Authorized shares represent the maximum number of shares a corporation is legally permitted to issue as specified in its articles of incorporation. These shares provide flexibility for future fundraising and stock issuance without needing shareholder approval each time. Discover how understanding authorized shares can impact your investment decisions by reading the rest of the article.

Table of Comparison

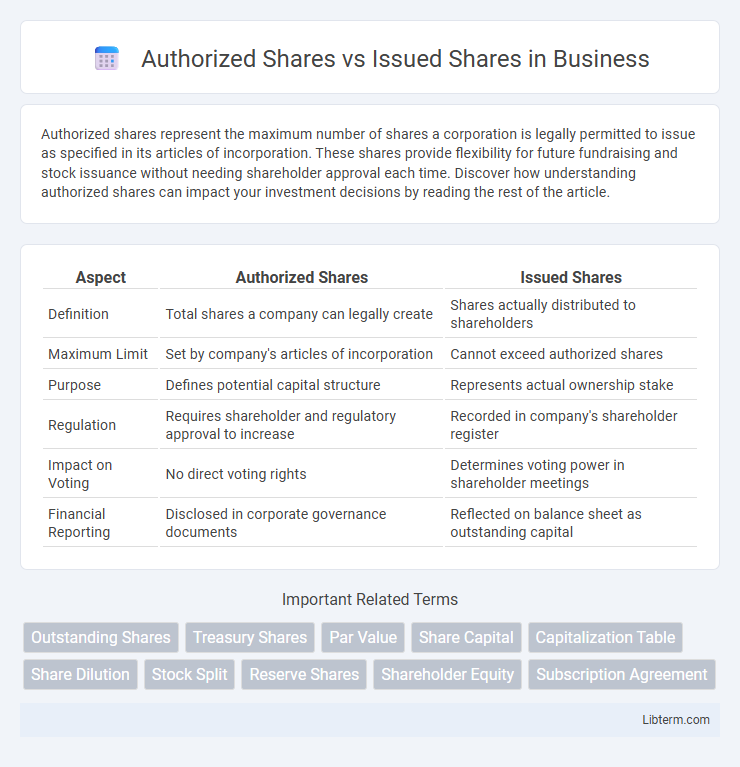

| Aspect | Authorized Shares | Issued Shares |

|---|---|---|

| Definition | Total shares a company can legally create | Shares actually distributed to shareholders |

| Maximum Limit | Set by company's articles of incorporation | Cannot exceed authorized shares |

| Purpose | Defines potential capital structure | Represents actual ownership stake |

| Regulation | Requires shareholder and regulatory approval to increase | Recorded in company's shareholder register |

| Impact on Voting | No direct voting rights | Determines voting power in shareholder meetings |

| Financial Reporting | Disclosed in corporate governance documents | Reflected on balance sheet as outstanding capital |

Understanding Authorized Shares

Authorized shares represent the maximum number of shares a corporation is legally permitted to issue as specified in its articles of incorporation. These shares set the upper limit for capital structure planning but do not reflect the actual shares distributed to investors. Understanding authorized shares is crucial for assessing a company's potential for raising future capital and controlling shareholder dilution.

What Are Issued Shares?

Issued shares represent the portion of a corporation's authorized shares that have been actually allocated and sold to shareholders, granting them ownership rights and voting privileges. These shares reflect the company's current equity distribution and are recorded on the balance sheet as outstanding stock. Understanding issued shares is crucial for evaluating a company's capital structure and investor stake.

Key Differences: Authorized vs Issued Shares

Authorized shares represent the maximum number of shares a corporation is legally permitted to issue as specified in its articles of incorporation, while issued shares are the actual number of shares distributed to shareholders. The key difference lies in authorized shares serving as a ceiling for issuance, providing flexibility for future funding, whereas issued shares reflect current ownership and voting rights. Companies maintain a balance between authorized and issued shares to manage capital structure and shareholder dilution effectively.

Importance of Authorized Shares in Corporate Structure

Authorized shares define the maximum number of shares a corporation can legally issue as specified in its articles of incorporation, forming the foundational limit for equity distribution and capital raising. This cap protects the company from unsolicited dilution while providing flexibility for future financing, stock options, or expansion without needing immediate shareholder approval. Maintaining a clear distinction between authorized and issued shares is crucial for corporate governance, influencing investor confidence, regulatory compliance, and strategic financial planning.

Implications of Issued Shares for Shareholders

Issued shares represent the actual number of shares distributed to shareholders, reflecting ownership stakes and voting rights within the company. These shares directly impact shareholder dividends, influence control over corporate decisions, and determine the dilution level of existing shareholders' equity. Understanding issued shares is crucial for investors to gauge their proportionate claim on company assets and earnings.

How Companies Decide the Number of Authorized Shares

Companies determine the number of authorized shares during incorporation based on expected capital needs, future financing plans, and regulatory requirements. Authorized shares represent the maximum stock a company can issue, providing flexibility for stock issuance without immediate shareholder approval. The number balances potential dilution against capital-raising capacity, ensuring readiness for investor demands and market opportunities.

Process of Issuing Shares Explained

The process of issuing shares begins with the company's board of directors approving the issuance within the limit of authorized shares specified in the corporate charter. Issued shares represent the portion of authorized shares actually allocated to investors, reflecting ownership stakes and influencing shareholder equity. During issuance, legal procedures such as filing with regulatory bodies and updating the shareholder register ensure compliance and formal recognition of ownership.

Impact on Ownership and Voting Power

Authorized shares represent the maximum number of shares a corporation is legally permitted to issue as defined in its charter, setting a ceiling on potential ownership dilution. Issued shares are the actual number of shares distributed to shareholders, directly determining the current ownership percentages and voting power among investors. The gap between authorized and issued shares allows companies to strategically manage future equity financing without immediate impact on existing shareholders' voting control.

Changes to Authorized and Issued Shares: Legal Considerations

Changes to authorized shares require shareholder approval through formal amendments to the corporate charter, complying with state corporate laws and filing with the appropriate regulatory authorities. Issued shares can be adjusted by the board within the limits of authorized shares, but any issuance must adhere to securities regulations and corporate governance policies. Failure to follow these legal procedures can result in invalid share issuance and potential liability for the corporation and its officers.

Frequently Asked Questions on Authorized vs Issued Shares

Authorized shares represent the maximum number of shares a company can legally issue according to its corporate charter, while issued shares are the actual number of shares distributed to shareholders. Frequently asked questions often address how authorized shares impact a company's ability to raise capital and why issued shares may be fewer than authorized shares. Investors should understand that unissued authorized shares provide flexibility for future financing, stock options, or acquisitions without requiring immediate shareholder approval.

Authorized Shares Infographic

libterm.com

libterm.com