic planning, while cash accounting records transactions only when cash changes hands, offering simplicity and real-time cash flow tracking. Choosing the right accounting system depends on your business size, complexity, and reporting needs; companies requiring in-depth analysis and budgeting benefit from managerial accounting, whereas small businesses with straightforward operations often prefer cash accounting. Aligning your accounting method with your business goals ensures accurate financial management and compliance.

Managerial Accounting Infographic

libterm.com

libterm.com