Capital gains refer to the profit earned from the sale of an asset, such as stocks, real estate, or other investments, when the selling price exceeds the original purchase price. Understanding how capital gains are taxed and the different types, like short-term and long-term gains, can help you make informed financial decisions. Explore the rest of this article to learn how to optimize your capital gains strategy effectively.

Table of Comparison

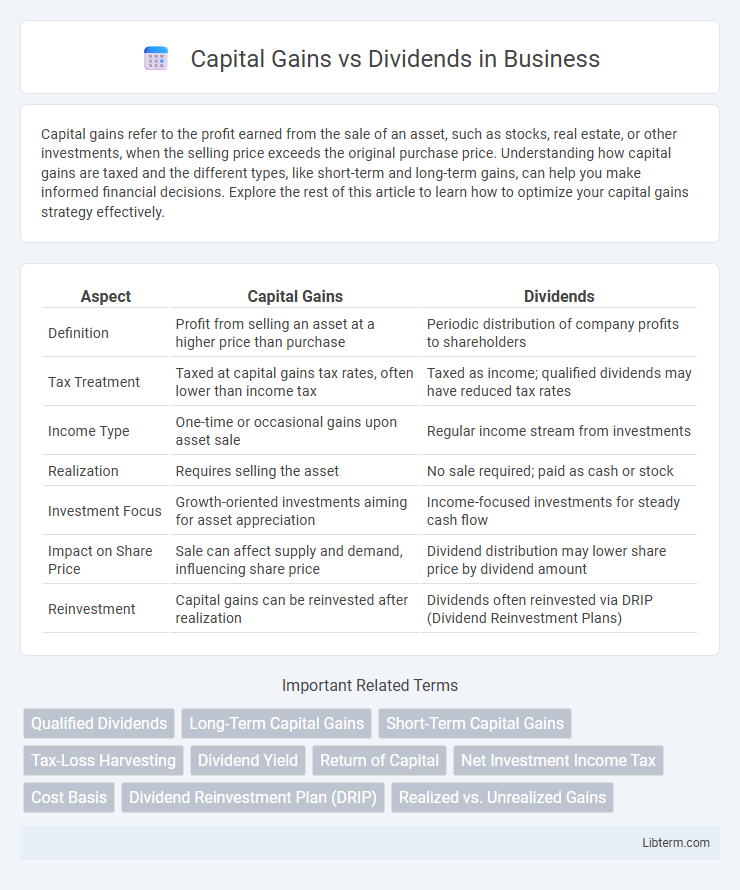

| Aspect | Capital Gains | Dividends |

|---|---|---|

| Definition | Profit from selling an asset at a higher price than purchase | Periodic distribution of company profits to shareholders |

| Tax Treatment | Taxed at capital gains tax rates, often lower than income tax | Taxed as income; qualified dividends may have reduced tax rates |

| Income Type | One-time or occasional gains upon asset sale | Regular income stream from investments |

| Realization | Requires selling the asset | No sale required; paid as cash or stock |

| Investment Focus | Growth-oriented investments aiming for asset appreciation | Income-focused investments for steady cash flow |

| Impact on Share Price | Sale can affect supply and demand, influencing share price | Dividend distribution may lower share price by dividend amount |

| Reinvestment | Capital gains can be reinvested after realization | Dividends often reinvested via DRIP (Dividend Reinvestment Plans) |

Introduction to Capital Gains and Dividends

Capital gains arise from the profit realized when an asset is sold for more than its purchase price, while dividends represent a portion of a company's earnings distributed to shareholders. Investors benefit from capital gains through appreciation in stock prices, whereas dividends provide a steady income stream, often preferred by income-focused portfolios. Understanding the tax implications and investment strategies for both capital gains and dividends is crucial for optimizing financial returns.

Defining Capital Gains

Capital gains refer to the profit realized from the sale of an asset, such as stocks, bonds, or real estate, when the selling price exceeds the original purchase price. These gains are typically classified as short-term or long-term, depending on the holding period, which impacts the tax rates applied. Unlike dividends, which are periodic income distributions from profits, capital gains represent a one-time profit event triggered by a transaction.

Understanding Dividends

Dividends represent a portion of a company's earnings distributed to shareholders, providing a steady income stream that can be reinvested or used as passive income. Unlike capital gains, which are realized through the sale of stock at a higher price, dividends offer regular payments regardless of market fluctuations. Investors seeking consistent returns often prioritize dividend-paying stocks for portfolio stability and income generation.

Key Differences between Capital Gains and Dividends

Capital gains arise from the profit earned when an asset is sold at a higher price than its purchase price, while dividends are periodic payments distributed to shareholders from a company's earnings. Capital gains are typically subject to taxation only upon realization, whereas dividends are often taxed as income in the year they are received. Unlike dividends, capital gains depend on market fluctuations and the timing of asset sales, making their occurrence less predictable.

Tax Implications of Capital Gains

Capital gains are taxable profits realized from the sale of assets like stocks, real estate, or bonds, typically subject to varying tax rates depending on the holding period and jurisdiction, with long-term capital gains often taxed at lower rates than short-term gains. Unlike dividends, which are taxed as income when received, capital gains taxation occurs only upon the sale or disposition of the asset, allowing for potential tax deferral. Understanding the differential tax treatment can influence investment strategies, dividend reinvestment plans, and timing of asset sales to optimize tax liabilities.

Taxation of Dividends

Dividends are typically taxed at a preferential rate compared to ordinary income, often ranging from 0% to 20% depending on the taxpayer's income bracket and whether the dividends are qualified. Qualified dividends meet specific IRS criteria, including being paid by U.S. corporations or qualified foreign corporations and held for a minimum period, which allows investors to benefit from lower long-term capital gains tax rates. Non-qualified dividends, however, are taxed at the individual's ordinary income tax rates, resulting in a higher tax burden compared to qualified dividends and certain capital gains.

Investment Strategies: Capital Gains vs Dividends

Investment strategies often weigh capital gains and dividends based on tax implications and portfolio objectives; capital gains arise from asset appreciation and are typically realized upon selling investments, whereas dividends provide regular income from company earnings. Growth-oriented investors may prioritize capital gains for potential higher returns and reinvestment opportunities, while income-focused investors rely on dividends for steady cash flow and lower volatility. Choosing between these depends on factors such as tax efficiency, risk tolerance, and the desire for immediate income versus long-term wealth accumulation.

Risk Factors and Market Considerations

Capital gains are subject to market volatility, with the potential for significant fluctuations impacting the timing and magnitude of returns, while dividends offer more stable income but may be reduced during economic downturns or company financial distress. Investors should consider tax implications, as capital gains taxes often differ from dividend tax rates, influencing net returns and portfolio strategy. Market conditions such as interest rate changes, corporate earnings stability, and investor sentiment critically affect both capital appreciation potential and dividend sustainability.

Long-Term Wealth Building: Which Is Better?

Long-term wealth building favors capital gains due to their potential for significant growth through asset appreciation and compounding over time. Dividends provide steady income and can be reinvested to enhance returns, but capital gains often outperform in tax-advantaged accounts and growth-focused portfolios. Strategic allocation between growth stocks with capital appreciation and dividend-paying stocks maximizes diversification and wealth accumulation.

Conclusion: Choosing the Right Income Source

Selecting between capital gains and dividends depends on an investor's financial goals, tax situation, and investment horizon. Capital gains often offer growth potential and favorable tax rates for long-term investors, while dividends provide steady income and can be reinvested for compounding returns. Evaluating liquidity needs, risk tolerance, and tax implications ensures a balanced portfolio aligned with income and growth objectives.

Capital Gains Infographic

libterm.com

libterm.com