Socially Responsible Investing (SRI) aligns your investment choices with ethical values by focusing on companies that prioritize environmental sustainability, social justice, and good governance. This approach not only supports positive change but also aims to deliver competitive financial returns by avoiding firms with harmful practices. Explore the rest of the article to learn how SRI can help you make a meaningful impact while growing your portfolio.

Table of Comparison

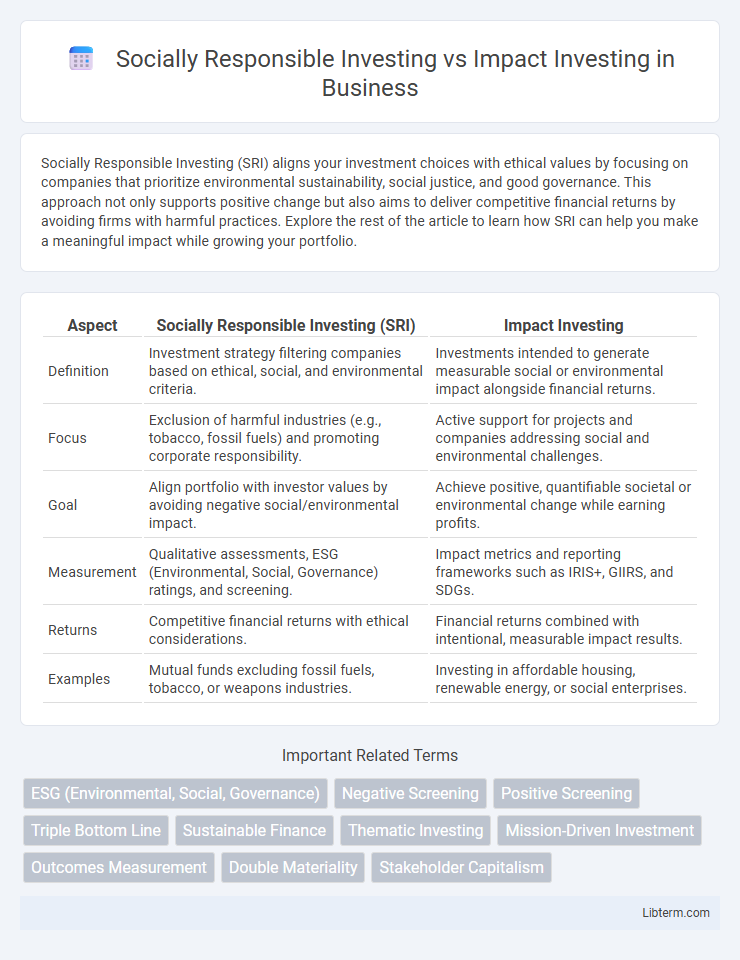

| Aspect | Socially Responsible Investing (SRI) | Impact Investing |

|---|---|---|

| Definition | Investment strategy filtering companies based on ethical, social, and environmental criteria. | Investments intended to generate measurable social or environmental impact alongside financial returns. |

| Focus | Exclusion of harmful industries (e.g., tobacco, fossil fuels) and promoting corporate responsibility. | Active support for projects and companies addressing social and environmental challenges. |

| Goal | Align portfolio with investor values by avoiding negative social/environmental impact. | Achieve positive, quantifiable societal or environmental change while earning profits. |

| Measurement | Qualitative assessments, ESG (Environmental, Social, Governance) ratings, and screening. | Impact metrics and reporting frameworks such as IRIS+, GIIRS, and SDGs. |

| Returns | Competitive financial returns with ethical considerations. | Financial returns combined with intentional, measurable impact results. |

| Examples | Mutual funds excluding fossil fuels, tobacco, or weapons industries. | Investing in affordable housing, renewable energy, or social enterprises. |

Introduction to Socially Responsible Investing and Impact Investing

Socially Responsible Investing (SRI) integrates environmental, social, and governance (ESG) criteria to screen and exclude companies with negative impacts, aligning portfolios with ethical values. Impact Investing actively targets measurable positive social or environmental outcomes alongside financial returns, often focusing on sectors like renewable energy, affordable housing, and education. Both strategies reflect a growing investor demand for aligning capital with sustainable and socially beneficial objectives, but SRI emphasizes risk mitigation through exclusionary practices, while Impact Investing pursues proactive change through targeted investments.

Defining Socially Responsible Investing (SRI)

Socially Responsible Investing (SRI) integrates environmental, social, and governance (ESG) criteria into investment decisions to promote ethical practices and sustainability. SRI focuses on avoiding companies involved in harmful activities like tobacco, fossil fuels, or human rights violations while supporting businesses with positive social impact. This investment strategy balances financial returns with social values, aiming to encourage corporate responsibility and long-term value creation.

Understanding Impact Investing

Impact Investing targets measurable social and environmental outcomes alongside financial returns, distinguishing it from Socially Responsible Investing (SRI), which primarily screens investments to avoid harm. This approach actively allocates capital to projects and companies addressing global challenges such as climate change, poverty, and healthcare disparities. Investors prioritize transparency and metrics like the Global Impact Investing Network's IRIS+ to evaluate the tangible benefits generated by their investments.

Key Differences between SRI and Impact Investing

Socially Responsible Investing (SRI) primarily focuses on avoiding investments in companies that engage in unethical practices, using negative screening to exclude sectors like tobacco, fossil fuels, or firearms. Impact Investing seeks to generate measurable social or environmental benefits alongside financial returns by actively supporting projects or companies addressing issues such as renewable energy, affordable housing, or education. While SRI emphasizes risk management through exclusion, Impact Investing targets proactive contributions to social change with quantifiable outcomes.

Investment Strategies and Approaches

Socially Responsible Investing (SRI) employs negative screening by excluding companies involved in harmful industries like tobacco or fossil fuels, emphasizing ethical alignment and risk mitigation. Impact Investing actively seeks investments in projects or companies that generate measurable social or environmental benefits alongside financial returns, often focusing on sectors such as renewable energy, affordable housing, and healthcare. Both strategies prioritize sustainability but differ in approach: SRI filters out harmful activities, while Impact Investing proactively funds solutions with tangible positive outcomes.

Measuring Social and Environmental Outcomes

Socially responsible investing (SRI) primarily focuses on screening companies based on environmental, social, and governance (ESG) criteria to avoid harmful activities, while impact investing directly targets measurable social and environmental outcomes with intentional positive effects. Impact investors use rigorous metrics such as the Global Impact Investing Network's IRIS+ system and the Sustainable Development Goals (SDGs) framework to quantify benefits like carbon reduction, affordable housing units created, or job opportunities generated. In contrast, SRI often relies on ESG ratings and exclusion lists, which may not provide detailed measurement of actual impact performance.

Financial Performance Comparison

Socially Responsible Investing (SRI) and Impact Investing both aim to generate positive social or environmental outcomes alongside financial returns, but their financial performance varies based on strategy and market conditions. SRI typically screens out companies with negative ESG factors, often resulting in performance aligned closely with traditional indices, while Impact Investing actively targets measurable social impact, sometimes accepting lower financial returns to achieve these goals. Studies indicate that Impact Investing can deliver competitive returns, though with a wider range of risk and return profiles compared to the more conservative, risk-averse approach of SRI portfolios.

Popular SRI and Impact Investment Vehicles

Popular Socially Responsible Investing (SRI) vehicles include exclusionary mutual funds and exchange-traded funds (ETFs) that filter out companies involved in tobacco, fossil fuels, or weapons manufacturing, emphasizing ethical screens and corporate governance. Impact investing often uses private equity funds, community development financial institutions (CDFIs), and green bonds, targeting measurable positive social and environmental outcomes alongside financial returns. Both strategies increasingly leverage ESG (Environmental, Social, and Governance) criteria, yet impact investing prioritizes direct, quantifiable benefits within sectors like renewable energy, affordable housing, and sustainable agriculture.

Trends and Market Growth

Socially Responsible Investing (SRI) emphasizes avoiding investments in companies with negative social or environmental impacts, while Impact Investing targets generating measurable positive social and environmental outcomes alongside financial returns. The global impact investing market reached approximately $1.16 trillion in assets under management in 2023, growing at a CAGR of 17%, driven by increasing investor demand for accountability and transparency. SRI funds also saw significant growth, with assets surpassing $30 trillion worldwide, reflecting a broader shift toward ethical investment practices and sustainable finance trends.

Choosing the Right Approach for Your Portfolio

Socially Responsible Investing (SRI) emphasizes avoiding companies with unethical practices, focusing on excluding industries like tobacco and fossil fuels to align with personal values. Impact Investing targets measurable social and environmental outcomes, actively seeking investments that generate positive change alongside financial returns. Selecting the right approach depends on your portfolio goals, risk tolerance, and desire for direct impact versus values-based exclusion.

Socially Responsible Investing Infographic

libterm.com

libterm.com