Bill payment methods have evolved to offer faster and more convenient options, including online portals, mobile apps, and automated services that ensure timely transactions. Understanding the benefits and security features of each method can help you manage your finances more efficiently. Explore the rest of the article to discover the best bill payment strategies tailored to your needs.

Table of Comparison

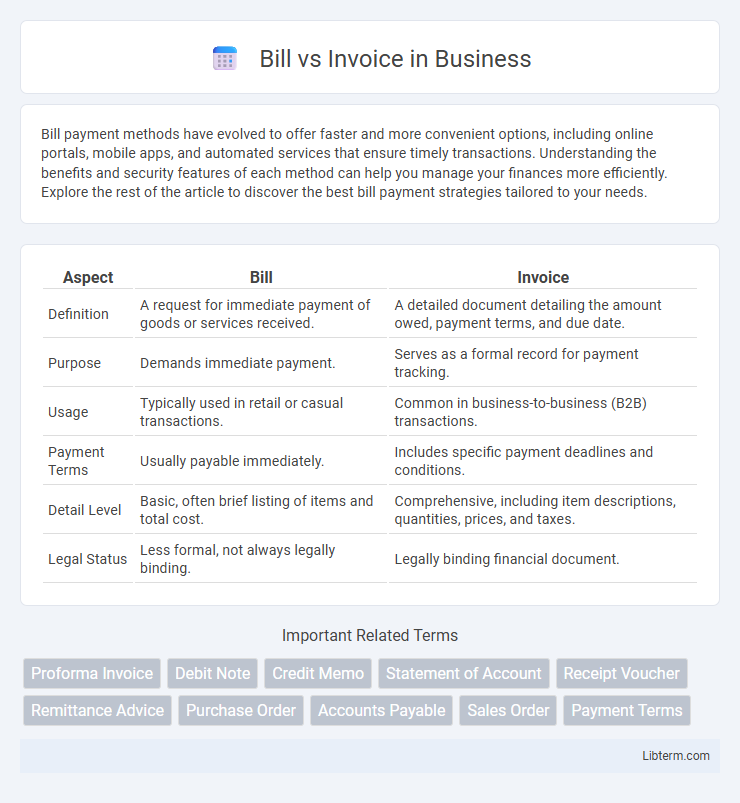

| Aspect | Bill | Invoice |

|---|---|---|

| Definition | A request for immediate payment of goods or services received. | A detailed document detailing the amount owed, payment terms, and due date. |

| Purpose | Demands immediate payment. | Serves as a formal record for payment tracking. |

| Usage | Typically used in retail or casual transactions. | Common in business-to-business (B2B) transactions. |

| Payment Terms | Usually payable immediately. | Includes specific payment deadlines and conditions. |

| Detail Level | Basic, often brief listing of items and total cost. | Comprehensive, including item descriptions, quantities, prices, and taxes. |

| Legal Status | Less formal, not always legally binding. | Legally binding financial document. |

Understanding the Difference Between a Bill and an Invoice

A bill is a request for payment issued by a seller to a buyer, typically used in immediate or short-term transactions. An invoice is a detailed document that itemizes goods or services provided, including quantities, prices, and payment terms, often used for formal accounting and record-keeping. Understanding the difference helps businesses manage cash flow and maintain accurate financial records.

Key Definitions: What Is a Bill? What Is an Invoice?

A bill is a document requesting payment for goods or services already received, typically used in everyday transactions such as utilities or restaurants. An invoice, on the other hand, is a detailed statement issued by a seller to a buyer, outlining the products or services provided, quantities, prices, and payment terms before payment is due. Both serve as proof of a financial obligation but differ primarily in timing and formality within business accounting processes.

Purpose and Function of Bills and Invoices

Bills serve as a request for payment from a seller to a buyer, detailing the amount owed for goods or services provided. Invoices function as official documents that record the sale, specifying quantities, prices, payment terms, and providing a basis for accounting and tax purposes. Both bills and invoices facilitate clear financial transactions, but invoices often carry more detailed information to support bookkeeping and legal compliance.

When to Use a Bill vs. an Invoice

A bill is typically used when a customer needs to pay immediately upon receiving goods or services, serving as a request for payment at the point of sale. An invoice is employed in transactions where payment terms extend beyond the delivery date, providing a detailed record of the amount due with specified payment deadlines. Businesses issue invoices to manage accounts receivable, while bills function as immediate payment demands in retail or service environments.

Essential Elements Included in Bills and Invoices

Bills and invoices both contain essential elements such as the date of issue, unique identification number, detailed description of goods or services provided, quantities, unit prices, total amount due, and payment terms. Invoices typically include additional information like tax details, seller and buyer contact information, and payment instructions to facilitate accounting and legal compliance. Bills tend to be simpler, primarily serving as requests for immediate payment without the extended transactional details found in invoices.

Legal Implications of Bills and Invoices

Bills and invoices serve as critical legal documents that establish the terms of a transaction and the obligation to pay. Invoices often include detailed information such as payment deadlines, penalties for late payment, and tax details, making them essential for contract enforcement and dispute resolution. Bills function as proof of services rendered or goods delivered, providing a legally binding record that supports claims in financial and tax audits.

Industries That Commonly Use Bills and Invoices

Retail and hospitality industries commonly use invoices for tracking sales transactions with detailed itemization and payment terms, while utility companies and service providers frequently issue bills to request payment for recurring services like electricity or internet. Manufacturing sectors rely on invoices to manage bulk orders and payment schedules, whereas healthcare facilities generate bills to itemize patient services and insurance claims. Both documents facilitate financial record-keeping, but the choice depends largely on the business model and transaction frequency within each industry.

Common Mistakes When Issuing Bills and Invoices

Common mistakes when issuing bills and invoices include incorrect or missing client information, such as names and addresses, leading to payment delays. Failing to clearly itemize services or products with accurate pricing and tax details can cause confusion and disputes. Neglecting to include payment terms, due dates, and invoice numbers reduces professionalism and complicates tracking and reconciliation processes.

Digital Solutions for Bills and Invoices

Digital solutions for bills and invoices streamline financial workflows by automating data entry, improving accuracy, and enabling faster payments. Cloud-based platforms integrate with accounting software, allowing businesses to generate, send, and track bills and invoices in real time while ensuring compliance with tax regulations. Mobile apps and electronic payment gateways facilitate seamless transaction processing, reducing paper usage and enhancing record keeping for both vendors and clients.

Best Practices for Managing Bills and Invoices

Effective management of bills and invoices requires clear organizational systems, such as categorizing by due dates and vendor names to streamline payment processes and avoid late fees. Implementing automated accounting software helps track expenses, send timely reminders, and maintain accurate financial records, enhancing cash flow control. Regularly reconciling bills and invoices against purchase orders and payment confirmations ensures accuracy and transparency in financial reporting.

Bill Infographic

libterm.com

libterm.com