Strategic alliances are collaborative agreements between businesses designed to leverage each other's strengths, share resources, and achieve common goals without merging. These partnerships enable companies to access new markets, enhance innovation, and improve competitive advantage while managing risks effectively. To discover how forming a strategic alliance can transform your business growth, continue reading the full article.

Table of Comparison

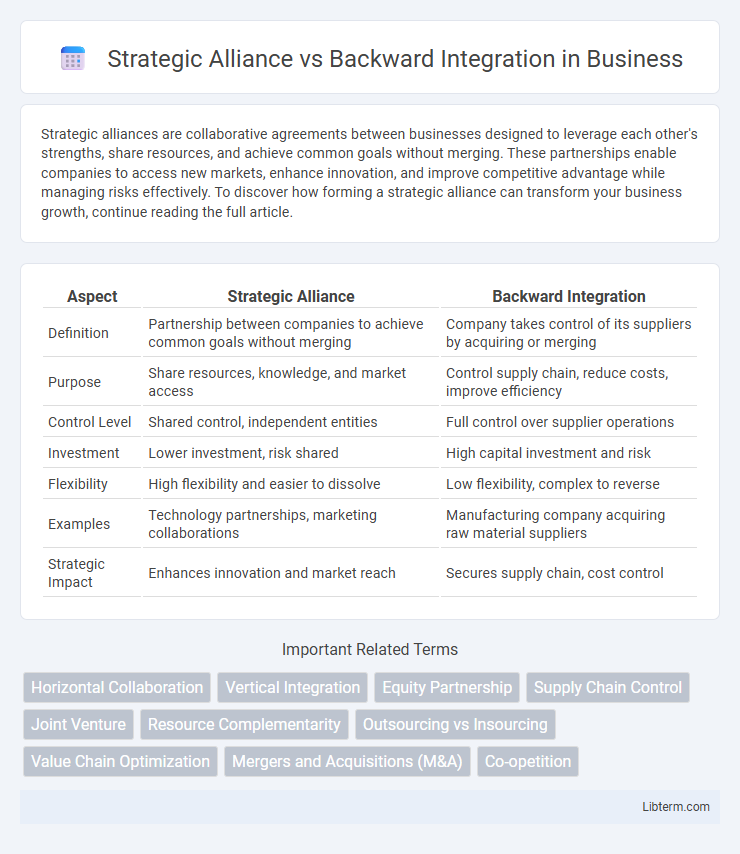

| Aspect | Strategic Alliance | Backward Integration |

|---|---|---|

| Definition | Partnership between companies to achieve common goals without merging | Company takes control of its suppliers by acquiring or merging |

| Purpose | Share resources, knowledge, and market access | Control supply chain, reduce costs, improve efficiency |

| Control Level | Shared control, independent entities | Full control over supplier operations |

| Investment | Lower investment, risk shared | High capital investment and risk |

| Flexibility | High flexibility and easier to dissolve | Low flexibility, complex to reverse |

| Examples | Technology partnerships, marketing collaborations | Manufacturing company acquiring raw material suppliers |

| Strategic Impact | Enhances innovation and market reach | Secures supply chain, cost control |

Overview of Strategic Alliances and Backward Integration

Strategic alliances are collaborative agreements between companies to leverage mutual strengths, share resources, and access new markets without full mergers or acquisitions. Backward integration involves a company expanding its operations by acquiring or merging with suppliers to control the supply chain and reduce dependency. Both strategies enhance competitive advantage, with strategic alliances emphasizing cooperation and flexibility, while backward integration focuses on vertical control and cost efficiency.

Defining Strategic Alliances: Key Features

Strategic alliances are collaborative agreements between two or more companies that pool resources and expertise to achieve mutual objectives without merging ownership, distinguishing them from backward integration which involves direct control over suppliers by acquisition or internal development. Key features include shared risks and rewards, complementary strengths, and flexibility in management and operations. These partnerships enable firms to enhance market access, innovate jointly, and reduce costs while maintaining independent business identities.

Backward Integration Explained

Backward integration is a vertical expansion strategy where a company acquires or merges with its suppliers to control the supply chain, reduce production costs, and improve raw material access. This approach enhances operational efficiency and decreases dependency on external suppliers, ultimately strengthening market competitiveness. Unlike strategic alliances, backward integration results in complete ownership and control over upstream processes.

Major Differences Between Strategic Alliances and Backward Integration

Strategic alliances involve partnerships between independent companies to share resources, expertise, and market access while remaining operationally separate, whereas backward integration entails a company acquiring or merging with its suppliers to control the supply chain and reduce dependency. Strategic alliances emphasize collaboration without ownership, focusing on mutual benefits and flexibility, whereas backward integration increases vertical integration by bringing supplier functions under direct company control. The key difference lies in strategic alliances promoting cooperation for competitive advantage, while backward integration focuses on internalizing production to enhance cost efficiency and supply security.

Advantages of Forming Strategic Alliances

Forming strategic alliances offers companies access to new markets, shared resources, and enhanced innovation through collaboration without the need for heavy capital investment. These partnerships enable firms to leverage complementary strengths, reduce risks associated with entering unfamiliar sectors, and accelerate product development cycles. Compared to backward integration, strategic alliances provide greater flexibility and scalability while avoiding the complexities and costs of owning upstream operations.

Benefits of Pursuing Backward Integration

Pursuing backward integration enables companies to gain greater control over their supply chain, reducing dependency on external suppliers and minimizing costs related to procurement and production delays. It enhances quality control and fosters innovation by integrating supplier capabilities directly into the manufacturing process. This strategy often improves competitive advantage by securing critical inputs and enabling better coordination across the value chain.

Risks Associated with Strategic Alliances

Strategic alliances expose companies to risks such as loss of proprietary information, misaligned objectives, and dependency on partners' performance, which can lead to operational disruptions. Unlike backward integration, which involves internal control over supply chains, strategic alliances rely on external entities, increasing vulnerability to partner instability and conflicts. These risks necessitate robust contractual agreements and ongoing trust-building to safeguard competitive advantage and ensure collaboration success.

Challenges Inherent in Backward Integration

Backward integration faces significant challenges such as high capital investment requirements, increased operational complexity, and risks associated with managing unfamiliar supply chain components. Companies must also navigate potential supplier resistance and regulatory hurdles while maintaining quality control and efficiency. Unlike strategic alliances that leverage partner expertise, backward integration demands full control and responsibility over previously outsourced processes, increasing managerial burden.

Choosing the Right Approach: Factors to Consider

Choosing between a strategic alliance and backward integration depends on factors such as control preferences, resource availability, and market dynamics. Strategic alliances offer flexibility and access to complementary capabilities without heavy capital investment, ideal for companies seeking collaboration while minimizing risk. Backward integration provides greater supply chain control and cost efficiencies, beneficial for firms aiming to secure raw materials or inputs internally to enhance competitiveness.

Real-World Examples: Strategic Alliance vs Backward Integration

Strategic alliances, such as the partnership between Starbucks and Nestle, allow companies to leverage each other's strengths without full ownership, enabling market expansion and shared resources. In contrast, backward integration, exemplified by Tesla acquiring its battery supplier Maxwell Technologies, involves a company taking direct control of its supply chain to reduce costs and increase production efficiency. Both strategies address growth and competitive advantage but differ in control level and resource allocation.

Strategic Alliance Infographic

libterm.com

libterm.com