A creditor is an individual or institution that lends money or extends credit to another party, expecting repayment with interest or other agreed terms. Understanding your rights and obligations as a creditor is crucial for managing financial agreements and minimizing risks. Discover more about creditor roles and best practices in the rest of this article.

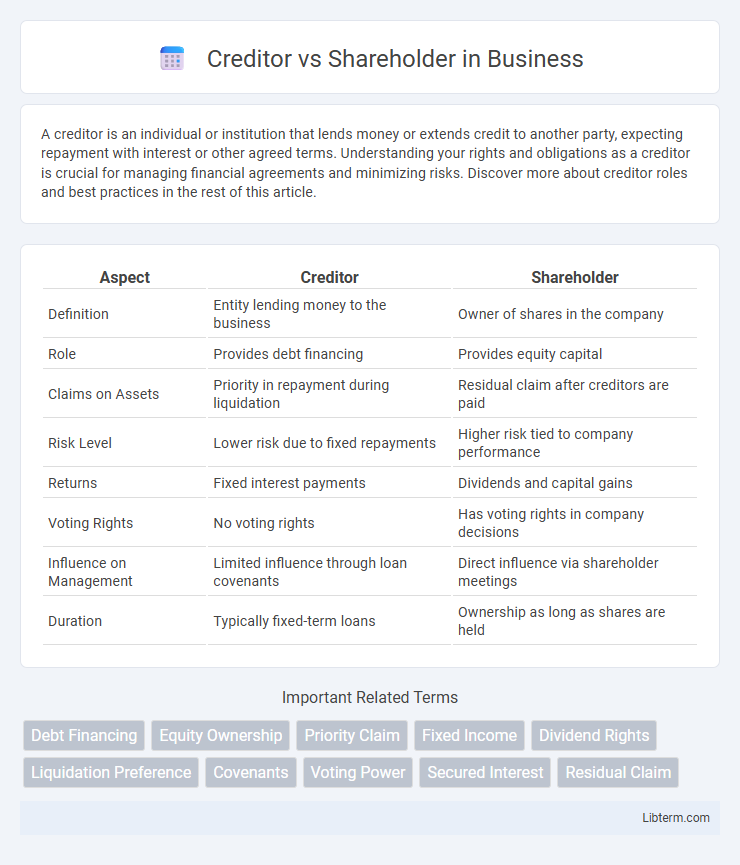

Table of Comparison

| Aspect | Creditor | Shareholder |

|---|---|---|

| Definition | Entity lending money to the business | Owner of shares in the company |

| Role | Provides debt financing | Provides equity capital |

| Claims on Assets | Priority in repayment during liquidation | Residual claim after creditors are paid |

| Risk Level | Lower risk due to fixed repayments | Higher risk tied to company performance |

| Returns | Fixed interest payments | Dividends and capital gains |

| Voting Rights | No voting rights | Has voting rights in company decisions |

| Influence on Management | Limited influence through loan covenants | Direct influence via shareholder meetings |

| Duration | Typically fixed-term loans | Ownership as long as shares are held |

Introduction to Creditors and Shareholders

Creditors provide loans or credit to a company, expecting timely repayment with interest, thus holding a debt-based claim on the company's assets. Shareholders invest capital by purchasing equity shares, obtaining ownership stakes and potential dividends based on company performance. Creditors have priority in claims over shareholders during liquidation, but shareholders benefit from voting rights and profit participation.

Definition of a Creditor

A creditor is an individual or institution that extends credit by lending money or providing goods and services with the expectation of repayment, often with interest, under agreed terms. Unlike shareholders, creditors do not hold ownership in the company but have a legal claim on the company's assets or income until the debt is fully repaid. Creditors include banks, bondholders, suppliers, and other entities that finance business operations through loans or credit arrangements.

Definition of a Shareholder

A shareholder is an individual or entity that legally owns one or more shares in a corporation, representing partial ownership and entitlement to a portion of the company's profits through dividends. Shareholders have voting rights proportional to their shareholding, influencing major corporate decisions such as electing the board of directors and approving mergers. Unlike creditors who lend money and have fixed claims, shareholders bear residual risk and benefit from the company's growth and value appreciation.

Key Differences Between Creditors and Shareholders

Creditors provide debt financing to a company and hold a legal claim to repayment with fixed interest, while shareholders are owners who invest equity capital and share in the company's profits and losses. Creditors have priority during liquidation, receiving repayment before shareholders who only get residual value after debts are settled. Shareholders possess voting rights influencing corporate decisions, whereas creditors typically do not participate in management.

Rights and Privileges: Creditors vs Shareholders

Creditors hold the right to receive fixed interest payments and repayment of principal before shareholders in case of liquidation, ensuring priority claim on company assets. Shareholders possess ownership rights, including voting privileges in corporate decisions and entitlement to dividends, which are variable and subject to company performance. Unlike creditors, shareholders bear higher risk as their returns depend on company profits and residual assets after creditor obligations are fulfilled.

Risk Exposure for Creditors and Shareholders

Creditors face limited risk exposure as their claims are prioritized and capped at the amount lent, minimizing potential losses in case of insolvency. Shareholders, on the other hand, bear higher risk exposure with residual claims on assets and unlimited loss potential tied to stock value fluctuations. This asymmetry in risk underscores creditors' preference for fixed returns and shareholders' pursuit of variable gains.

Role in Company Decision-Making

Creditors primarily influence company decision-making through loan covenants and financial oversight, aiming to protect their investments and ensure debt repayment. Shareholders hold voting rights that directly impact corporate governance, including electing the board of directors and approving major strategic decisions. While creditors focus on financial stability and risk mitigation, shareholders prioritize company growth and profitability through active participation in governance.

Payment Priority in Bankruptcy

Creditors hold a higher payment priority than shareholders during bankruptcy proceedings, as they have legal claims to company assets before equity holders. Secured creditors, who have collateral backing their claims, are paid first, followed by unsecured creditors, while shareholders receive any remaining funds only after all debts are settled. This structured hierarchy reflects the lower risk exposure and residual ownership stake of shareholders compared to the fixed claims of creditors.

Impact on Company Growth and Stability

Creditors provide debt financing that imposes fixed repayment obligations, limiting a company's cash flow flexibility but enhancing financial discipline, which can stabilize growth during volatile periods. Shareholders contribute equity capital without mandatory repayments, enabling more aggressive reinvestment and long-term expansion but increasing ownership dilution and potential risk exposure. Balancing creditor debt and shareholder equity impacts a company's capital structure, influencing its ability to fund growth initiatives and maintain financial stability.

Choosing Between Being a Creditor or Shareholder

Choosing between being a creditor or shareholder depends on risk tolerance and investment goals. Creditors receive fixed interest payments and have priority in bankruptcy, offering lower risk but limited returns. Shareholders hold ownership stakes with potential for higher dividends and capital gains, facing greater risk due to market volatility and residual claims on assets.

Creditor Infographic

libterm.com

libterm.com